ProAssurance

Producer Guide

Table of Contents

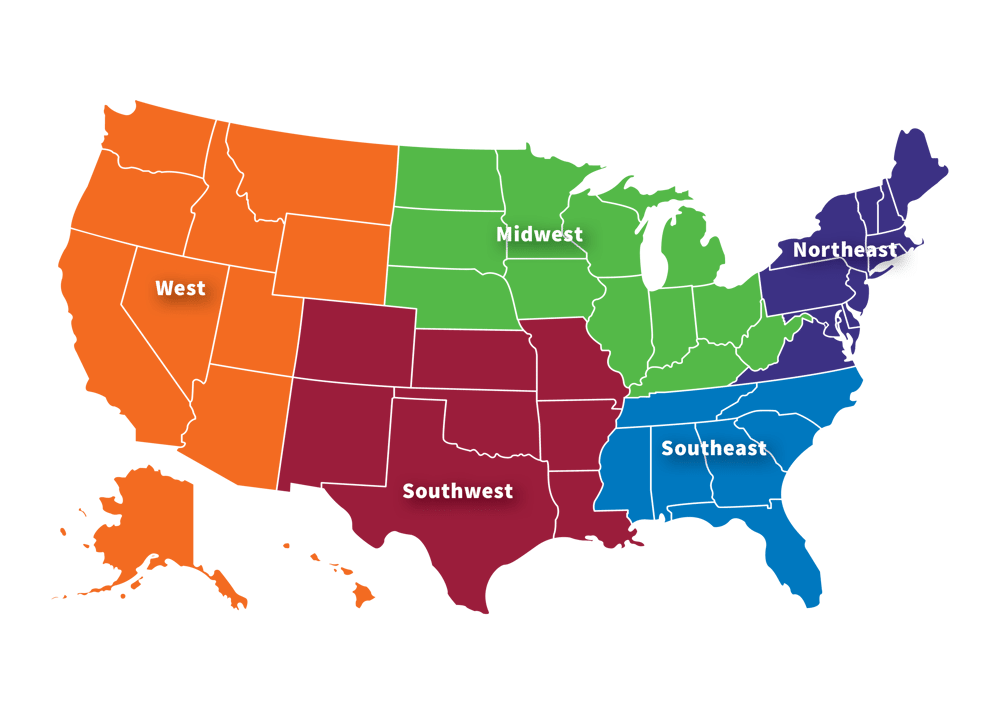

A Truly National Platform

- Locally focused MPL knowledge delivered through our regional service model

- Regional teams with local claims and risk management expertise

- Access to robust MPL coverage options from simple first-dollar provider coverage to complex excess tower reinsurance for healthcare systems and captives

- Products liability coverage for medical technology and life sciences, legal professional liability, and workers’ compensation insurance

- Responsible financial reserves to defend and support favorable outcomes

- Access to risk management resources to help minimize risk and improve defensibility of claims

ProAssurance is a top-five MPL carrier by market share nationwide.

Direct Written Premiums by MPL Line of Business, 2024

ProAssurance

MPL Industry

Regional Service Model for Standard/Physician Business

Department and Regional Leader Directory

We are committed to being your Carrier or Choice and source of local expertise. The blending of regional and product line expertise allows us to be flexible and provide you with the solutions your clients need. The direction of the regulatory environments is different for each state, and we spend considerable resources and time ensuring that we are prepared.

As we continue to build strong, productive relationships, we encourage you to reach out to your regional team leaders when questions aside.

.png?width=300&name=MikeSeveryn%20(1).png)

|

Claims Gina Harris Standard Underwriting Lucy Sam |

Risk Management Katie Theodorakis Business Development Andrea Linder |

Specialty Underwriting

Cindy Sloan

Assistant Vice President, Underwriting

CindySloan@ProAssurance.com

|

Claims Laura Ekery Standard Underwriting John Alexander |

Risk Management Jennifer Freeden Business Development Seth Swanson |

Specialty Underwriting

Chris Sweet

Vice President, Underwriting

ChrisSweet@ProAssurance.com

|

Claims Mike Reynolds Standard Underwriting Debbie Farr |

Risk Management Barbara Hunyady Business Development Doug Darnell |

Specialty Underwriting

Heather Van Bibber

Vice President, Hospitals & Facilities

HeatherVanBibber@ProAssurance.com

|

Claims Tara Bostick Standard Underwriting Christine Vaz |

Risk Management Brad Byrne Business Development Seth Swanson |

Specialty Underwriting

Chris Sweet

Vice President, Underwriting

ChrisSweet@ProAssurance.com

|

Claims Mark Lightfoot Standard Underwriting Tim Pingel |

Risk Management Barbara Hunyady Business Development Lori Sunday |

Specialty Underwriting

Mike Iovine

Vice President, Miscellaneous Medical &

Senior Living Programs

MikeIovine@ProAssurance.com

ProAssurance Financial Strength

To ensure stability and sound investments, independent insurance rating agencies assess our financial strength regularly.

To ensure stability and sound investments, independent insurance rating agencies assess our financial strength regularly.

An AM Best Financial Strength Rating is one of the most respected tools for assessing financial strength of an insurance carrier.

ProAssurance Group is rated "A" (Excellent) by AM Best as of 7/9/2025. This is the third highest of 16 ratings. AM Best's financial strength rating is assigned to companies that have, in their opinion, an excellent ability to meet their ongoing insurance obligations.

New Business Placements by State & Issuing Company

We've selected a primary issue company for each state for the placement of new physician business in the standard market. Please send new business submissions to the email indicated below.

Route new business submissions to Submissions@ProAssurance.com when:

- Gross primary premium is generally less than $4 million in no more than 3 states in a singe Standard Underwriting region

- Multi-state exposures will generally be underwritten by the Standard Underwriting region for the policy issue state

Send new business submissions to CustomPhysicians@ProAssurance.com when:

- Gross primary premium is greater than $4 million

- Large account with national footprint

- Seeking E&S, retrospective rated, large deductible and SIR plans, or captive solutions

The Underwriting Rules and Rates manuals for all active issue companies in all states are available to appointed agents are located on the Portal.

Specialty Underwriting

Custom Physicians

Custom Physicians offers E&S and admitted solutions to large multi-state groups, locum tenens organizations, physician contract staffing, loss sensitive plans, non standard individual physicians, etc.

Led by Chris Sweet. Route new business submissions to CustomPhysicians@ProAssurance.com

Hospitals and Alternative Risks

Hospitals and Alternative Risks underwrites E&S and products with primary and excess solutions for hospitals and systems of any size. Admitted solutions are also available in select states. Alternative Risks offers assumes reinsurance/ART risk-sharing programs, captive programs, loss portfolio transfers, and other innovative solutions for large healthcare operations.

Led by Heather Van Bibber. Route new business submissions to Hospitals@ProAssurance.com

Miscellaneous Medical

Miscellaneous Medical offers E&S solutions to a wide array of medical facilities. Coverages offered include healthcare PL, shared limits for physicians, general liability, HNOA, EBL and Sexual Misconduct/Physical Abuse coverage.

Led by Mike Iovine. Route new business submissions to MiscMedSubs@ProAssurance.com.

Senior Care

Senior Care provides E&S solutions for the full spectrum of senior care from independent living to skilled nursing.

Led by Mike Iovine. Route new business submissions to SeniorCare@ProAssurance.com.

ProAssurance Risk Management Services

Your physicians, administrators, and healthcare staff have access to risk consultants with prior experience as healthcare administrators, attorneys, nurses, and quality professionals. Risk Management consultants assist insureds with their liability concerns and questions using specialized knowledge of healthcare risk management issues and the Company's experience defending claims.

All risk management services are available to ProAssurance insureds at no additional cost.

Annual Baseline Self-Assessment*

This risk management assessment survey takes each team member approximately 15 minutes to complete.

Risk Management consultants review the aggregated results, pinpoint knowledge gaps, and offer resources and activities to boost operational proficiency.

Educational Seminars and Publications

- Online loss prevention seminars are available on-demand.*

- Claims Rx online CME courses offer claims-based learning and risk reduction strategies on trending topics.**

- Malpractice Case Studies offer risk management insights on a variety of specialty-focused cases.

- 2 Minutes: What's the Risk? videos feature clinical, quality, and legal consultants discussing medical liability issues.

- Medical liability articles and content bundles on current topics are in regular development.

- Sample letters, checklists, forms, and guidelines are available on the ProAssurance website to support proper documentation and best practices.

*Premium discounts may be available for successful completion of select risk management activities. Contact your agent or ProAssurance underwriter for more details.

**The ProAssurance Indemnity Company, Inc., is accredited by the Accreditation Council for Continuing Medical Education (ACCME) to provide continuing medical education for physicians.

Risk Management Helpline

Anyone in your practice can reach out to a Risk Management consultant for answers to pressing concerns.

Call 844-223-9648

Email RiskAdvisor@ProAssurance.com

Monday-Friday, 8 a.m. to 5 p.m.

How To Contact Us

Customer Service: Call 800-282-6242

Credentialing: Call 877-274-7007 or email Credentialing@ProAssurance.com

Submissions: Call 800-282-6242 or email Submissions@ProAssurance.com

Billing: Call 800-282-6242 (Option 1) or email Billing@ProAssurance.com

Claims Reporting: Call 877-778-2524 or email ReportClaim@ProAssurance.com

Risk Management: Call 844-223-9648 or email RiskAdvisor@ProAssurance.com

Commissions*: Call 800-282-6242

*To set up direct deposit for commissions, download the authorization form and submit to Accounts Payable at Corporate@ProAssurance.com.

Customer Service: 844-466-7225 (Option 0) or email CustomerService@Norcal-Group.com

Credentialing: Call 844-466-7225 (Option 4) or email Info@Norcal-Group.com

Submissions: Call 844-466-7225 (Option 0) or email Submissions@Norcal-Group.com

Billing: Call 800-282-6242 (Option 1) or email Billing@ProAssurance.com

Claims Reporting: Call 877-778-2524 or email ReportClaim@ProAssurance.com

Risk Management: Call 844-223-9648 or email RiskAdvisor@ProAssurance.com

Commissions*: Call 844-466-7225 (Option 0, request Agency Services) or email HCPLAgencyServices@ProAssurance.com

*To set up direct deposit for commissions, download the authorization form and submit to Accounts Payable at Corporate@ProAssurance.com.

Pay Online

To pay online 24/7, sign in to the portal and select the “Payments” menu option.

Pay by Phone

To make a payment by phone, call 800-282-6242 during regular business hours (Option 1).

Automatic Payments

To enroll in or manage automatic payments, sign in to the portal and select the “Payments” menu option.

One-Time Payments

To make a one-time payment, visit ProAssurance.com/Pay or call 844-466-7225.

ProAssurance Portal

ProAssurance’s portal is the secure area of ProAssurance’s website, which requires online registration of your account to view. All agents appointed with ProAssurance are eligible to register.

Registering Your Account for Online Access

To request online access for your account, click “Sign In” at the top of any page of ProAssurance.com, then follow the link to “Register Your Account for Online Access”.

After following the on-screen prompts and submitting your request, we will confirm your information and verify your account. If you experience any technical issues while setting up your account, you can contact the Support team at Portal@ProAssurance.com.

3rd Party Administrator

* Only if the customer is in the Ob-Gyn Risk Alliance (OBRA) or DentistCare program. OBRA courses are produced and housed with Relias, ProAssurance’s

partner for ob-gyn specific risk management content. Full transcripts of OBRA insured seminar participation are available upon request.

† For NORCAL insureds, recurring BillPay and Automatic Payments are now managed through the Portal. 24/7 online payments are powered by InvoiceCloud® at NORCAL-Group.com/pay.

ProAssurance AOR/BOR Guidelines*

It is the responsibility of our agents and brokers to maintain and perpetuate their client relationships and accounts. While ProAssurance prefers to maintain an account with the distribution partner that originally wrote it, we understand that there are circumstances that require insureds to change their designated agent or broker relationship. ProAssurance will consider AOR/BOR letters pursuant to the following guidelines, where contractually applicable and/or regulatorily appropriate

- Agent/Broker must be licensed and appointed in venue, for segment and with company on which policy is written.

- Current and approved agency/broker information must be on file with ProAssurance before accepting an AOR/BOR letter.

- Please Note: newly updated Agent/Broker information can take up to 10 business days from the date received to process, depending on the nature of the information provided.

- AOR/BOR letters must be printed on the insured’s letterhead and include the following:

- Reference to the ProAssurance policy number and printed name of the insured.

- Dated with an authorized signature of the insured or group representative and their title.

- Name of newly proposed Broker/Agency, name of Producer/Agent, and contact information.

- An email copy of the letter is acceptable to expedite the process.

- Proprietary information will not be released until the AOR/BOR has been approved by an authorized ProAssurance representative and all relevant timelines have been met.

- No AOR/BOR will be accepted within the first 12 months of an appointment and until the requesting agent/broker’s book of business reaches a minimum of $250,000 in written premium.

- Wholesale brokers may not AOR/BOR admitted policies with less than $250,000 in written premium.

- Wholesale brokers may not AOR/BOR policies written by directly appointed retail agents/brokers.

- Directly written policies are not subject to AOR/BOR except when there is a change of control for the insured and the AOR/BOR is related to the new controlling entity.

- All AOR/BOR requests are subject to management review and approval.

Upon receipt of an AOR/BOR request, a ProAssurance Business Development team member will take the following actions:

- Immediately notify the current agent/broker of the request.

- The current agent/broker will have a 7-business day grace period, from the date of receipt of notice, to obtain a rescinding letter from the insured.

- If the policyholder requests immediate release of all policy documents to the newly appointed agent, the 7-business day grace period may be waived. This may require a direct inquiry from a ProAssurance representative to the insured to confirm.

There will be no commission change for AOR/BOR requests received within 45 days of the renewal.

- If circumstances dictate that an AOR/BOR, received within this time period, is accepted, and the renewal is issued, the new agent/broker will immediately be responsible for service but will not receive commissions until the subsequent renewal. This includes any endorsements issued during the current policy period (e.g., ERP endorsements).

ProAssurance will not consider an AOR/BOR request for a new business submission unless a qualified underwriting submission is also included. The requesting agent/broker may not use another’s work product.

- Once an AOR/BOR is approved, the new agent may be required to provide a complete renewal submission when appropriate. ProAssurance will not share the prior agent’s work product (i.e., applications, physician roster, etc.). Requests to cancel/rewrite will only be considered for underwriting purposes.

- We will not accept an AOR/BOR within 30 days of the prospect’s current renewal date or if the terms have already been provided to the existing AOR/BOR.

- We do not accept AOR/BOR on direct business except as noted above.

*These guidelines are a general framework for the evaluation of AOR/BOR letters and are subject to change.

Using the ProAssurance Brand on Your Agency Website

Are you using the ProAssurance brand on your website? Use this checklist to ensure ProAssurance is properly represented.

As part of the demutualization process, NORCAL Mutual Insurance Company was renamed NORCAL Insurance Company, and can now be referred to as NORCAL in running text. To clarify that the organization is no longer a mutual, please update any references to NORCAL on your website.

| ProAssurance is one word with a capital P and capital A. Please list as ProAssurance. The following uses are not acceptable: Pro Assurance, proAssurance, Proassurance, etc. If issuing companies are specified, the statutory entity name must be accurate. |  |

All ProAssurance company descriptions are reviewed by our legal department yearly. Any variations may not be in compliance and may cause legal ramifications. Please use the company descriptions we provide.

Please visit ProAssurance.com/Contact-Us to ensure our contact information is accurate.

Broken links should be updated or removed.

ProAssurance has different logos for different uses (e.g., promotional items, signage, websites). Use only master logo art supplied by the ProAssurance Marketing department. Contact AskMarketing@ProAssurance.com for the proper files to suit your production needs.

| Our ProAssurance identity was carefully designed to represent our company with consistency and integrity. Here are some examples of what not to do. |

|

| Maintaining specified clear space will minimize visual interference. When using the logo near artwork or other graphics, always maintain clear space equal to the height of the letter N on all sides of the logo. |

|

| Our preferred background color is white. When using the logo on a tinted background, each portion of the logo should be readable and well-defined. |

|

ProVisions Agent News & Insights

Our main channel for providing useful information to our strategic business partners is ProVisions, a monthly magazine focusing on MPL industry and Company news. Each issue is focused on a theme impacting the medical professional liability industry along with insights from ProAssurance leadership, sales tips, and a roundup of industry news.

This magazine is provided in two formats: a webpage that is delivered in a monthly email and a printed magazine mailed monthly.

ProVisions Website Features

- Mobile friendly layouts—Scroll through each issue on whatever device is most convenient for you. No pinching or squinting necessary.

- Interactive table of contents—The table of contents moves through the issue with you. Open it at any time to jump to a new article.

- Enhanced content features—Each issue will continue to include links to additional resources, but we can now include additional elements like video,

interactive graphs, and more within each issue.

The website can be accessed by visiting Agents.ProAssurance.com/ProVisions.

ProVisions Print Magazine

Get a hard copy of our monthly issues delivered right to your door. Our print issues are ideal for sharing around your office or passing to new hires as a training tool. Get on our monthly mailing list, or request copies of individual issues as needed.

ProAssurance Corporation: Our History of Successful Mergers & Acquisitions

It’s remarkable to consider, but the company we know today as ProAssurance is the product of more than 25 previously independent companies including (most recently) NORCAL and the four companies it previously acquired. Our history demonstrates companies of similar values coming together to deliver stable, adaptive healthcare liability coverage options to protect our customers.

2021 - On May 5, following regulatory and policyholder approval, ProAssurance acquires NORCAL Group in a sponsored demutualization. NORCAL Group is integrated into operations of the healthcare professional liability (HCPL) division, making ProAssurance the third largest writer of medical professional liability insurance by U.S. market share.

2020 - The COVID-19 pandemic causes significant global quarantines. Social and economic disruptions include business closures, cancellations of elective surgeries, and increases in telehealth. ProAssurance’s response includes approximately $3.7 million in premium reduction to impacted policyholders, new online seminars for physician and practice administrators, and guidelines for mitigating risk while practicing during a pandemic. Complimentary confidential coaching for COVID-19-related stress is made available to insureds, as well as virtual risk assessments for office practices, and deferrals for premium payments.

2019 - In October, organizational structural changes include development of the Innovative Specialty Team, integrating chiropractic, dental, lawyer, and podiatric lines of business. Mid-Continent is consolidated into other existing HCPL operations.

2018 - December 3, Edward L. “Ned” Rand, Jr. is named President of ProAssurance in addition to his role as Chief Operating Officer. He was previously Chief Financial Officer for 13 years. Mr. Rand would become CEO of ProAssurance on July 1, 2019, succeeding Stan Starnes and retaining his title as President of the organization.

Dana S. Hendricks, previous Senior Vice President of Business Operations for PICA, is promoted to Chief Financial Officer effective September of 2018.

Michael L. Boguski, former President of Eastern Alliance Insurance Group, assumes presidency of a new division, Specialty Property & Casualty, effective mid-May of 2019. The division includes standard and specialty underwriting units, Innovative Specialty Team operations, and products liability.

Also in May, Kevin M. Shook, former Executive Vice President of Eastern, is named Eastern’s President. Robert D. Francis rejoins ProAssurance as Executive Vice President of Underwriting and Operations for the Healthcare Professional Liability operation within the Specialty P&C division.

2017 - ProAssurance’s subsidiary, Eastern Alliance, completes a renewal rights transaction with Great Falls Insurance Company’s book of worker’s compensation business on September 18, expanding Eastern’s operations to Maine, New Hampshire, and other New England states.

NORCAL Mutual acquires Preferred Physicians Medical Risk Retention Group, a Mutual Insurance Company (PPM), an anesthesiologist-founded, specialty-specific insurer.

2015 - ProAssurance forms ProAssurance American Mutual, A Risk Retention Group domiciled in Washington, D.C., which provides ProAssurance additional flexibility to service customers with challenging and complex needs.

NORCAL Mutual acquires FD Insurance, a private stock insurance company held by a group of Florida physicians and investors.

2014 - ProAssurance becomes the majority capital provider to Syndicate 1729 at Lloyd's of London operations, which expands ProAssurance’s commitment to writing the broadest range of healthcare-specific liability coverage, eventually enabling participation in carefully selected opportunities outside the U.S.

ProAssurance acquires Eastern Insurance Holdings, Inc., a publicly traded, healthcare-centric writer of workers’ compensation insurance. Eastern has proven expertise in alternative risk transfer through its Inova program. With the ability to provide customers proven solutions for professional liability and workers’ compensation, ProAssurance offers insureds, agents, and brokers unmatched ease in placing two difficult lines of business.

2013 - ProAssurance acquires Medmarc Insurance Group, consisting of Medmarc Casualty Insurance Company and Noetic Specialty Insurance Company, and expanding ProAssurance’s healthcare-centric focus to medical products and life sciences, and lawyer writings.

2012 - ProAssurance acquires Independent Nevada Doctors Insurance Exchange (IND), a reciprocal insurer, achieving a leadership position in the Nevada market and a strong base of operations in the far West.

2011 - NORCAL Mutual acquires Medicus Insurance Company, a medical professional liability insurance start-up established in. Texas, increasing its professional liability insurance business with a strong agent network and a presence in 34 states.

2010 - ProAssurance acquires American Physicians Service Group, Inc., the parent company of an Austin, Texas-based insurer. This moves ProAssurance into the vital Texas market and expands writings in Arkansas and Oklahoma.

ProAssurance and Ascension Health, the nation’s largest not-for-profit healthcare provider, announce creation of the Certitude® program.

2009 - ProAssurance acquires Podiatry Insurance Company of America, A Mutual Company (PICA), in a sponsored demutualization. PICA is the largest insurer of podiatrists in the U.S. and also insures U.S. chiropractors and acupuncturists through its subsidiary, PACO Assurance Company, Inc. PICA previously acquired PACO (1999), Dependable Protective Mutual (2000), and OUM (2001).

2008 - ProAssurance acquires Mid-Continent General Underwriters, offering coverage to allied healthcare professionals.

ProAssurance acquires Georgia Lawyers Insurance Company (GLIC) and names new agencies to begin expanding its legal professional liability business in Mid-Atlantic and far West regions.

2007 - ProAssurance Corporation's Chairman and Chief Executive Officer, A. Derrill Crowe, MD, announces his retirement in April. The Board of Directors elects former medical liability defense attorney, W. Stancil Starnes, to succeed Dr. Crowe.

2006 - ProAssurance acquires Physicians Insurance Company of Wisconsin, Inc. (PIC Wisconsin), a physician-founded insurer serving Wisconsin, adjacent Midwest states, and Nevada.

2004 - ProAssurance purchases renewal rights to Ohio Hospital Insurance Company’s physician, hospital, and healthcare facility business in Indiana, Illinois, Kansas, Kentucky, and Wisconsin. ProAssurance acquires NCRIC Group, Inc. in 2005, a parent company of NCRIC, Inc. (an insurer serving Washington, D.C. and Mid-Atlantic states).

2001 - Medical Assurance and Professionals Group merge to form ProAssurance Corporation, setting the stage for nationwide expansion and laying a foundation for growth in balance-sheet strength and industry leadership.

1999 - Medical Assurance assumes the business of Medical Defense Associates to strengthen its commitment to the state of Missouri.

1998 - Florida’s Physicians Protective Trust Fund (PPTF) and PICOM consolidate, forming ProNational Insurance Company.

MAIC Holdings acquires Missouri Medical Insurance Company (MOMEDICO), a publicly traded insurer, expanding westward and providing a base for operations in the Central U.S.

1997 - MAIC Holdings moves to the New York Stock Exchange under symbol MAI and changes its name to Medical Assurance, Inc.

1996 - PICOM assumes the business of American Medical Insurance Exchange (AMIE), serving physicians in Indiana.

Professionals Group forms as the holding company for PICOM, focusing on growth outside of Michigan.

1995 - The company assumes the business of Physicians Insurance Company of Ohio (PICO) and purchases Physicians Insurance Company of Indiana (PICI), providing a central base of operations for Midwest expansion.

Mutual Assurance is renamed MAIC Holdings to reflect a growing number of subsidiaries and greater scope of operations.

PICOM expands professional liability coverage to a limited segment of attorneys. PICOM assumes the business of Associated Physicians Insurance Company (APIC), an Illinois-based, physician-led insurer.

1994 - Mutual Assurance acquires West Virginia Hospital Insurance Company (WVHIC), expanding outside of Alabama and serving West Virginia physicians.

1993 - PICOM lists its stock under the symbol PICM.

1991 - Mutual Assurance becomes the first physician-founded company to demutualize and convert to a publicly traded stock company. Shares are listed on the NASDAQ Stock Market under symbol MAIC.

1987 - Preferred Physicians Medical Risk Retention Group, a Mutual Insurance Company (PPM) is founded.

1985 - Mutual Assurance becomes the first of physician/policyholder-founded companies to begin insuring hospitals and facilities.

1984 - Mutual Assurance becomes one of the first policyholder-founded companies rated by AM Best. ProAssurance’s high ratings today underscore a commitment to the security of a strong balance sheet and disciplined underwriting and pricing.

1980 - Physicians Insurance Company of Michigan (PICOM) is formed to assume the Brown-McNeely Fund’s business, a state fund created to address the dearth of affordable professional liability coverage. Founding physicians receive stock.

1976 - Mutual Assurance is formed by Alabama physicians to fill the liability insurance void left when Medical Association’s endorsed carrier abandoned the market. Medical Defense Associates, Ltd. is incorporated as a mutual professional liability insurance company, commencing business on February 7, 1976.