July 2023

LEARNING CURVES:

MPL Market Dynamics

Table of Contents

Market Firming

A hard market develops when pricing for insurance coverage fails to adequately compensate for the cost of claims. Underwriters must adjust to ensure their standards reflect responsible pricing that will allow for adequate reserves to address a carrier’s long-term obligations. The property and casualty insurance segment is seeing a turn toward a hard market—and medical liability is often called out in reports as seeing a more severe market turn due to the long-tail nature of the business and high cost of the increasingly frequent nuclear verdicts.

Underwriting losses have persisted through the industry for several years. The MPL Association recently released a report citing a $224 million underwriting loss in the MPL industry, and a combined ratio of 103.0% for 2022. These numbers are consistent with figures from the past five years.

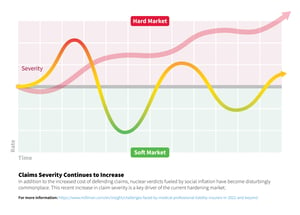

While increased claim severity is the most discussed factor impacting the property/casualty market, there are several factors adding additional pressure. In this issue we will review the lingering uncertainties from COVID-19, the increasing cost of reinsurance, and the increased costs associated with malpractice litigation.

As always, if you would like to discuss ProAssurance’s market approach, or any of these topics in more detail, do not hesitate to reach out to your business partners.

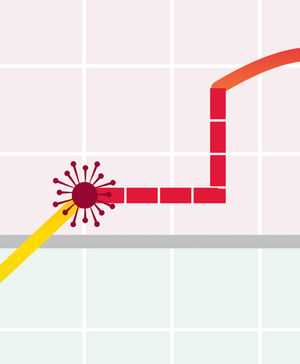

The Market Cycle

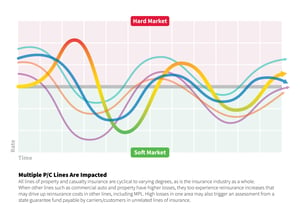

There are several indicators that may signal a firming or softening of the property/casualty insurance market. Some factors are particularly unique to the MPL space given the long-tail nature of the policy.

The Big Asterisk with Sokol Berisha

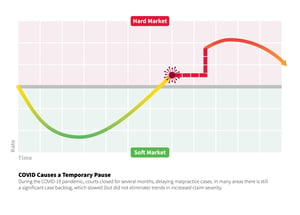

Court interruptions due to COVID create uncertainty in MPL data

A: I think we’re doing the best that we can given the large number of uncertainties we faced. This is a rough timeline of events: The first thing we saw during COVID that impacted our customers directly was the closure of some facilities or postponement of some procedures. This represents less exposure since fewer procedures are being performed. We reacted to this by providing discounts to those most impacted by the changes. Shortly thereafter, we saw two other impacts in the data. The first are the decreases in claims as the courts shut down at the height of the pandemic. However, that impact was temporary because the courts found ways to re-open or transitioned to electronic filing. The second, and potentially bigger one from an actuarial perspective, our ability to close claims was also significantly impacted. Certain things occur as a case moves closer to trial such as discovery, depositions, court ordered mediation, etc. None of these things were occurring or they were severely slowed which impacted our ability to close claims. These things did not occur only for ProAssurance but the industry at large as we all operate in the same environment. These slowdowns add additional costs to operations as generally the longer claims are open, the more it costs to drive them to resolution. Notably, almost every single one of these observations varies greatly by state.

Unfortunately, some of these impacts are still with us. While the courts have reopened and are functioning normally, the backlog that occurred between 2020 and 2021 has not cleared. And based on conversations with the Claims department, it will probably take some time for that backlog to clear. Until that time, we must make assumptions about what the future will look like.

A: I think here it’s a matter of perspective. I can only comment on the lines of business that I have worked on over my career. I think first and foremost what you saw—and this was because I started my career with Liberty Mutual—was auto. Auto saw massive decreases in frequency, and it was very abrupt. This happened because businesses shut down and people weren’t driving. And if you think about it, how do people get into accidents? Well when they drive around. I believe some states forced auto insurance companies to provide refunds to their customers. Other lines are directly related to work such as workers’ compensation. Businesses shut down so workers weren’t working, and the exposure base, which is payroll, goes down dramatically, followed by fewer injuries occurring. I think those two were directly impacted because of COVID at the height of the pandemic. You could argue other lines were impacted greatly as well; I am just less familiar with them.

We need to remember that those effects were temporary; after the pandemic, people made up for lost time. If you listen to financial news now, many of the auto insurance companies have filed for double-digit rate increases across the board, because you have two phenomena that are occurring. One is the ‘revenge vacation’ or ‘revenge travel.’ You had a period of low exposure moving to high exposure and the second to that is severity. Severity, with other lines of business, especially auto, is impacted by general inflation.

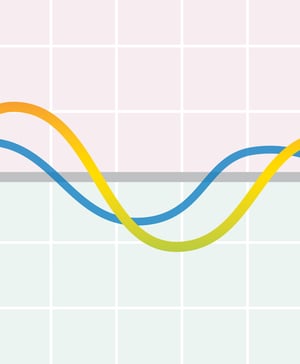

A: It depends on the industry and what we are talking about. On the frequency side I think generally things tend to revert to the mean. So if you had a period of high/low frequency, it will generally return to the average or long-term trend at some point. On the severity, prices tend to be sticky. If you see a period of high severity, like the current, it is unlikely that you will see a decrease in severity in the future to return to the long-term mean. It’s possible that year over year trends normalize but at that higher level, almost like a plateau jump. Let’s use an example: If you experienced 15% severity, you would need to experience a large decrease next year to return to normal trend … that is unlikely in my view. What’s more likely is that next year you get 5% severity, but that’s on top of the 15% experienced in the prior year.

A: So it depends on the line of business. If you think about how COVID occurred and its impact on, for example, workers’ comp, a lot of businesses shut down. Now mind you, the steepness of that has probably—at least in our lifetime—never occurred that quickly. Within a short timeframe, businesses were closed. When you think about the Great Financial Recession (’08-’09 period), there was significant contraction. So if you think about workers’ comp, where your base is payroll, there was a major contraction in payroll during the recession. So because your premium is a function of that, your premiums go down significantly, and more specifically audit premium goes down. This has a negative impact on you since you are bringing in a lot less premium than you thought you would so things like expense ratios, etc., increase. I think some of those things can be observable.

However, in our field, specifically healthcare, if you think about the impacts on our business, the shutdowns did not occur across the board. If anything, some things like ICU bed utilization increased dramatically. With healthcare personnel already stretched thin, we are especially concerned about the impact of procedure volumes on claim frequency in the next two years.

We also know through other evidence that some procedures were canceled or delayed. It will take time for us to understand the impacts of that to see if there will be “catch-up” in the future or if potential outcomes could be worse due to the delay. This is all speculation of course as only time will reveal the truth.

A: I think what we want to convey is we are reacting to the data that we see, but we are also cautious because we believe that there are long-term repercussions due to COVID that we do not yet fully know.

So those procedures that were delayed or put off for a year, will they have long-term consequences? And the severity of diseases that can be helped due to early discovery, those situations will take many years to play out.

During COVID, doctors were seen as heroes, and we thought there would be a lasting effect of that. But plaintiffs’ lawyers quickly adapted to this new reality and pivoted their strategy. Understanding the public good will toward doctors, they became quite adept at blaming the institution rather than the individual healthcare providers. Because of this, we have seen a record number of high verdicts in 2022 and early 2023.

To summarize, in the short term we understand the impacts of COVID, but in the long term, we do not fully know the implication of COVID and its impact on severity or claims. I believe that will take some time to play out. We have observed the short-term implications, but we are waiting to see the long-term impacts over time.

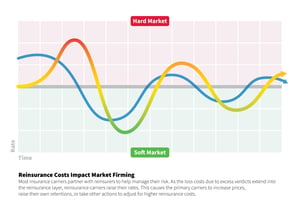

The Rising Cost of Reinsurance

As the medical professional liability (MPL) market has hardened, we’re seeing the same kind of firming in the reinsurance market as well. What is driving today’s reinsurance market dynamic, and what does the future hold?

Increased Rates and Claims Severity

As of March 31, 2023, AM Best maintains its Stable outlook on the global non-life reinsurance segment.

However, many of the issues affecting MPL insurers are also impacting reinsurers. Rapidly rising interest rates, inflation, and increasing claims frequency and severity are the primary challenges facing both insurers and reinsurers.

“Nationwide large verdicts and increased claim costs have led to conversations regarding the evaluation of price adequacy, structural considerations, as well as terms and conditions,” said Katy Ladisch, AVP, ProAssurance Assumed Reinsurance and Alternative Risk. “These are the same pressures felt from the MPL carrier side but are amplified for reinsurers.”

A recent article by the Medical Professional Liability Association (MPLA) notes that systemic exposure is also an issue in the MPL reinsurance space currently. Systemic exposure refers to a potentially widespread risk or liability stemming from a specific medical issue or trend, such as a pandemic, cybersecurity, or sexual misconduct.

The increase in reinsurance rates is seen most prominently in the U.S. property catastrophe reinsurance sector, where rates rose by as much as 50% at a key July 1 renewal date, according to Gallagher Re. Further, mid-year reinsurance renewals saw “a continuation of the pricing and structural market dynamics that defined the [January 1, 2023], renewal period.”

The MPL industry is seeing significant rate increases as well and additional restrictions on reinsurance placements impacting the hospital sector (with low-limit physician business being the least affected), according to a Fall 2022 BMS Re report on MPL industry trends. In addition, the past five years have seen reinsurers generally reduce their MPL portfolios. Ultimately, it is the profitability margin on the MPL segment that continues to drive decision making for reinsurers, according to Ladisch.

Outlook

Recently AM Best assessed how rising reinsurance pricing is set to affect P&C underwriters across the U.S. The rating agency indicated that it expects the pressure of paying higher costs for reinsurance protection to build on those that had previously been reliant on reinsurance.

However, buyer demand for reinsurance capacity continues to grow, and primary carriers “appear to have generally accepted the new norms of reinsurance pricing and structures,” according to AM Best.

To help manage the steep rise in reinsurance rates primarily brought on by large verdicts, many MPL carriers are increasing premium rates and facing mounting uncertainty about the claims environment. We have continued to see the record-setting pace of excess verdicts across the MPL industry in 2023, and as we discussed in the May issue of ProVisions, there appears to be no end in sight.

AM Best expects these market challenges will continue to affect reinsurer appetite throughout 2023. According to Gallagher Re, there is a trend of consolidation into fewer, larger reinsurance entities and few new reinsurance entities. This points toward a greater chance of prolonged pricing stability, despite the continued hard market.

“The longevity and strength of relationships remains a crucial part of successful reinsurance partnerships,” said Ladisch. “Partnering with experienced reinsurers who are committed to the MPL space and understand our mission, values and vision allows ProAssurance to continually deliver value to our insureds.”

Litigation Funding: Trending Trouble for the Market?

In the late 1990s, a relatively new third-party litigation funding (TPLF) mechanism emerged1 as an alternative to the traditional tort compensation model, coinciding with states relaxing common law prohibitions on maintenance, champerty, and barratry.2,* Sometimes called settlement loans, lawsuit loans, lawsuit funding, or plaintiff funding,1 the litigation funding market in the U.S. was estimated by Swiss Re Institute at nearly $9 billion in 2020—52% of the $17 billion global market.3

In the traditional compensation model used in medical malpractice and other personal injury litigation, plaintiff’s counsel receives a percentage of the award or settlement with the remainder going to the plaintiff. Because a plaintiff only receives compensation if the case is successful (by settlement or award), they must wait for the litigation to conclude to receive funds—which may take years—and receive no compensation if the case is unsuccessful. In a funded case, however, a litigation funding company (LFC) advances money in exchange for interest on the loan, a multiple of the amount funded, or a percentage of the plaintiff’s share of the recovery in the lawsuit.2 Importantly, the plaintiff usually has no obligation to repay the advanced funds if the lawsuit is unsuccessful. Because of this non-recourse loan structure, it generally falls outside state usury laws.1

This type of legal funding mechanism offers risks and benefits to the LFC and plaintiff. For the LFC, lawsuit funding is an all-or-nothing investment. Its non-recourse status means they risk losing their entire investment if the plaintiff loses the case. However, that risk—coupled with the absence of usury restrictions—brings with it potentially high returns.1,2 For a plaintiff, it provides immediate access to much-needed funds with often no obligation to repay if the case is unsuccessful. However, depending on relevant law and contract terms as well as the amount of advanced funds, the plaintiff may forfeit much or all of any settlement or jury award.1 For a plaintiff who still stands to receive a portion of the final proceeds, such arrangements may enable them to better sustain a longer litigation in hopes of a higher jury award or settlement offer.2

Impacts on the MPL Market

A 2021 report by Swiss Re Institute identified TPLF as a contributing factor in social inflation by “incentivizing litigants to initiate and prolong lawsuits.” The report also identified impacts on the length, cost, and resolution of legal action:3

While the industry is not specifically regulated under U.S. federal law, federal securities laws may be generally applicable.2 State laws, regulations, and case law governing the TPLF industry also exist and are becoming more prevalent, typically based on continued recognition of the torts of maintenance and champerty, or consumer protection regulations such as usury and disclosure requirements.3 For details on these state regulations, see the following resources:

- Swiss Re Institute. US Litigation Funding and Social Inflation: The Rising Costs of Legal Liability, Table 5: Summary of TPLF rules for a selection of US states.

- U.S. Government Accountability Office. Third-Party Litigation Financing: Market Characteristics, Data, and Trends, Appendix III: State Laws Addressing Third-Party Litigation Financing.

* “Maintenance refers to helping another prosecute a suit; champerty is maintaining a suit in return for a financial interest in the outcome; and barratry is a continuing practice of maintenance or champerty.”2

References

1. National Law Review. September 2022.

2. GAO. December 2022.

3. Swiss Re Institute. December 2021.

Market Dynamics Presentation

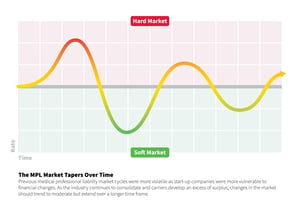

Medical professional liability (MPL) insurance has been in a soft market cycle since 2005. Soft markets are generally characterized by coverage that is widely available, policy terms have been "loose," and price-based competition is common.

However, in a hard market cycle, insurance becomes less available, policy conditions tighten, and premiums increase to stabilize reserves.

Due to the long-tail nature of medical malpractice claims that may take years to resolve, an insurer's long-term financial health is of utmost importance to insureds. ProAssurance was founded in response to the first hard market after it began in 1975, providing stability for our insureds during the next three hard market cycles in the 1980s, 1990s, and early 2000s.

We have created a report that outlines key drivers of the MPL market for use in your sales conversations around hard and soft market cycles and nationwide trends. Download a copy of the presentation at ProAssurance.com/MPLMarketDynamics.

Contact ProAssurance’s Marketing department or your Business Development representative if you have questions about using the presentation.

Tales from Past Hard Markets

The MPL market is in a constant state of evolution, with each rise and fall in the cost of insurance claims and premiums creating significant impact for insurers, policyholders, and providers. ProAssurance closely monitors these market conditions, staying ahead of both hard and soft cycles with responsible underwriting and pricing that meets the long-term needs of our insureds while covering the high cost of claims.

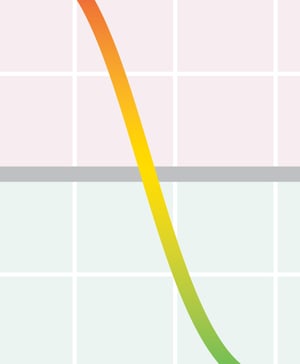

Our current hard market follows a lengthy period from 2005 to 2019 characterized by readily available insurance coverage options, price-based competition, and secure profits for carriers. In subsequent years the market witnessed an increase in medical malpractice claim severity due in large part to excess jury verdicts, and combined ratios rose over 100%. Pressures from both financial constraints and social inflation have pushed underwriters to reevaluate their policy terms and pricing, and today we see premiums and reinsurance costs climb while coverage availability diminishes. Companies at this difficult turn in the cycle face rating downgrades, state-imposed evaluations or receiverships, and even potential liquidation while unprepared nonspecialist carriers exit the MPL market, further limiting policy options.

ProAssurance can better understand, anticipate, and navigate these challenges now and in the future by collecting the insights and strategies of team members who have endured hard markets from years past.

You must educate your insured on the trends going on in the market that are driving the need for higher rates. These involve two inflationary trends, and the first is general economic inflation. Everything costs more for the insurance company, as it does for all of us. One of the largest of those costs is the defending of a claim. Experts charge more, and attorneys charge more as their costs increase. However, the biggest inflationary driver is the loss cost of claims. These have been rising for years, and the increase has accelerated over the past few years, driven by what has been termed social inflation. This describes increases in jury verdicts and plaintiff demands for payment outside of normal inflationary trends. We have higher jury verdicts than ever and more of them across every jurisdiction. Verdicts of $100 million or more are becoming commonplace, driving up settlement costs as plaintiff attorneys become more and more emboldened.

Hard markets do not last near as long as soft markets. A return to price stability will come once premiums adjust to the current claim severity trends and the unpredictability of claims volatility is lowered.

Wise agents should place their clients with a carrier who has a strong balance sheet and a consistent track record for successful claims resolution. They will have prudently navigated the insurance cycles of previous decades.

The MPL market is cyclical. All carriers are going through this, not just us. There are pressures to price accounts responsibly in order to obtain profitability and pay future claims. Agents should review their loss runs and coverage closely to better understand why premiums are where they are.

A hard market is a seller's market. Although we may have leverage to raise rates due to tightening on the availability of insurance, we cannot forget the importance of using this time to build trust and relationships. Our insureds may have limited choices in a hard market, but that will change when the market softens. The relationships, trust, and value we add to their practice can and will help carry us forward and affect retention through the next softening of the market. In addition, we have an impact on claim severity. All of these advantages directly impact the insured's ability to maintain quality insurance during a hard market. The least expensive insurance is not always the best choice.

Ongoing Market Cycle Coverage

Additional resources on key drivers of the MPL market cycle and their current impact on the industry.

MPL carriers and their insureds are facing an environment in which large verdicts are too commonly rendered without regard to the facts of the case regarding liability or a reasonable assessment of damages. 2023 has continued the record-setting pace of excess verdicts across the MPL industry.

Anchoring is a form of cognitive bias in which a person relies too heavily on the first piece of information they receive and use it to direct future decision-making. It’s an effect that’s very durable and difficult to overcome. It’s used in many ways from influencing retail purchases to influencing damage awards in civil courts.

One common example of anchoring is when a retailer lists a manufacturer’s suggested retail price (MSRP) of an item as, say, $99 but offers it at the “steep discount” of $40. The inflated MSRP is our reference point for decision-making so $40 seems like a great price.

While this is a simple and relatively harmless example to illustrate the concept of anchoring bias, anchoring can have serious real-world consequences in a medical malpractice suit when used as a plaintiff tactic to influence a jury to higher awards.

Despite a reduction in medical malpractice claims in recent years, plaintiffs’ attorneys are using strategies to boost the number of excess verdicts in litigation, leading to increased costs for physicians and hospitals. This article covers three of those tactics and suggests ways that insureds and their attorneys can respond with an effective defense.

Summary of ProAssurance webinar presented November 2, 2022 with guest presenter William Burns, VP Research, MPL Association—featuring MPL financial results, COVID-19 lingering impacts, inflation, and more.

Surge in Medical Liability Premiums Increases Reaches Fourth Year

A protracted period of upward volatility in medical liability premiums has extended into a fourth consecutive year and suggests a hard insurance market has spread across many states making it difficult for physicians to find affordable coverage, according to an analysis issued today by the American Medical Association (AMA). The prevalence of year-to-year increases in medical liability premiums between 2019 and 2022 has not been observed in two decades.

Source: American Medical Association

Increasing premiums are a sign that the MPL industry is responsibly addressing trends related to claim severity. Carriers are expected to apply rate discipline in order to weather the unpredictable cycles of claim volatility. Healthcare providers should look for clear messaging from their carriers on the subject of increasing premiums, and pay attention to the drivers responsible for them. Things that will help restore stability to premiums include preserving effective and proven tort reform measures, obtaining guidance from seasoned agents, and partnering with a financially strong and dependable carrier that takes the long view to insurance cycles.

Are we there yet?! Depends...

Over the years, hard markets challenging affordability and/or availability for medical professional liability coverage have occurred due to various reasons. Factors impacting the current journey toward a hard market in some areas of the country include increased claim severity due to social inflation, eroding tort reform, and the continuing progression in the way healthcare is delivered. Agents can proactively help their clients through a hard market by preparing them for coming changes in premium and policy terms and conditions.

There is a correlation between those states identified with double-digit increases in rates over the past few years and those with tort reform. States with no caps on pain and suffering tend to see higher premiums than those states with caps. Tort reform is constantly challenged each year so it will be interesting to see if more states experience double-digit rate increases in the future.

.png?width=300&name=MicrosoftTeams-image%20(28).png)

On the whole, the medical professional liability (MPL) sector is currently perceived to be in an excess capital position. This is defined as holding more capital than regulators and rating agencies require. Insurers are required to retain capital to cover potential losses and meet obligations to their shareholders.

The MPL Association assessed year-over-year-surplus changes in 2022 and then did a deep dive into stress testing insurers’ balance sheets and AM Best’s Capital Adequacy Ratio (BCAR) scores. These scores describe the quantitative relationship between the strengths of an insurer’s balance sheet and the key financial risks that could potentially impact that balance sheet. (MPL Association)

New analysis from Fitch Ratings has predicted improved underwriting results for the US property & casualty industry in 2023.

According to the report, this improvement will be driven by premium rate increases in the underperforming segments of automobile and property. However, higher inflation and macroeconomic uncertainty could also impact claims volatility, potentially hindering a return to underwriting profitability. (Insurance Business Magazine)

The MPL Association Data Sharing Project recorded the closure of approximately 22,000 paid claims from 2011 to 2020, resulting in approximately $8 billion paid in indemnity and $4 billion spent on defense expenses. During this period, a review of states with medical liability reforms revealed that 28 states had noneconomic damage caps (with one state implementing caps during that time) and 23 states had no caps (four of those states had caps declared unconstitutional during that time frame). Additionally, states with noneconomic damage caps reported a lower average indemnity payment of $249,556 compared to states without tort reform, which had an average indemnity payment of $388,430. (MPL Association)

Global property catastrophe reinsurance rates increased between 10% and 50% during July 1 renewals, with even higher rates for insurers that incurred losses on their reinsurance programs, Guy Carpenter & Co. LLC said in a recent report. The mid-year rate hikes follow steep increases in June, April and January reinsurance renewals. Reinsurers reduced capacity and increased pricing this year, citing losses from Hurricane Ian in 2022 and prior catastrophes. (Business Insurance)

Kevin O’Donnell, president and chief executive officer of RenaissanceRe Holdings Ltd., and Brian Young, president and CEO of Odyssey Group Holdings, gave their assessment of the current hard market, and drivers they believe will persist into next year during a session of the S&P Global Ratings 39th Annual Insurance Conference in New York. (Carrier Management)

Audio available. Free sign in required to read the full article.

A trio of property/casualty carrier executives voluntarily offered their views on a growing insurance availability crisis in a state like California at an industry conference last week, pointing to regulatory disconnects and political issues as drivers. W. Robert Berkley, Jr., Chief Executive Officer of W.R. Berkley Corp., Wayne Peacock, Chief Executive Officer, USAA, and Chief Executive Officer John Marchioni, Selective Insurance weigh in. (Insurance Journal)

It’s no secret that the U.S. property/casualty insurance industry does not always enjoy a sterling reputation among consumers. As one insurance professor recently put it, the industry’s rank in public opinion is somewhere between that of a personal injury lawyer and used-car salesmen.

But a barrage of developments and negative press reports in the last year, especially in Florida, Louisiana and California, may have exacerbated the ill feelings nationwide. The president of the American Property Casualty Insurance Association called this “a critical inflection point for the industry.” (Insurance Journal)

No Pressure

Everyone hates pushy salespeople; no agent wants to be perceived as such. It’s time to push your pushy salesperson fears aside! When it comes to healthcare selling, there's no need to apply pressure with prospects and clients because there is something inherent in healthcare that's far more powerful—urgency! I'm not talking about manufactured FOMO-based urgencies like product scarcity or short-term price reductions; I'm talking about fix-it-before-it-becomes-a-problem urgency.

I learned this during my first year in medical sales. My company released a new hospital product—a pressure infuser to increase the delivery speed of intravenous fluids. The infusers available at this time were flexible plastic sleeves that inflated to compress the IV solution, increasing the flow rate.

The infuser I sold was a rigid stainless steel box clamped to an IV pole. Instead of struggling to slide an IV bag into a sleeve, you just opened the door, hung the bag on a hook, and closed the door. Rather than squeezing a hand bulb 10 or 20 times to pressurize the flexible infuser, two to four stomps on a pneumatic foot pump had the fluids flowing. It was superior in every way but presented one obstacle—the price. Whereas the soft infusers sold for about $35, my new device was priced at $595.

I brought the product to an orthopedic surgery I was covering at a large hospital to see how it would be received. When I entered the staff lounge that morning, Dr. J., one of the anesthesiologists I was friendly with, was sipping a cup of coffee and reading the morning newspaper. I asked him if he had a minute to give me his thoughts about the new infuser. I reviewed the features and benefits, and before I could ask for his feedback, he called over the Chief of Anesthesia. As Dr. J. explained the product to him, he seemed impressed.

The Chief turned to me. "Do you have any literature on this?" I said, "Of course," and handed it to him. He said, "Follow me."

The Chief led me to the O.R. Director's office, where he interrupted her phone conversation.

"Carol, I want one of these in every O.R. this week. I don't care what it costs, and I don't care how you pay for it. Just get it!" He then turned and walked out. I received an order for 11 units by the end of the day.

What made this sale so easy? Urgency! Dr. J. later explained that the Chief had been on call the previous weekend and had multiple trauma surgeries that needed blood transfusions. The transfusions were delayed because the old infusers were slow to inflate and wouldn't hold pressure. Restoring blood volume in a bleeding patient is a matter of life and death. The Chief found a solution to an urgent situation and took immediate action.

In healthcare, urgency gets attention and makes things happen. Getting a sale can be as simple as presenting a scenario and allowing the HCP prospect to sense the urgency. I used the story I shared with you here to create a sense of urgency about replacing old infusers at my other hospital accounts.

MPL insurance matters are almost always urgent for healthcare professionals since a litigation-triggering event could occur at any time. Investing in MPL insurance is not just a business decision but a matter of sleeping well at night, and in the exhausting world of healthcare, sleep is an urgent priority.

|

Written by Mace Horoff of Medical Sales Performance. Mace Horoff is a representative of Sales Pilot. He helps sales teams and individual representatives who sell medical devices, pharmaceuticals, biotechnology, healthcare services, and other healthcare-related products to sell more and earn more by employing a specialized healthcare system. Have a topic you’d like to see covered? Email your suggestions to AskMarketing@ProAssurance.com. |