January 2026

From Vinyl to Virtual: Our 50th Year

Table of Contents

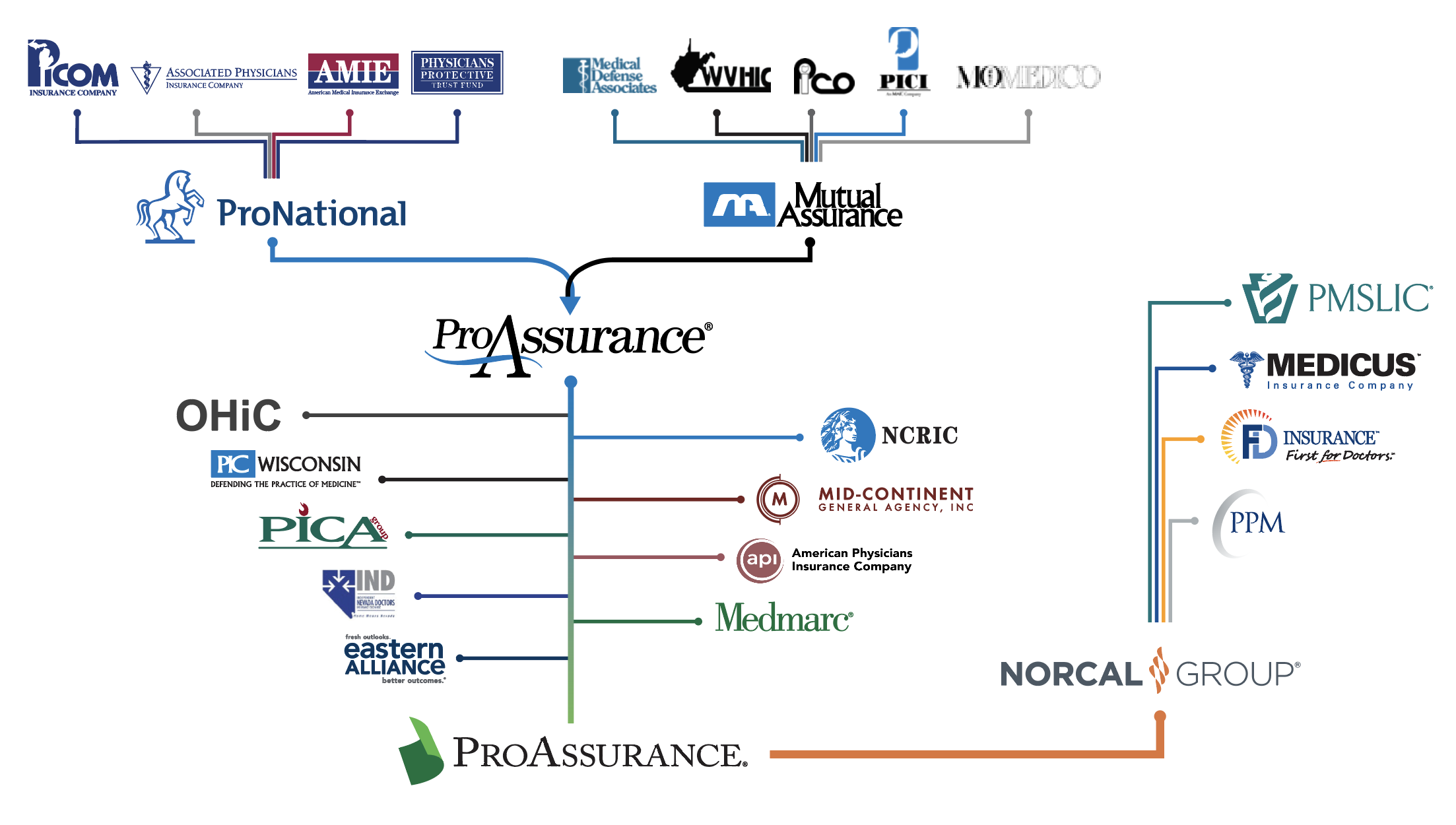

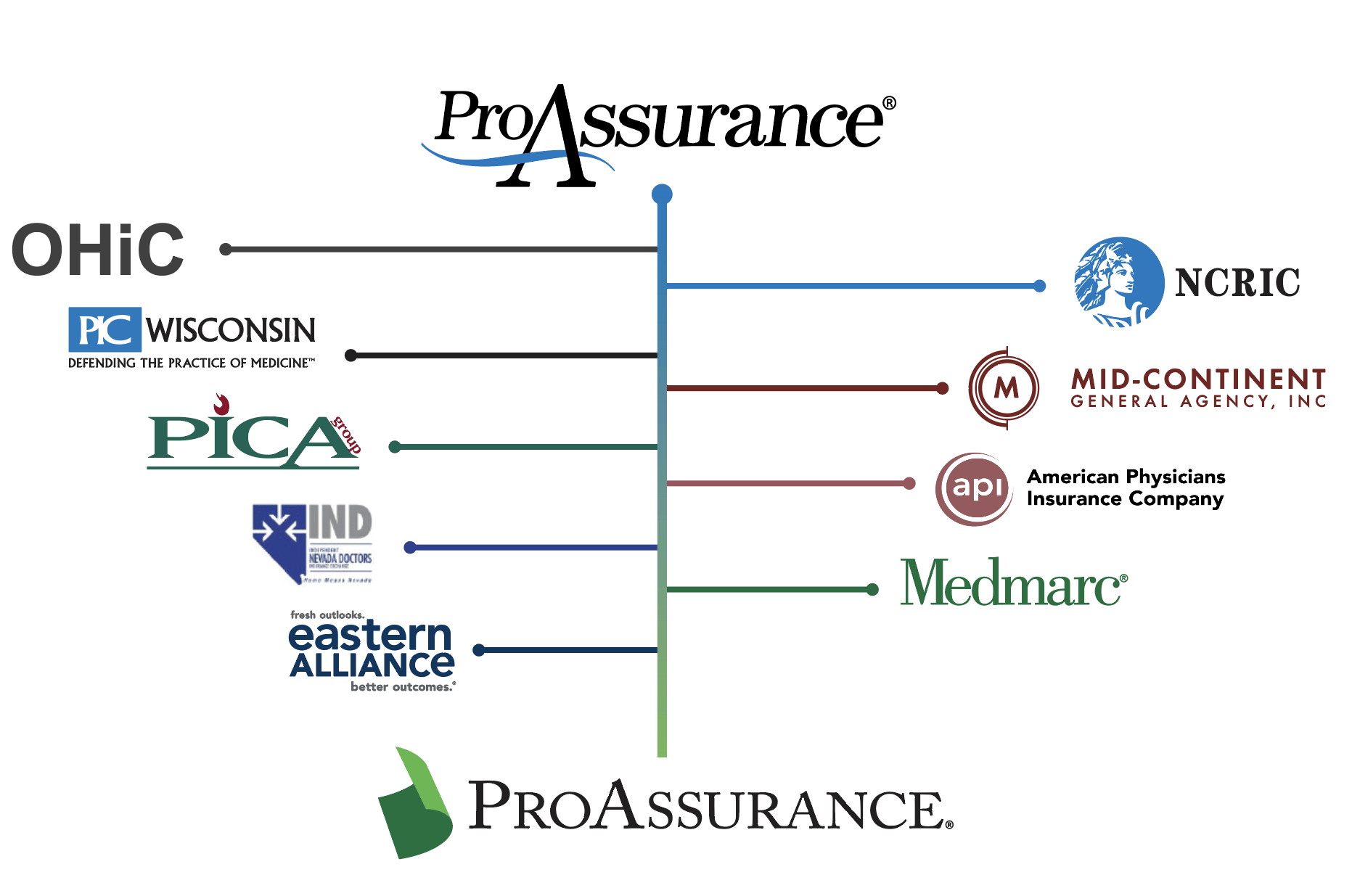

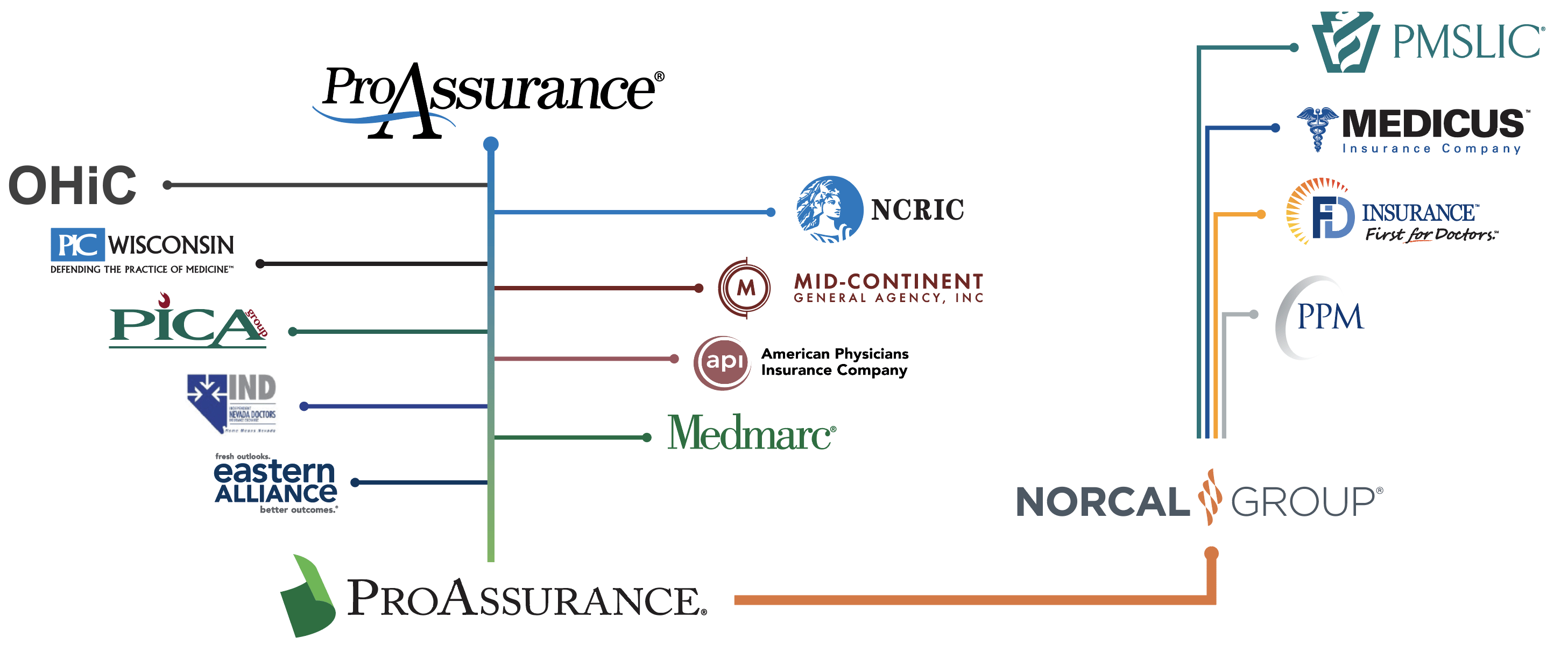

The History of ProAssurance Is a History of Mergers and Acquisitions

Birthdays are straightforward for individuals, but settling on one for an organization, as we recently did to celebrate ProAssurance’s 50th, can be complicated.

Is a company “born” when the entrepreneur has the Eureka! spark of inspiration, or does it at least have to be sketched out on the proverbial bar napkin? If the date is “official,” does it need to tie back to a government body affirmation of your existence, like the date of your business license or a certificate of authority? What if the state approves you Monday but the city or county takes longer? Maybe it’s the date of the first board meeting or some official act after all the red tape is sorted?

If the business is open to the general public, like a retail store or a restaurant, maybe it’s the day the doors were first open for business (never mind last week’s “soft launch” to test the point-of-sale system or the fact that the mayor couldn’t schedule the ribbon cutting photo op until the next week). For professional services, maybe it’s your first sale. Does an insurance company that hasn’t yet sold a single policy really exist?

And those are the easy questions! It gets a lot more complicated once your company starts engaging in mergers and acquisitions. If a firm you acquire was “born” before you, do you get older or do they get younger?

What’s clear for us at ProAssurance is that at some point, indeed at several points over the next 18 months, we will have cause to celebrate our 50th birthday. Therefore, we are declaring 2026 as “Our 50th Year!”

Officially our “birthday” is October 1, 1976, which is the date of incorporation for the Mutual Assurance Society of Alabama, now known as ProAssurance Indemnity Company, Inc. The many competing dates that also would have been great choices include February 14, 1977, the date we were licensed by the state of Alabama, and April 15, 1977, the date our first policy became effective.

Once you start contemplating birthday time travel via mergers and acquisitions, ProAssurance may already be 51, or even 76! The ultimate predecessor company to ProNational (part of the merger that formed modern-day ProAssurance) was PICOM, which privatized Michigan’s state fund, the Brown-McNeely Insurance Fund. The act that created Brown McNeely was passed in the 1975 legislative session, and the fund began issuing coverage on January 1, 1976. But in the 1990s, PICOM bought MEEMIC, an auto insurer, that was incorporated August 10, 1949. That company was sold in 2009, arguably de-aging us by 26 or 27 years. Yes, it can get complicated.

One thing that’s simple for us at ProAssurance is the mission and focus of our last 50 years—and the next 50. Our company, and numerous other medical malpractice insurance companies also celebrating their 50ths, were formed from an insurance crisis in the 1970s. Claims frequency and severity against physicians were rapidly escalating, making commercial insurance either unavailable or unaffordable. In Alabama, a group of visionary physicians partnered with the state medical association to address the crisis by forming a mutual insurance society. This same pattern of mutual formation in partnership with organized medicine was happening in numerous other states in those years.

For the next 50 years, defending the practice of good medicine remained our mission. While the company structure, practices, names, and product offerings adjusted over the years to adapt to market demands, protecting the interests of our insured physicians remained our focus, and we’re proud of our accomplishments today.

To all our customers, agency partners, defense attorneys, employees, medical association partners, and other stakeholders past and present, thank you for a terrific half-century.

The 50th anniversary logo and this announcement launch our 50th anniversary campaign, and throughout this year we’ll be celebrating key moments from the past and those who made them happen. We look forward to sharing those moments here online as we venture into our next 50.

How Alabama Physicians Created Their Own Insurer

The labor pains that gave birth to today’s ProAssurance began with the arrival of a letter on October 24, 1975.

That letter, from Employers Mutual of Wausau, notified the Insurance Committee of the Medical Association of the State of Alabama that the insurer was planning to end its medical professional liability (MPL) coverage for Alabama physicians on July 31, 1976.

The rapidly deteriorating claims environment nationally was forcing insurers to either abandon the MPL line altogether or severely restrict coverage. Wausau’s experience was a prime example. A leading provider of malpractice insurance—largely through association programs such as Alabama’s—its experience in New York ultimately resulted in the decision to exit the line entirely.

Alabama’s loss environment had been relatively benign until the early 1960s. In fact, one of the state’s leading plaintiff attorneys did not handle malpractice suits and had even written an article discouraging malpractice lawsuits, citing the difficult decisions physicians faced in medical crisis situations.

That began to change after a string of million-dollar medical liability verdicts opened the floodgates. Between 1967 and 1973, malpractice rates in Alabama rose between 300 percent and 400 percent. Wausau’s exit was thus understandable from a business perspective, but it left Alabama physicians facing the prospect of having no medical liability coverage at all. Wausau eventually agreed to remain in the state for one additional year. The clock was ticking.

A small group of physicians who were active in the leadership of organized medicine was asked to work to find a new carrier to provide coverage. Among them was A. Derrill Crowe, MD, who would emerge as a driving force behind the formation of Mutual Assurance.

“We went to virtually every insurance company in America looking for coverage, and nobody would cover us. We went to Lloyd’s in London and got the same answer,” Crowe said. He added, “I was the one who finally said, ‘I don’t think we have any choice. We have to form our own company.’”

One of Crowe’s colleagues on the committee searching for coverage would later recap the moment in a 1978 letter to policyholders. Dr. C. A. Lightcap, who would later become Chairman of Mutual Assurance, wrote: “Necessity, then, was Mutual Assurance’s mother … the baby was going to be born with or without us. There were times when the doctors working on the problem wanted to throw up our hands and quit. We were physicians, not underwriters. But we didn’t have the luxury of that choice.”

Dr. Norton Cowart, Chairman of the Association’s Insurance Committee, understood that the undertaking required expertise the physicians did not possess. The group brought on Dow Walker—who had been running the Medical Association’s program for Wausau—as Executive Director.

Charles Payne, the Alabama Insurance Commissioner at the time, recognized the dire situation but still needed convincing that doctors forming their own insurance company was a sound idea. Walker credits Dr. Leon Hamrick, another highly respected leader in organized medicine, with helping ensure the company obtained the necessary regulatory approvals. “Dr. Hamrick and I were working with the insurance commissioner’s office to get everything filed. He was the one actually talking to the media and giving the speeches.”

One condition of gaining insurance department approval was raising sufficient capital to ensure the company’s survival. That was no small task, as skepticism was widespread within the Alabama medical community. Crowe and a host of the heavyweights in organized medicine fanned out across the state to explain the lack of viable alternatives and the advantages of a dedicated insurer owned by its policyholders.

Rank-and-file physicians warmed to the idea but still had to be convinced to contribute the funds required to start the company. “At that time, the rule was if you wrote a million dollars in coverage, you had to have 10 million dollars in capital, and we were going to limit each physician’s policy to a million dollars,” said Crowe. “So, to raise the capital we needed, each doctor had to agree to put in cash. The most we felt we could get was $2,500 per doctor. And the doctors—believe it or not—realized the seriousness of the situation and jumped on the bandwagon and said, ‘Yes, we’ll do it.’”

Crowe proudly notes that approximately 2,500 physicians stepped up by purchasing subordinated debentures. Additional funds, however, were still required to meet regulatory requirements. Finding a bank willing to lend to the fledgling insurer proved difficult. “We went to several banks in town, and remember, at that time Birmingham was headquarters for several large publicly traded banks. None of them were interested,” Crowe recalled.

Finally, Birmingham Trust National Bank (now part of Wells Fargo after several mergers) agreed to loan the company $5.3 million—on the condition that physician insureds each sign a promissory note personally guaranteeing the loan.

“In addition to meeting regulatory requirements, the capital was important because at the time there was no reinsurance,” Walker explained.

With the loan approved and capital infused by its insureds, The Mutual Assurance Society of Alabama was incorporated on October 1, 1976. The acronym MASA was no accident; it mirrored that of the Medical Association of the State of Alabama, further cementing the company’s connection to organized medicine.

With a charter in hand and money in the bank, the next challenge was building an organization with long-term staying power. That meant a firm commitment to charging adequate rates to cover the risks assumed. At the time, a number of other mutual insurers—derisively called “bedpan mutuals” by the broader insurance market—had sprung up. Many viewed their future as limited, intending merely to survive until large national insurers returned to the market.

The physicians leading Mutual Assurance envisioned a different future—one they could control, independent of market whims. That founding principle remains a through line to the present day.

Committing to unchallenged financial strength was not the only operating principle that set Mutual Assurance apart. Crowe quickly realized why lawsuits were accelerating. “We were using lawyers who had done work for other insurance companies. They’d say, ‘Oh, we’re gonna defend this case. There’s nothing to it.’ Then, after milking it for two or three years—taking depositions and all that—they’d come back and say, ‘We’ve got to settle it.’ Settling all those cases, after racking up their fees, just caused plaintiff lawyers to go out and get more cases. It was like feeding the tiger in hopes he’ll eat you last.”

Crowe knew there had to be a better way, one that would break the settlement cycle, distinguish Mutual Assurance, and advocate fiercely for physicians who needed someone in their corner when they had done nothing wrong. That conviction led him to an up-and-coming young lawyer in Birmingham.

“I started to understand that many of the usual defense lawyers weren’t up to snuff in the courtroom. Then somebody told me there was a young guy downtown named Stan Starnes who I needed to meet,” Crowe said.

Starnes picks up the story. “He called and wanted me to come over, and my father and I went. He really didn't intend for my father to come, but there were two Stan Starnes, and so we both went. Crowe walked us through it all, what he wanted to do and how he wanted to do it. I thought he was nuts. But I needed the work, and he was, you know, a smart guy, and if he wanted to try cases, I was happy to go try them.”

Starnes recalls warning Crowe: “If you do this, I’m fine with it—I’m all for it. But remember, you’re going to win some cases you shouldn’t win, and you’re going to lose some cases you should win. If you try enough cases, you’re going to get some aberrant results.” Crowe replied, “I get it. I know it, and I’m willing to do it.”

Crowe’s dogged determination to fight for the company’s policyholders fostered intense loyalty and attracted a cadre of like-minded defense attorneys eager to try cases before juries with the unwavering support of the company behind them.

Crowe recalls telling one lawyer who warned that a case could result in a devastating verdict: “If we lose it and they bankrupt us, we’ll just start another company. Did it once. We can do it again.”

Walker, who later left Mutual Assurance and became a leader in medical liability reinsurance, says many companies tried—but failed—to emulate Mutual Assurance’s philosophy. “I was off in the reinsurance world, and I sat in on probably 10 to 11 different companies’ board meetings as their intermediary. And I can say without question, nobody had the same commitment to that philosophy as Mutual Assurance.”

By 1978, Mutual Assurance was on firm financial footing. The company repaid $2.3 million of its startup loan and added hundreds of new policyholders. But storm clouds loomed. In the latter half of the year, claims surged, with lawsuits increasing by 300 percent. Alabama was solidifying its reputation as a judicial hellhole. The state’s first attempt at tort reform failed in 1979. By 1980, one in three policyholders faced a claim or lawsuit. In 1981, the first verdict exceeding $1 million arrived—a $2.5 million verdict in Mobile, AL. The company’s claims philosophy, however, never wavered.

As commitment to aggressive defense continued, the company began mining data from its growing experience, and underwriting assumed an expanded role—again with Crowe deeply involved.

“I started reviewing applications. I personally underwrote about 2,000 of them,” Crowe said. “What I learned was unbelievable. We had people performing all kinds of procedures but listing themselves as general practitioners because GP rates were cheap. Nobody checked what they were actually doing, so premiums in Alabama were greatly underestimated.”

The Board of Directors—primarily physicians representing diverse specialties and regions in the state—convened as a committee to review applications flagged by underwriters. Walker explained, “If we were going to keep seeing claims and huge verdicts, premiums had to be adequate.”

Crowe is convinced these underwriting decisions improved healthcare delivery across the state. “The quality of medicine in Alabama changed dramatically because the Board effectively said, ‘If you do that, we won’t insure you—or if we do, we’ll charge a rate that reflects the reality of your practice.’”

That stance drew the ire of some physicians whose applications were denied or who were surcharged due to their claims history, and several complained to the Insurance Department. The commissioner reviewed a number of applications and claims with Crowe, who recalls the exchange this way: “One day he said, ‘I’ve been looking at this stuff, and I’m worried you’re not charging enough. These are some horrible damn doctors. You need to charge more money.’”

By the mid-1980s, Mutual Assurance—despite the challenging claims environment—was in such strong financial condition that it had paid off the remaining balance of the original loan and repaid much of the debentures contributed by the founding policyholders. In 1984, AM Best awarded Mutual Assurance an “A” (Excellent) rating just seven years after the company wrote its first policy, underscoring its financial strength and operating discipline.

In 1987, Mutual Assurance, the Medical Association, business leaders, and members of the defense bar were finally successful in pushing comprehensive tort reform over the finish line. Crowe credits Starnes and Paul Butrus, a longtime Mutual Assurance executive, with helping overcome the dominance of the plaintiff bar in the state capital. The results that followed the passage of the 1987 Medical Liability Act, drafted by Starnes and Butrus, further strengthened Mutual Assurance’s financial position. Today, almost 40 years later, those reforms have survived legal challenges and continue to govern cases against physicians in Alabama.

That strong balance sheet positioned the company to respond to sweeping changes in healthcare delivery in Alabama and across the nation. Hospitals and physicians were becoming increasingly integrated, requiring a new approach to medical liability insurance. In 1985, Mutual Assurance became the first policyholder-founded companies to offer coverage to hospitals and facilities. That capability quickly expanded into jointly insuring more complex risks—demanding greater financial strength to support higher limits and innovative coverages.

As healthcare delivery evolved rapidly, Mutual Assurance’s leadership became convinced that access to capital and geographic expansion were critical to the company’s future. Once again, Crowe turned to his trusted adviser, Paul Butrus, to help chart the path forward.

Starnes recalls the moment clearly. “Paul and Dr. Crowe deserve a lot of credit for realizing the company needed access to capital. We were insuring hospitals, and it was clear that more and more medicine was becoming hospital-based as physicians increasingly became employees. You could feel the entire medical environment changing. To compete in that world, Mutual Assurance needed to be bigger—and to get bigger, we needed capital. Crowe said it plainly: ‘We can either raise capital by making you stockholders, or we can come to you through higher premiums. And you’re already paying a bunch.’”

The decision to become the first of the so-called “bedpan mutuals” to demutualize—converting to a public company—set the stage for Mutual Assurance’s second act. First, it had established itself as an innovative, financially strong medical liability insurer. Demutualization would ultimately allow the company to become a major force in the industry.

Medical Assurance of Alabama Annual Report - 1979

Rekindle our commitment

The crisis which we all foresaw in 1975 when Mutual Assurance was conceived, is upon us today! Alarming increases in the frequency and severity of claims and lawsuits filed during the past year made reinsurance mandatory, and, though expensive, we were able to acquire it in December, 1979.

But the problem before us, and the one which must be stressed, is the impact of claims on the continued financial viability of the company.

…

Most importantly, the decline in underwriting profit for 1979, as illustrated in the Statutory Financial Statements, is directly attributable to the increased number of claims and lawsuits, and provisions for increasing our reserves for claim losses. During the last eight months of 1979, there was a three-fold increase in the number of malpractice lawsuits in which our insureds are defendants. The number of claims likely to become lawsuits adds another 300 to our file.

There should be no doubt in any Alabama physician's mind as to the reality of the present crisis, but rather, “how do we respond to it, and when do we begin?”

I suggest we begin today to rekindle the commitment we all had several years ago when the company was formed. Otherwise, we face two choices:

- A spiraling round of ever-increasing malpractice premiums, or

- The ultimate failure of the company—both financially and symbolically.

Mutual Assurance, acting alone, can do very little to affect malpractice claims frequency or severity. We only defend them. And quite frankly, we can control only 6% of the premium dollar. The remaining 94%, related directly or indirectly to claims, is under your control.

As you expect Mutual Assurance to perform and to retain the financial viability it has achieved, each and every other insured has a right to expect all members in this Society to be responsible. Mutual Assurance is nothing more than an institution, representing, collectively, the individual efforts of its owners. If we do not, individually, heed the perilous signals all around us, make no mistake about it, Mutual Assurance cannot save us collectively.

My belief is that an overwhelming number of Alabama physicians do not wish this company to fail, nor do they look forward to ever increasing malpractice premium costs.

Here is what we must do to avoid them:

- Channel as much of your other insurance business as practical through Mutual Assurance Agency. Commissions earned by that wholly owned subsidiary add directly to the financial strength of the Society, with no underwriting risk to it. Ultimately, that stability greatly enhances our ability to resist the malpractice claims we now encounter.

- Join with the other professions in the state who are working for legislative reform of our current Tort Law.

- As physicians, practice good medicine. Attend and take part in one of the various risk management programs which Mutual Assurance participates in sponsoring.

To the extent that we are not collectively successful in these kinds of efforts, you should expect, if we are to maintain this company as a sound provider of professional liability insurance, ever-increasing professional liability premiums. We cannot ask, nor should you expect, independent actuaries to ignore the reality of the Alabama experience. Currently, one in nine of our insureds is facing a claim or suit. As recently as ten years ago, that ratio was one in fifty. Ten years ago we were ranked far below the national average in such ratios. Today, we are above that average.

I assure you that we will continue to do everything possible to avoid claims increases. We will continue to analyze each and every claim as professionally as we know how. The years ahead are likely to be difficult; with your commitment and your cooperation, we can successfully confront the obstacles before us. Finally, I'd like to thank the Board of Directors and the management staff for their efforts and continued dedication.

How Mutual Assurance and PICOM Became ProAssurance

The second major chapter of ProAssurance’s rise to prominence is, at its beginning, a story of two companies on parallel paths: Mutual Assurance, based in Alabama, and Physicians Insurance Company of Michigan. Each shared a similar overarching philosophy, yet each brought distinctive strengths to the table.

The road each took to form ProAssurance is a story that informs the DNA of ProAssurance to this day.

Mutual Assurance, led by visionaries such as founding President A. Derrill Crowe, MD, and Executive Vice President Paul Butrus, clearly understood that a larger and more financially stable company would be required to meet the challenges of a changing healthcare delivery system.

Hospital/physician partnerships, specialty-specific practices consolidating and expanding across state borders—all demanded new capabilities and additional capital to ensure long-term financial stability and maintain top-tier ratings from agencies such as AM Best.

Crowe recalled, “Mutual Assurance was doing well, but it became clear that capital was going to be king, and we would have to raise it somehow. I also wanted the company to go public so policyholders and employees could own part of what we had built. And I began to see that there would likely be opportunities to acquire some of the single-state companies, because some were beginning to experience financial problems from charging inadequate premiums and paying too much too often to settle claims.”

The solution was demutualization—converting the company from a policyholder-founded and -owned company to a publicly traded stock company, albeit with most of the shares held by insureds. Internal discussions that began in the mid-1980s gained momentum following consultations with financial advisors and the support of the Board of Directors.

The full-scale push to demutualize began in earnest in late 1989. The process required educating policyholders about the need for additional capital, the inefficiency and burden of raising that capital through higher premiums, and the opportunity for them to profit from the strong company they helped build and support over the years.

Mutual Assurance successfully navigated both the politics of organized medicine in Alabama and the complexities of the demutualization process. In simple terms, each policyholder was entitled to a prorated share of the company’s net worth, based on the percentage of total premiums paid between 1987 and 1989.

Policyholders had the option to take the money due them in cash—which was immediately taxable—or in stock, which could allow them to defer taxes and share in the further success of the Company. An overwhelming majority took stock, but the success of the process depended on maintaining a level of cash that would maintain the strength and stability of the company in the eye of regulators and rating agencies.

Additional shares were offered to policyholders at $10 per share, and many chose to purchase more. Those additional share purchases, along with a limited number of shares sold to institutional investors, satisfied regulatory requirements.

Following an overwhelming policyholder vote in favor on March 15, 1991, Mutual Assurance entered the final stage of the demutualization, becoming the first property casualty insurer in decades to convert to a public company.

Mutual Assurance shares were listed on the NASDAQ exchange on September 11, 1991, under the symbol MAIC. While Mutual Assurance was the first of the so-called “bedpan mutuals” to convert to a stock company, it was not the first physician-founded stock company. That distinction belongs to Physicians Insurance Company of Michigan (PICOM), which also had its roots in the same medical malpractice crisis that birthed Mutual Assurance and numerous other physician-founded insurers. PICOM’s path to becoming a stock company, however, was somewhat different.

During the crisis that spurred these companies’ formation, Michigan was a state of essentially two medical communities: physicians (primarily surgeons) in and around Detroit, and physicians practicing outside the Detroit metropolitan area.

Vic Adamo, who would later become President of PICOM, says plaintiff lawyers largely accounted for the bifurcation, “The medical malpractice crisis in Michigan was felt primarily by Detroit-area surgeons,” he said. “They were the primary targets of the Detroit area plaintiff’s bar, which was more focused on malpractice lawsuits, and was probably more sophisticated at the time.”

Meanwhile, organized medicine—led by the Michigan State Medical Society—was exploring the formation of an MPL insurer. “At that time, the medical society was more focused on non-Detroit physicians—non-surgeons and general practitioners,” Adamo noted.

With the mid 1970's crisis biting harder, Detroit surgeons Arthur Eisenbrey, MD, and Harvey Gass, MD, approached Jack Dodge, an attorney well connected in medical and political circles, for assistance. In Eisenbrey’s case, two malpractice claims against him resulted in a 300 percent increase in his premiums. When the Michigan Insurance Bureau refused to allow the increase, Eisenbrey’s insurer pulled out of Michigan.

The trio came together to form what would eventually be known as the Physicians Crisis Committee. That group began the organizing, fundraising, and lobbying efforts typically handled in other states by the medical societies. By 1975, all but one commercial insurer had exited Michigan.

The Committee leveraged the surgeons’ medical community connections and Dodge’s influence at the statehouse to push through a series of bills that dealt with tort reform, largely limitations on plaintiff's lawyers’ fees, and the creation of a state-backed insurance vehicle, the Brown-McNeely Fund, named after Basil Brown and William McNeely, the two sponsoring legislators.

Adamo describes the Fund’s purpose, “It insured most of the Detroit area surgeons, and also the foreign medical grads in Michigan, who couldn't get insurance because most were practicing where there was a limited private market or no market at all. The Fund wrote the same level of coverage that was available in the private market.”

The medical-legal environment in Michigan gradually improved through incremental reforms, including rate-setting for high-risk specialties—such as surgery, anesthesiology, and obstetrics—based on actual loss experience rather than assumed loss data.

Although the malpractice crisis had not ended, it abated enough that the state of Michigan decided it wanted out of the malpractice insurance business. In 1979, the state put the business of the Brown-McNeely Fund up for bid. The Physicians Crisis Committee secured the financial backing of Physicians Insurance Company of Ohio (PICO) for their bid and were successful.

Much like Mutual Assurance’s demutualization, there was a formula by which insureds were granted stock based on premiums paid, but there was no option to take cash. However, any profits from the emerging company would go to physicians who had paid premiums.

Thus, on June 27, 1980, Physicians Insurance Company of Michigan commenced operations—structured as a stock company from inception. Adamo, who practiced law with Jack Dodge and had been heavily involved in the Fund’s evolution, eventually became PICOM’s president. He says of the early days, “Although we were a stock company, there was no real trading in the stock for five or six years. It was only after physician stockholders began to want the ability to sell shares that we moved to the Pink Sheets and later to the NASDAQ in 1993 listed under the symbol PICM.”

With both Mutual Assurance and PICOM public, both focused on building financial strength and both eyed limited de novo expansion into neighboring states. Each successfully walked the fine line of maintaining policyholder involvement while meeting, and often exceeding, the expectations of investors that were largely mutual funds that embraced the longer-term horizon required to be a shareholder in an insurer in a long-tail business such as MPL.

Mutual Assurance was the first of the two companies to execute an expansion move through a business transaction. On January 1, 1994, Mutual Assurance acquired the West Virginia Hospital Insurance Company and shortly thereafter became the endorsed medical liability carrier of the West Virginia Medical Society. The combined transactions added dozens of hospitals and more than 1,400 physicians to the company’s policyholder base.

Later that year, PICOM agreed to renew policies from Associated Physicians Insurance Company, an Illinois insurer with more than 2,200 insureds. The renewals began on January 1, 1995.

1995 was also the year that Mutual Assurance made significant inroads into the Midwest. First, the company acquired 52 percent of the stock in Physicians Insurance Company of Indiana (PICI) and later that year acquired the remainder of PICI’s outstanding shares.

Then in July 1995, Mutual Assurance assumed the business of Physicians Insurance Company of Ohio (PICO). This transaction helped cement the foundation for Mutual Assurance’s future transactions in the region as PICO was seen as a leader, having been a co-founder of PICOM, and the founder of PICI and Physicians Insurance Company of Wisconsin (PICWIS).

Mutual Assurance, recognizing that having “Mutual” in its name could be confusing to insureds, distribution partners, and regulators, changed its name to MAIC Holdings, Inc., on August 31, 1995. That would be followed in 1997 by a further renaming to Medical Assurance, Inc., and a move to the New York Stock Exchange, trading under the symbol MAI.

PICOM also continued to grow. In 1996, it assumed the business of American Medical Insurance Exchange, which insured approximately 900 physicians and dentists in Indiana but lacked the size and strength to expand independently.

The next big move was PICOM’s, in July 1998, when it merged with Florida-based Physicians Protective Trust Fund (PPTF). At the time, PPTF insured nearly 6,000 practitioners and 500 medical groups. The merger doubled PICOM’s size, adding $430 million in assets and $60 million in premiums while helping diversify PICOM’s insured base. Reflecting the significance of the transaction, PICOM changed its name to ProNational Insurance Company.

That same year, Medical Assurance expanded westward for the first time by acquiring Missouri Medical Insurance Company, another publicly traded MPL insurer. In 1999, it further strengthened its Missouri presence by assuming the ongoing business of Medical Defense Associates.

Around this time, Crowe recalls that he began considering other big steps. One of many conversations about consolidation and expansion led to discussions with Adamo at industry meetings. “I’d been talking with Vic on and off for three or four years,” Crowe recalled. “Eventually we agreed to talk seriously, and I went up to speak with their Board.”

Adamo noted that ProNational’s Board had been looking at strategic options as early as 1996, “Our Board went through an extensive strategic planning exercise, and I gather it was similar to what Medical Assurance did, and we came to the conclusion we had to be a bigger company. Also, the Florida transaction became half our book and we needed a broader spread of risk. So, that was a big motivation at our end, because we needed more non-Florida business to balance out Florida.”

Crowe says it all made sense strategically and monetarily. Adamo agrees, “If you looked at the map, both companies had grown into large regional companies but with overlapping footprints. Ohio, in our backyard, was Mutual Assurance’s second largest state, and Florida, in Medical Assurance’s backyard, was our second largest state. So when we laid out the map, the fit was obvious.”

The merger was completed on June 27, 2001, and was by far the largest transaction of its kind in the MPL space and made the new company, now named ProAssurance, the third largest MPL insurer in the country.

Synergies emerged immediately. Both leaders recall that each company brought strengths to the table, and both men agree they each had qualities that made them a successful pair.

“Vic had skills and expertise I didn’t—especially in personnel and process,” Crowe said. “And I brought attitudes and convictions that he didn't have.”

Adamo concurred. “We had a very good balance—a strong combination of skills. Each side brought something the other lacked, and we did a good job integrating those strengths.”

Just as Adamo and Crowe complemented each other, each company brought a strength to the combined operations. Adamo mentions Crowe’s focus on claims management and underwriting that enhanced the operations of the previous ProNational business. Crowe, in turn, praised ProNational’s expertise in sales and marketing—particularly relationships with agents and brokers, which then, as now, accounted for the majority of ProAssurance’s business.

Crowe acknowledges there were the usual bumps in the road that come from merging two companies but, all in all, he says, “There is no question that this combination allowed us to really put the hammer down and start doing all those other acquisitions.”

And other acquisitions did follow. ProAssurance broadened its expertise, expanded its geographical footprint, and enhanced the coverages it could provide to a constantly evolving healthcare delivery system.

PICOM Annual Report - 1980

In early 1975, the Michigan State Legislature, in recognition of the “diminishing availability of malpractice insurance” which was the chief symptom of what was then known as the “malpractice crisis,” created by statute the Brown-McNeely Insurance Fund (“Fund”). In simple terms, this legislation created a self supporting, state administered insurance company which was required to offer professional liability insurance to any member of a group of health providers which the Insurance Commissioner determined could not “readily obtain malpractice insurance ... for a reasonable premium.” During the succeeding five years the Fund fulfilled its legislative purpose by insuring more than 3200 Michigan physicians.

In the late winter of 1979, the Legislature informed the Fund that its authority would not be continued beyond June 30, 1980. The Fund then publicly announced that it would accept proposals to take over the operation of the Fund and assume all of its assets and liabilities.

During the Spring of 1980, eight proposals were submitted to the Board of Directors of the Fund, including proposals from Michigan Blue Cross/Blue Shield, General Reinsurance (one of the country’s largest reinsurers), and the Physicians Insurance Company of Ohio (“PICO”). The latter Company is an Ohio physicians owned stock company created by the Ohio State Medical Association. All of the proposals were reviewed by the Fund and by its manager, consulting actuaries and independent financial consultants. On June 13, 1980, the Fund’s manager, and its financial consultants recommended the acceptance of PICO’s proposal (which by that date included the active involvement of Michigan physicians) “as the best alternative,” and the Board of Directors of the Fund adopted this recommendation by formal resolution.

Of the eight proposals, the PICO proposal was the only one that protected the equity in the Fund for former Brown-McNeely insureds by:

First, providing that this equity would be governed by a Board of Directors of a new corporation (PICOM), which Board would be heavily weighted toward former Brown-McNeely insureds and controlled by Michigan physicians; and

Second, by distributing to policyholders of the Fund (in the form of PICOM common stock) more than 90% of the equity in the Fund.

PICOM was formed and capitalized through the authorization of 700,000 shares of common stock ($2.00 par value). PICO was permitted to purchase 50,000 shares at a price of $4.00 per share and 600,000 shares of PICOM stock were issued to the approximately 3,200 then present and former policyholders of the Fund without charge. Shares were issued to policyholders of the Fund on the basis of the proportion of the total premiums paid into the Fund by or on behalf of each policyholder.

During its preliminary organizational period, PICOM was managed by an interim Board of Directors consisting of seven persons, five of whom were Michigan practicing physicians. In October, 1980, at its first shareholders meeting, PICOM expanded its Board of Directors to 13 members, nine of whom are Michigan practicing physicians. The full Board also includes a representative of PICO, and a public member.

During its first year of operations, PICOM, by agreement, continued all of the underwriting policies of the Brown-McNeely Insurance Fund. PICOM has otherwise established, subject to regulation, its own premiums, its claims and underwriting policies for policies written after June 30, 1981 and has otherwise operated as a private Michigan insurance company.

Since its inception, all of the covenants, warranties and representations set forth in the written agreement between PICOM and the Fund have systematically been fulfilled. PICOM is the culmination of years of efforts by many Michigan physicians to provide healthy competition, stability and continuity in Michigan’s medical professional liability insurance market place.

ProAssurance’s Journey of Growth Through Strategic Mergers

The third, and penultimate, chapter in ProAssurance’s remarkable story begins with the successful conclusion of the 2001 merger between Medical Assurance and Professionals Group, the parent of ProNational Insurance Company.

The third, and penultimate, chapter in ProAssurance’s remarkable story begins with the successful conclusion of the 2001 merger between Medical Assurance and Professionals Group, the parent of ProNational Insurance Company.

Bringing together the footprints of both companies resulted in a super-regional organization with the financial strength, geographic reach, and sophisticated expertise to meet the liability needs of a rapidly changing healthcare delivery system.

Derrill Crowe, M.D., who was Chairman and Chief Executive Officer of the new company, says, “There was a strong commitment among senior management to ensure that ProAssurance maximized the potential advantages gained through the merger. I’d like to think much of that came from the spirit of cooperation that Vic and I demonstrated. There was some of the usual friction that comes from merging two companies and their cultures, but we all wanted it to work. And remember, both companies, each with different strengths, shared a common commitment to serving our policyholders and our distribution partners.”

“I think the merger went very well; we did everything basically right, and over the course of the next ten years, the transaction certainly proved itself financially,” said Vic Adamo, the former President and Chief Executive Officer of Professionals Group, who became President and Chief Operating Officer of ProAssurance. He added, “While there was some attrition as a result of the integration of the two companies, an important measure of the success of the merger was that almost all of the C-suite officers from both Medical Assurance and Professionals Group spent the remainder of their careers with the combined company.”

Having demonstrated its successful integration, the new company moved to take advantage of its standing in the market through a succession of capital-raising activities.

In late 2002, ProAssurance sold just over three million shares of common stock, raising approximately $6.5 million to support continued business expansion and to ensure the company maintained the financial strength required to retain its ratings as it pursued new opportunities to insure large, complex risks.

That stock sale was followed in mid-2003 by the issuance of $105 million in convertible debentures. The proceeds helped the company eliminate debt, strengthen the finances of its subsidiary insurers, and expand its insurance operations.

In 2004, ProAssurance issued $46 million of trust-preferred securities. The funds ensured that the company would remain on a strong financial footing and be able to sustain its growth trajectory.

Both Medical Assurance and ProNational had grown prior to the merger through de novo expansion and a number of strategic acquisitions. That trend continued following the merger.

Already a leader in the Midwest, ProAssurance in 2004 purchased the renewal rights to Ohio Hospital Insurance Company’s physician, hospital, and healthcare facility business in Indiana, Illinois, Kansas, Kentucky, and Wisconsin.

ProAssurance remained active and in 2005 acquired the NCRIC Group, a policyholder-founded company that had converted to a mutual-holding company with publicly traded stock. The NCRIC transaction strengthened ProAssurance’s footprint in Washington, D.C., and surrounding states.

In 2006, ProAssurance acquired Physicians Insurance Company of Wisconsin (PICWIS), which primarily served its home state but also had business in surrounding states and in Nevada through a prior transaction. With the acquisition of PICWIS, all the Midwestern companies that shared a founding legacy through Physicians Insurance Company of Ohio were now part of ProAssurance.

The market was not standing still, and other companies were expanding with the same rationale and imperative that drove ProAssurance. One of the leaders was California-based NORCAL Mutual Insurance Company, which would become part of ProAssurance much later in the story.

NORCAL, as the acronym implies, served primarily physicians in Northern California. The company emerged from the malpractice availability crisis that prompted the creation of other policyholder-founded companies across the country. In NORCAL’s case, eight county medical societies were the sponsoring organizations, and it insured just over 3,000 physicians at the outset.

Given the size of the California market, NORCAL largely operated within the state, where it competed with similar companies based in Southern California. Over time, however, the need to grow and diversify its insurance base drove NORCAL to expand into surrounding states, eventually reaching as far afield as Alaska and Hawaii.

NORCAL’s first significant acquisition came in 2002, when it acquired the Pennsylvania Medical Society Liability Insurance Company (PMSLIC), which had been created during the medical liability crisis of the late 1970s.

Veteran medical liability insurance executive Scott Diener was named by NORCAL to assume the leadership role at PMSLIC. Diener, who would later become President and Chief Executive Officer of NORCAL, says, “Like many of the professional liability companies at the time, we felt that we needed scale to be successful long term and to be able to cover the spectrum of healthcare delivery, from individuals and small groups to larger organizations.”

The changing medical-legal landscape and changes in healthcare prompted a move that surprised nearly everyone. In early 2007, Dr. Crowe, who had guided Mutual Assurance at its creation and through its ascension to the top ranks of the medical liability industry, announced that he was stepping away from his role as Chief Executive Officer.

Dr. Crowe recalls the thought process this way: “Healthcare was changing rapidly, and the legal system was undergoing another detrimental shift in the thinking of juries and the way state laws were structured, particularly in Florida. I wanted someone who understood the law and the ethos of the company, but who could make the changes that I felt might be needed.”

Dr. Crowe’s handpicked successor was Stan Starnes, ProAssurance’s lead defense attorney who knew ProAssurance because of his long association with the Company. Starnes, and the network of skilled defense attorneys he helped the company recruit, had vindicated Crowe’s innovative approach to handling claims and earned the company a remarkably loyal following among its insureds.

Starnes recalls the conversation clearly: “He said, ‘Stan, we’ve built an enormously successful company, but I’m almost 70. I’m tired. I’m ready to quit. I’m either going to name you the new CEO or I’m going to have to think about selling the company.’ I told him I had to think about it, and we reconvened a week or so later. After a long, frank conversation, I decided to take it.”

“I didn’t want to see him sell the company. I believed the company was playing a very important role in making the world safe for physicians and others in healthcare to practice medicine without the threat of a devastating lawsuit. And I knew that if we sold the company, whoever bought it would run it like a regular insurance company, not like the organization it had become. It was the right decision for me. It was the right decision for him, and it was the right decision for the organization.”

Crowe would remain as Chairman until 2008, but the DNA he injected into the company is woven into the fabric of ProAssurance to this day.

Acquisitions continued under Starnes’s leadership, bolstering not only the traditional medical liability business but also expanding ProAssurance’s vision of the company as it prepared to address the tangential risks increasingly intertwined with modern medicine.

The first acquisition under Starnes’s leadership came in January 2009, when ProAssurance acquired Mid-Continent General Underwriters, which brought expertise in insuring allied health providers and added hundreds of policyholders.

In 2009, ProAssurance acquired the Podiatry Insurance Company of America (PICA) in a sponsored demutualization that brought the largest insurer of podiatrists in the country into ProAssurance and expanded its umbrella to chiropractors and acupuncturists. PICA itself had grown through acquisitions, having acquired PACO Assurance Company, Inc., in late 1998, Dependable Protective Mutual in 2000, and OUM in 2001.

ProAssurance entered the dynamic Texas market in 2010 with the acquisition of publicly traded American Physicians Service Group, based in Austin, Texas. That transaction also expanded the company’s business in Arkansas and Oklahoma.

Austin became something of a medical liability insurance hub. In 2011, NORCAL acquired Medicus Insurance Company, an MPL start-up also based there. The transaction dramatically enlarged NORCAL’s footprint, as Medicus operated in 34 states and had built a strong agent network.

In 2013, ProAssurance acquired Independent Nevada Doctors Insurance Exchange (IND), which, combined with business gained through the PICWIS transaction, made ProAssurance the largest medical liability insurer in that state.

Looking further afield within the healthcare-related space, ProAssurance in 2013 acquired Medmarc Insurance Group, one of the nation’s leading providers of liability insurance for medical products and life sciences. The scope of insurance products available to the company’s distribution partners continued to expand.

Another leap forward came the following year, when ProAssurance acquired Eastern Insurance Holdings, a significant provider of healthcare-centric workers’ compensation insurance that also demonstrated expertise in alternative risk transfer through self-insurance and captive programs.

While not initially expected by the market, the benefits of the transaction soon became clear: coverage for two of the most difficult lines of insurance was now available through a single company with a depth of expertise unavailable in the broader commercial market.

2014 was also the year ProAssurance became multinational as the majority capital provider for Syndicate 1729 at Lloyd’s of London. This provided access to an innovative avenue for insuring one-off risks and allowed ProAssurance to participate in select opportunities outside the United States. While the venture ultimately did not achieve the level of success envisioned, it further demonstrated the company’s forward-thinking approach to professional liability.

The next major transaction belonged to NORCAL, which purchased FD Insurance, then the largest insurer in Florida. The all-cash transaction added approximately 2,200 healthcare providers in Florida and Georgia and strengthened NORCAL’s assets by more than $80 million.

NORCAL followed that acquisition with the purchase of Preferred Physicians Medical Risk Retention Group (PPM), an anesthesiologist-founded, specialty-specific insurer.

Consolidation in the medical professional liability space continued, but Scott Diener, by then President and Chief Executive Officer of NORCAL, notes that willing sellers were becoming increasingly scarce: “Continuing to acquire or combine with smaller or similarly sized companies was very definitely a strategy—and arguably the preferred strategy—for us. But at some point, every company that wanted an exit or needed to leave the business had already done so.”

Further, Diener explains that changes in physician practice ownership began to erode the claims philosophy of traditional MPL insurers: “As practices consolidated and hospitals took over, the importance that physician-owned companies attached to provisions like the consent to settle clause began to diminish. Administrators holding the purse strings were less concerned and sometimes even found it objectionable to pay for policies built around values that mattered to physicians, but not necessarily to an administrator’s vision of the bottom line.”

Everything appeared to be pointing toward the combination that would bring NORCAL into ProAssurance. Initial conversations had begun, but first there was another change at the top.

In 2019, Stan Starnes decided it was his time to relinquish his role as CEO. He says, “I was weeks away from my 71st birthday and completing my 12th year as the CEO of a public company. There is a reason the average tenure of a public company CEO is about half of that.”

During each year of Starnes’s tenure, ProAssurance was named one of the top 50 casualty insurance carriers in the United States out of a universe of more than 3,500 carriers—a testament, he says, to the people of ProAssurance. “Thanks to the hard work of our executive team and employees across the country, I felt that we had accomplished what we set out to do 12 years earlier. The timing was right.”

Longtime ProAssurance executive Ned Rand was named to succeed Starnes, who remained Executive Chairman of the Board until 2022, long enough to lead the Board through completion of the NORCAL transaction and the challenges of the COVID-19 pandemic.

Rand joined ProAssurance in 2004 after stints in public accounting and financial leadership roles within the insurance industry. Having risen through the executive ranks—as Senior Vice President of Finance, Chief Financial Officer, Chief Operating Officer, Executive Vice President, and now President and Chief Executive Officer—he recalls the excitement he felt with the transition.

“I had a real sense of excitement because of the people we had in leadership, the team of employees we had assembled, and the opportunity ahead of us. With that excitement came a sense of optimism.”

By the time Rand assumed his leadership role, discussions with NORCAL were already progressing. “We were still a long way from getting the transaction done when I moved into the president’s role. But I remember a pivotal meeting where we ultimately solidified things with the NORCAL board.”

Diener says ProAssurance offered everything the NORCAL Board had identified as essential to a transaction. From his perspective, the combination honored NORCAL’s commitment to policyholders and ensured their protection going forward. “The Board was very pleased with the company. We believed we were top tier, but we asked ourselves, ‘Are we able to serve our changing, large healthcare-system policyholders effectively? And are we using our policyholders’ capital effectively?’ The answer to both questions was no. That’s what led us to combine with ProAssurance.”

He continued. “We were using capital contributed by our original and early customers to serve newer, larger customers. When we weighed the alternatives and considered the opportunity both to honor policyholders and to meet the needs of future customers, consolidation with ProAssurance was the clear answer.”

The acquisition was completed in May 2021. The two policyholder-founded companies that were started to serve a few thousand physicians in Alabama and California have united through dozens of transactions to become a leading national force in the medical liability industry.

The numbers tell a quantitative story: tens of thousands of policies in force and a strong network of hundreds of distribution partners. But there is a qualitative story that’s told in the legacy of service to policyholders, agents, and brokers. It is, according to Ned Rand, the story of an enduring corporate culture, “I'm probably most proud of the culture of the organization. It is about everybody working together while, at the same time, respecting and valuing the uniqueness of each individual within the organization. That’s what has allowed us to perpetuate the values that were present in our company at our founding five decades ago.”

Now a new chapter is ready to be written with the agreed-to acquisition of ProAssurance by The Doctors Company (TDC). ProAssurance shareholders have approved the transaction, and regulatory approval is expected in the first half of 2026. The legacy will endure, given TDC’s policyholder focus and broad insurance capabilities.

NORCAL Mutual Insurance Company Annual Report - 1975

During 1975, the medical profession of Northern California was faced with many significant crises, some of them requiring hard decisions relating to the professional liability insurance covering our practices. Faced with huge increases in professional liability insurance premiums and the near term possibility of no source of coverage, the physicians were polled and it was concluded that they wanted to have their own company. That company is now a viable business entity, and I am proud to serve you as your president.

The Company achieved initial enrollment of 2,356 policyholders on November 14, 1975. Enrollment subsequently increased to approximately 2,800 policyholders as of December 31, 1975. These physicians contributed over $2 million to the Company’s surplus. The enrollment period revealed clearly that there was much pressure for physicians to alter their practices either by time element or by altering practice patterns. This created difficult and challenging administrative problems which for the most part have been resolved. Since that time, there is further evidence of continuing pressure for change.

Dr. James Affleck, Sacramento, has been Chairman of the Underwriting Committee since its inception and has been performing in yeoman-like fashion. We are working hard to improve our underwriting techniques and hope to develop some innovative programs during the coming years. We are not satisfied that the traditional insurance company approach truly responds to the needs and desires of our profession. Therefore, we are seeking appropriate changes in the future. We would appreciate any suggestions which you, as a policyholder, may have for our guidance.

The problem of loss prevention is another area needing attention in the coming months. We are aware that careful and judicious medical care is the best means of avoiding error but there are other areas of activity which certainly deserve careful review and perhaps subsequent alterations of modes of practice. Can the very serious claims, which have cost us so much in the past, be prevented in the future? We believe such claims can be effectively reduced if we are more vigilant. To this end the Company will be establishing a loss prevention program in 1976.

Dr. Duane Collier, San Mateo, is Chairman of the Claims Management Committee and is handling these problems in superb fashion.

The Investment Committee chaired by Dr. Paul Henry of Tulare has been active in placing your money in government notes, certificates of deposit and high quality commercial paper, thereby generating investment income. This conservative investment policy has been adopted by the Investment Committee as the most prudent policy in the Company’s early years.

A final word about Company philosophy as reflected by the Board of Directors. We are proud of the response and the direction achieved in establishing the Company and we are attempting to represent the physician. There are times, however, when our responsibility to keep our Company financially sound for the benefit of all its members may override individual physician preferences. We ask for your help and understanding when this arises.

The Bind Order

This selection of accounts ProAssurance bound recently is intended to give our partners tangible examples of risk classes we’ve been successful quoting and that we’d like to see more of. These examples are anonymized with final premium rounded, but otherwise present actual accounts.

UROLOGY

California

Limits: 1M/$3M

Admitted

Premium: $4,700

INTERNAL MEDICINE

California

Limits: $1M/$3M

Admitted

Premium: $5,100

FAMILY PHYSICIAN

Florida

Limits: $250k/$750k

Admitted

Premium: $4,100

PATHOLOGY

Kentucky

Limits: $1M/$3M

Admitted

Premium: $2,900

RADIOLOGY

New Jersey

Limits: $1M/$3M

Admitted

Premium: $12,000

CONCIERGE MEDICINE

Pennsylvania

Limits: $500k/$1.5M

Admitted

Premium: $3,600

ANESTHESIOLOGY

Texas

Limits: $1M/$3M

Admitted

Premium: $2,300

FAMILY PHYSICIAN

Virginia

Limits: $2.75M/$8.25M

Admitted

Premium: $2,800

ANESTHESIOLOGY

South Carolina

Limits: $1M/$3M

Admitted

Premium: $5,200

RHEUMATOLOGY

Maryland

Limits: $1M/$3M

Admitted

Premium: $20,000

CARDIOVASCULAR DISEASE

Wisconsin

Limits: $1M/$3M

Admitted

Premium: $5,800

MID-LEVEL PROVIDER

Alabama

Limits: $1M/$3M

E&S

Premium: $3,300

MID-LEVEL PROVIDER

New Hampshire

Limits: $1M/$3M

E&S

Premium: $2,800

MID-LEVEL PROVIDER

Texas

Limits: $1M/$3M

E&S

Premium: $2,800

AMBULATORY SURGERY CENTER

Florida

Limits: $2M/$4M

E&S

Premium: $24,000

THERAPY SERVICES

Arizona

Limits: $1M/$3M

E&S

Premium: $10,000

New Business Submissions

Our standard business intake address for submissions is Submissions@ProAssurance.com. For specialty lines of business, please use one of the following: CustomPhysicians@ProAssurance.com, Hospitals@ProAssurance.com, MiscMedSubs@ProAssurance.com, and SeniorCare@ProAssurance.com. Visit our Producer Guide for additional information on our specialty lines of business.

The types of business and premium amounts are illustrative of where we have written new business and not intended to reflect actual pricing or specific appetites.

Get all past editions of The Bind Order on our Marketing Materials page.

.png?width=300&name=MicrosoftTeams-image%20(28).png)

The American Tort Reform Foundation named eight Judicial Hellholes today in its 2025-2026 report, citing fraud allegations, high-dollar, nuclear verdicts, and made-for-litigation science as top concerns. (American Tort Reform Association)

A wave of federal and state healthcare policies is set to take effect in 2026, bringing major changes to hospital operations, reimbursement, insurance markets, and patient access. (Becker’s Hospital Review)

The projections cover changing federal regulations, the continued growth of AI and other technologies, and cybersecurity threats. They point to the need to adapt new technologies and care models but also to closely examine their performance, how they mesh with workflows, and assess returns on investment. (Chief Healthcare Executive)

This year, more hospitals are getting the Top Hospital award, a trend driven in large part by increased participation in the 2025 Leapfrog Hospital Survey, the company said.

“This year marks Leapfrog’s 25th anniversary—and the 25th year of the Leapfrog Hospital Survey—making it especially meaningful to recognize our 2025 Top Hospitals and Top ASCs,” Leah Binder, president and CEO of The Leapfrog Group, said in a press release. (TechTarget)

Patient safety across hospitals and health systems nationwide is improving, according to a new analysis of key safety and quality metrics from Q4 2019 to Q2 2025, recently released last week by the American Hospital Association (AHA) and Texas-based healthcare performance improvement company Vizient. (Healthcare Innovation)

Just over three-quarters of health system and hospital C-suites say they plan to increase value-based care model participation within the next two years, up from the 57% who indicated similarly back in 2023, according to survey data from Sage Growth Partners. (Fierce Healthcare)

(Subscription required)

Health systems and physician groups were reluctant in 2025 to execute deals that would have led to industry consolidation and rising investment by private equity firms. (Modern Healthcare)

You Can’t Change History … But You Can Try to Change Perspective

History is fascinating, and sometimes worth celebrating—like ProAssurance turning 50 and reflecting on its impact in the industry.

And then there’s the history you wish people would forget. I’m talking about prospects and clients who blame you for someone else’s past mistakes. Sometimes you can fix it, and sometimes you can’t.

The Doctor Who Hated Me (Without Knowing Me)

Throughout my sales career, I’ve always been persistent. I’d show up with purpose, a smile, and keep coming back. Most surgeons, even if they were busy, would at least acknowledge me.

Except for one. Dr. Bernard. After a year in my new territory, he was the only surgeon I hadn’t met. I’d stop by his office, leave a card, drop off literature, repeat. Crickets.

Then one day, as I headed into his office, he was walking out. I stopped, smiled, extended my hand, and said, “Dr. Bernard! I’m Mace with XYZ Orthopedics. Great to finally meet you.” He didn’t stop. Didn’t slow down. Didn’t even pretend he might shake my hand. He just glanced back and said flatly in his South African accent: “I have absolutely no interest in meeting you.” Then he turned fully around and delivered the knockout blow:

“I trained on your company’s products as a resident. When I opened my practice, I never saw a sales rep. To me, your company doesn’t exist. Don’t come back.”

And off he went.

I Tried Everything

I ignored the doctor’s order not to return and kept trying. I’d leave product literature, scientific papers, and even donuts. I even had my manager send the doctor a formal letter of apology for the company’s past failure to acknowledge him.

Nothing changed.

One morning, I noticed Dr. Bernard in the OR locker room and, figuring I had nothing to lose, confronted him. “Dr. Bernard, forgive me, but you’ve been blaming me for something that happened long before I was here. I’m trying to make it right. Can we at least talk?”

His response was short and final. “I hate your company. I’ll never use your products. Stop wasting your time.”

So … I did.

The Lesson

You can’t rewrite history for someone who refuses to open the book. No level of sincerity, logic, or even donuts will change them (although his staff appreciated the goodies). But before you give up, here are things worth trying (that work with most reasonable people):

1. Acknowledge the past—even if it wasn’t your fault.

2. Apologize sincerely and personally—not corporately.

3. Explain what’s changed—people, processes, results.

4. Be consistent—it wins most people over in time.

5. Ask for a clean slate—many will give it.

6. Know when to move on—there are some battles you won’t win.

Keep Looking Forward

You can’t change the past—whether it’s industry history, corporate history, or circumstances that existed before you arrived. But you can choose how that history informs what comes next.

As ProAssurance marks 50 years, its history becomes a foundation of trust. Carry it with you into the new year, focusing on clients who are ready to adapt to the changing demands of healthcare and liability, while providing patient care with confidence.

As for any Dr. Bernards along the way, wish them well and move on. The future is built with those willing to move forward together.

|

Written by Mace Horoff of Medical Sales Performance. Mace Horoff is a representative of Sales Pilot. He helps sales teams and individual representatives who sell medical devices, pharmaceuticals, biotechnology, healthcare services, and other healthcare-related products to sell more and earn more by employing a specialized healthcare system. Have a topic you’d like to see covered? Email your suggestions to AskMarketing@ProAssurance.com. |

Risk Management Updates

NEW RISK OFFERING:

Resident Rundown Podcast

This podcast series, hosted by Barbara Hunyady, JD, CPHRM, covers the medical malpractice insurance concerns on the minds of residents, fellows, and other early-in-career doctors. These six episodes cover topics such as when and how to get malpractice insurance, how premiums are calculated, what happens when you’re in a lawsuit, how to protect your personal assets, and how to avoid getting sued in the first place.

- When and how to get malpractice insurance

- How premiums are determined

- What happens when you’re in a lawsuit

- How to limit personal asset exposure

- How to avoid lawsuits

Episodes are available on Spotify, Apple Podcasts, and iHeartRadio. You can also browse all of the episodes on the Risk Management website.

The estate of an 80 YOF alleged that the rehabilitation facility failed to assess, monitor, and document skin integrity, nutritional intake, and repositioning practices, resulting in the development and progression of pressure ulcers, infection, and subsequent death.

Read the issue

In this episode, host Lesley Lopez-Viner discusses medical malpractice lawsuit defense with attorney Bill Chamblee. They explore the evolution of courtroom dynamics, the strategies plaintiff attorneys employ, and the trust jurors place in healthcare providers. Bill shares insights on the rise of nuclear verdicts, the impact of life care plans, and offers risk management advice for healthcare professionals.

Read the issue

Medical assistants can enhance patient care but also pose liability risks if tasks exceed their scope. Proper delegation, supervision, and ongoing competency assessments are essential for patient safety and reducing malpractice exposure.

Read the issueKeep Up-to-Date on All Our Risk Management Resources

Our weekly risk management newsletter features the latest releases from ProAssurance’s Risk Management department—as well as highlights from our expansive online library of tools and publications. Join our email list.

Congratulations to Our Partners Earning Elite Status in 2026

ProAssurance congratulates our partners who have achieved Elite Partner status for 2026. This prestigious recognition is awarded to the top 20 percent of appointed partners, reflecting our commitment to building valuable, reliable, and authentic partnerships with our agents and brokers. Elite Partners receive priority status, enhanced market education, and a prominent voice in our ongoing collaboration.

Using our proprietary Broker Report Card, our goal is to maintain a transparent and measurable evaluation system, ensuring Elite Partner status is both meaningful and accessible. We strive to be your Carrier of Choice and strong partnerships are essential to that endeavor. The Broker Report Card measures more than premium volume, focusing on the broader relationship and long-term mutual success. The Elite Partner Program is key in our continuous effort to strengthen these relationships.

Congratulations to all 2026 Elite Partners. Your dedication and excellence are commendable, and we are thrilled to celebrate this achievement with you.

ProAssurance 2026 Elite Partners:

- Acrisure Great Lakes Partners Insurance Services – LLC Marquette, MI

- Alera Group – Austin, TX

- Alera Group – Chicago, IL

- Alliant Insurance Services – Chicago, IL

- Amwins Group

- Aspen Insurance Services – Las Vegas, NV

- Brown & Brown Insurance – Brentwood, TN

- Brown & Brown Insurance – Carmel, IN

- CRC Insurance Services, Inc. – Birmingham, AL

- Cunningham Group – Elmwood Park, IL

- Don Powers Agency – Munster, IN

- Gallagher Healthcare

- Grady Professional Services, Inc. – West Palm Beach, FL

- Hilb Group, formerly Keane Insurance Group Now Known as Hilb Healthcare – St. Louis, MO

- HUB International

- Lockton Companies, LLC – Kansas City, MO

- LP Insurance Services – Reno, NV

- Marsh McLennan Agency – Loveland, OH

- Marsh McLennan Agency – San Diego, CA

- Medical Society of Virginia Insurance Agency – Richmond, VA

- NFP-Aon – Simi Valley, CA

- OneDigital – Morristown, NJ

- Prevail Insurance Management Services – Granite Bay, CA

- Professional Risk Associates – Midlothian, VA

- Professionals’ Insurance Agency, Inc. – Louisville, KY

- RT Specialty, LLC – Chicago, IL

- Shepherd Insurance – Carmel, IN

- WisMed Assure – Fitchburg, WI

- USI Affinity – Newtown Square, PA

- USI Insurance Services – Las Vegas, NV

- Western Summit, LLC – Fort Lauderdale, FL

ProVisions Team

- Communications

- Design

- Digital Marketing