October 2025

MPL Horror Stories

Table of Contents

American Juror: Perhaps This Year’s Scariest Halloween Costume!

At Jury Impact, we used to have a blog called “Things That Make You Say Hmmm.” But with the way juror perspectives have changed post-COVID, the better blog title might be “Things That Make You Say Yikes!”

Our company has interviewed about 7,500 focus group jurors around the country since mid-2020, giving us a unique perspective about how real Americans think about lawsuits and healthcare. Jury research is invariably an eye-opening process, and we are constantly shocked, amused and, yes, scared by what we hear during our focus groups.

Below are just a few of the things we at Jury Impact have observed during focus groups and mock trials:

Expectations for healthcare providers have reached impossible heights.

A recent focus group juror in a med-mal case in Seattle told us that when it comes to caregivers at a hospital, “there’s no margin for error.” We have heard something similar hundreds of times, like the many jurors who tell us that doctors “have to go 150 percent” and that “saving lives is the bare minimum.” (As a side note, this is why we typically recommend defendant providers not attend focus groups—they might be scared out of medicine forever.)

In this era of medical miracles, anything is possible.

Here’s a snapshot of juror thinking: Prenatal testing should be able to detect every birth defect and predict a baby’s size with 100 percent accuracy. If a specific medication isn’t advised after the treatment window is closed, there must be some other treatment. When there is a question of whether a certain medication should be given, just “try a little” and see if it works. Frankly, the constant advances in medicine have shot doctors in the foot, since jurors now expect that anything is possible, as long as (here’s the really scary part) the patient has good insurance.

The ‘not my money’ philosophy when it comes to damages.

A growing number of jurors are highly suggestible when it comes to damages and award whatever the plaintiff suggests. A Boston participant told us a few months ago that he was fine with awarding the $40 million the plaintiff requested because, “If it’s what they feel is right, who am I to tell them they’re wrong?” When asked if he would award $140 million if the plaintiff lawyer asked for it, the same juror shrugged and gave an answer that would scare any defendant into at least considering settlement: “Sure, it’s not my money.”

Lawsuits are considered a ‘golden ticket’ out of poverty.

Many of our participants see lawsuits as a realistic way to escape poverty. A recent juror in Orlando told us, “If something bad happens to you, you get paid—that’s just the way it works.” The notion that lawsuits are a quick and easy cash source reminds me of the recent focus group participant in rural Illinois who was convinced that if he spent his entire $200 cash incentive on Powerball tickets, a jackpot was a sure thing. When lawsuits and the lottery are considered reliable ways of making money, we should all be scared.

Scary jurors often wear friendly costumes.

A few years ago, we felt comfortable looking at jurors and making some judgments (admittedly, often based on previously proven assumptions) about whether they would likely lean plaintiff or defense. It was a simpler time, assuming that millennials were bad and engineers were good. But we can’t do that anymore, and neither should you. The better gauge of likely juror leanings falls along very different lines, such as whether they’re vaccinated for COVID, believe punishment of corporations can fix a broken system, or have had negative experiences with medical providers or insurance companies.

Perhaps the most frightening part of writing this article is that I realized I could easily write a book (perhaps even a horror series) on scary jurors. These anecdotes are just the tip of the iceberg when it comes to how much more plaintiff-oriented juror perspectives have become in recent years—and strong evidence of why we need pre-trial jury research now more than ever.

Claire Luna is the managing partner and senior vice president at Jury Impact, headquartered in Irvine, California. Claire has been with the company for almost 20 years and heads the company’s daily operations, sales, and client communications. She has led presentations in front of upward of 1,000 people throughout the United States, Caribbean, London, Canada, and Mexico discussing juror trends.

Claire has interviewed more than 10,000 focus group jurors in 49 states, prepared more than 100 witnesses to testify at deposition and trial and led jury selection in dozens of trials throughout the country covering the civil litigation spectrum. Claire was previously a reporter for the Los Angeles Times and is a graduate of the University of Southern California.

About Jury Impact

Jury Impact is a boutique full-service jury research company that specializes in civil litigation. The company’s revolutionary focus group process is based on a political research model and prioritizes narrative development for its defense clients. Most of Jury Impact’s clients are in healthcare and include many large healthcare firms and dozens of the country’s top university hospitals and healthcare systems.

Phantom Damages: Ghostly Sums that Inflate Malpractice Verdicts

As fall arrives and we revel in tales of ghouls and goblins, a more menacing, real, and harmful apparition lurks in the hallowed halls of justice for healthcare providers entangled in the complicated web of a medical malpractice lawsuit. Chilling stories of outsized verdicts often due to inflated damage claims continue to scare the industry. A tort law concept called “phantom damages” often drives these frightening, catastrophic verdicts.

“Phantom damages” refer to the difference between billed cost of medical treatment and the actual discounted amount that is accepted by healthcare providers.

For example, a patient undergoes lengthy hospitalization because of alleged malpractice for which the hospital bills the patient $250,000. After submission and negotiation with the patient’s insurance carrier or Medicare, the hospital agrees to accept $50,000. The remainder of the billed balance is forgiven by the hospital and is owed by no one. In the subsequent malpractice litigation, the plaintiff claims medical damages for the full $250,000. The $200,000 difference is the “phantom damage.”

The “phantom damages” concept stems from a long-standing evidentiary/damages doctrine called the collateral source rule. The rule prohibits defendants from introducing evidence to show that the medical expenses were paid by collateral sources wholly independent of the defendant, such as the patient’s healthcare insurance, and allows plaintiffs to recover the full amount of the billed medical expenses, which can lead to recovery of “phantom damages.”

Trick or Treat?

Proponents of the rule rationalize that the defendant wrongdoer should not benefit from the plaintiff’s decision to maintain health insurance; the plaintiff should receive any windfall or “treat” from the double recovery. Opponents, on the other hand, argue that permitting recovery of the entire billed amount results in a recovery by the patient of expenses they did not incur – no one in fact incurred these expenses. This “trick” leads to excessive verdict awards, more litigation, and an unfair, illusory means of recovery.

The impact can be substantial, as medical expenses play a significant role in medical malpractice jury and settlement amounts. Not only do they make up a substantial portion of economic, quantifiable type damages, they often serve as a “multiplier” in the calculation of noneconomic damages, such as pain and suffering.

Eliminating Excess

Although some states maintain strict adherence to the collateral source rule, many states have enacted tort reform measures to address the “phantom damages” issue. Legislation varies across different states—ranging from (1) legislation that limits recovery to the sums paid to satisfy the billed amount with no consideration of discounted amounts; (2) legislation permitting evidence of collateral source payments; (3) legislation allowing damages awards to be offset by collateral source payments; and (4) legislation allowing admission of evidence to show collateral sources paid the medical expenses while also allowing the plaintiff to present evidence about the cost of purchasing the insurance that paid the benefit.

Most recently, Georgia enacted tort reform legislation aimed at reducing nuclear verdicts that have plagued their state over the last few years. Traditionally ranked in the top 5 judicial hellholes in the country by the American Tort Reform Foundations’ annual report, Georgia became a “trailblazer” on the 2025 list because of their tort reform efforts.

One of the core provisions of the new legislation permits evidence to show the actual amount paid rather than just the amount billed. Scott Bailey, a leading defense attorney in Georgia, explains the impact, “Hopefully this new provision will give the jury a more realistic view of actual damages and allow a basis for effective counter-anchoring on economic loss that is more of a reflection of actual loss.”

Limiting recovery in a medical malpractice case to the amount of medical expenses paid rather than the “phantom” amount billed is critical, as the industry faces rising medical malpractice verdict amounts. Tort reform measures aimed at eliminating these spectral sums will hopefully restore transparency in the calculation of medical expenses and reduce claims severity.

|

|

Intraoperative Awareness: How Often Does It Really Happen?

Intraoperative awareness (“awareness”) occurs when a patient experiences consciousness during general anesthesia and has recall of the surgical procedure.1 It is estimated that approximately 0.1-0.2 percent of adult patients who receive general anesthesia experience intraoperative awareness.2 However, Preferred Physicians Medical’s (PPM) claims experience suggests the incidence of awareness may be even lower.

Since 1987, PPM has investigated 73 awareness claims, an average of 1.92 per year. That said, PPM uses the injury description “awareness” more broadly than the anesthesia community. PPM includes this injury description when awareness under general anesthesia results from a human error or equipment malfunction, and anytime a patient reports experiencing intraoperative pain from surgical stimuli, regardless of the anesthesia plan. For example, a sizeable number of PPM’s “awareness” claims involve laboring patients who experience pain during emergency cesarean sections (C-section) due to inadequate neuraxial anesthesia. The majority of C-section awareness claims are closed without an indemnity payment, and PPM has successfully defended these types of cases through trial.

- A 38 YO underwent a C-section due to pregnancy complications, which included preeclampsia, gestational diabetes, fetal macrosomia, and morbid obesity. A labor epidural was administered as the PPM policyholder decided that general anesthesia was not indicated due to plaintiff’s morbid obesity and risk of difficult airway. During the procedure, the patient complained of inadequate anesthesia. Fentanyl, ketamine, and midazolam were administered to help ease the patient’s reported pain. The patient filed a lawsuit against the anesthesiologist, alleging she suffered from PTSD and major depressive disorder as a result of experiencing awareness during the procedure. Plaintiff’s demand prior to trial was $1,000,000. This case proceeded to trial, and the jury returned a defense verdict.

If we exclude claims involving neuraxial anesthesia, medication errors, and equipment malfunctions and examine only events involving the phenomenon “accidental awareness during general anesthesia” (AAGA), awareness claims are exceedingly rare. PPM insureds have reported 225 AAGA events over the course of the company’s 38-year history, but only 30 reported events resulted in a claim or lawsuit. In addition to being infrequent, AAGA claims are largely defensible. Since 1987, only four AAGA claims were closed with an indemnity payment as illustrated in the chart below. However, anesthesia professionals can invite liability exposure for AAGA claims if they neglect to include awareness in the informed consent process or fail to properly recognize a patient may be experiencing awareness.

- A 56 YOF, ASA IV, presented for cardiac artery bypass graft (CABG) under general anesthesia. The PPM policyholder intentionally administered a “light” anesthetic because of the patient’s history of myocardial infarction and the nature of the planned procedure. Postoperatively, the patient complained of awareness, reporting that she felt pain, experienced anxiety, and heard conversations. In her lawsuit, the patient alleged the anesthesiologist did not disclose the risk of awareness during the informed consent process and failed to administer adequate anesthetic agents to ensure she was unconscious during the procedure. The patient claimed that she developed severe anxiety and PTSD following the event, which ultimately led to a hypertensive stroke. Though we secured supportive experts, a compromise resolution was reached with the consent of the insured prior to trial.

Anesthesia professionals can take several steps to prevent and, if necessary, manage intraoperative awareness events, including:

- Informed Consent – PPM encourages anesthesia professionals to utilize an anesthesia-specific informed consent form containing the risk of intraoperative awareness.

- Identify High-Risk Patients – When developing an anesthesia plan, anesthesia professionals should contemplate whether the patient’s clinical presentation or the underlying procedure is associated with an enhanced risk of intraoperative awareness.

- Bispectral Index (BIS) Monitoring – Though not a monitoring standard, BIS monitoring can help anesthesia professionals identify and prevent AAGA events. BIS monitoring is a particularly useful tool to utilize when patients receive total intravenous anesthesia (TIVA), as anesthesia professionals cannot reference end-tidal anesthetic agent concentrations to assess the patient’s depth of anesthesia.

- Watch for Vital Sign Changes – If a patient’s heart rate or blood pressure remain elevated after induction, anesthesia professionals should consider whether the patient might be experiencing awareness, especially if the patient’s medical history, the procedure, or the anesthesia plan carries a heightened risk for intraoperative awareness.

- Disclose Event – If a patient experiences intraoperative awareness due to medication error or mechanical issue, the anesthesia professional should disclose the cause of the event.

- Assist Patient with Support – To ensure there is proper continuity of care following an awareness event, anesthesia professionals should offer to assist the patient with a referral for counseling or other psychological support.

1. G.A. Mashour, B.A. Orser, M.S. Avidan. “Intraoperative Awareness: From Neurobiology to Clinical Practice.” Anesthesiology. 2011 May;114(5):1218-33. https://doi.org/10.1097/aln.0b013e31820fc9b6

2. M.C. Kim, G.L. Fricchione, O. Akeju. “Accidental Awareness Under General Anaesthesia: Incidence, Risk Factors, and Psychological Management.” BJA Education, Volume 21, Issue 4, 154–161. https://doi.org/10.1016/j.bjae.2020.12.001

|

|

Trick or Treatment? Separating Facts from Frights

Dracula, Bigfoot, and the Loch Ness Monster are mythical, alarming creatures with just enough folklore to make you wonder if there is a tinge of truth to their legends. Fast forward to the age of social media, where medical misinformation—and disinformation—are passed along from lightning-quick shareable memes, TikTok and YouTube videos, and Instagram, Threads, and X posts. Like the allure of Halloween tales, their messaging carries just enough urgency and potential truth to cause a vulnerable reader to fall for what might be dangerously inaccurate healthcare-related information.

Misinformation is defined as unintentionally misleading, incomplete, or inaccurately shared information that is unvetted for errors. Disinformation takes on a more malicious note and is deliberately untrue, meant to deceive and manipulate.1

Post-COVID, social media was hit with what has been dubbed an “infodemic,” or a bombardment of healthcare-related information that was often manipulative and full of scientific half-truths. Medical misinformation reached such a heightened prevalence that, in response to the spread of misinformation surrounding the COVID pandemic, the Surgeon General published a 2021 Advisory on the issue stating, “health misinformation is a serious threat to public health. It can cause confusion, sow mistrust, harm people’s health, and undermine public health efforts.”2 It is important to note that the advisory was aimed at the American people, and not necessarily the healthcare industry or its staff. In its Global Risks Report 2024, the World Economic Forum identified misinformation and the technology that spreads it as a major global threat.3

It is often faster and easier for the public to avoid a deep dive into complicated or confusing medical data by leaning into simple infographics and short, easy-to-recall conclusory claims. We live in an era of the erosion of the traditional doctor-patient relationship, along with skepticism of scientists and the medical field. A 2024 KFF Health Misinformation Tracking Poll found that two-thirds of adults used AI, with one-third doing so at least a few times a week. The poll noted that one in six adults used AI chatbots at least once a month for health information and advice, increasing to 25 percent for adults under 30.4

With ever-advancing technology, the ability to keep up with unchecked data and healthcare advice becomes exponentially more difficult. Social media influencers and ads selling health supplements and cures to common ailments prey on viewers with a lower level of health literacy, who may simply be trying to feel better or take steps to become healthier. Quick and easy access to any social media platform in the palm of our hand is unbridled, and doctors cannot keep up with content creators. Alarmingly, social media algorithms will continue to feed misinformation to those who consume it the most.

AI using chatbots and other sources can easily generate medical misinformation. AI can create subject matter with fake citations and erroneous illustrations that bolster its facade of truth, while an interactive element with users willing to provide sensitive health information may make it harder to distrust. AI- or human-generated articles and videos can appear polished, professional, and accurate but have the potential to be misleading and harmful. A recent study by the Icahn School of Medicine at Mount Sinai found that AI itself is easily misled and vulnerable to repeating and amplifying false medical information.5 Deepfake technology can create very believable, lifelike, but ultimately fake experts providing health advice when these experts are, in reality, not real people.

The Physicians Foundation, a nonprofit group, surveyed over 1,000 American physicians concerning mis- and disinformation they encounter while providing care. Sixty-one percent of those surveyed reported that these manufactured or inaccurate communications influenced patients at least a moderate amount in the last year, with even higher frequency for rural populations. Eighty-six percent of physicians felt the incidence of medical misinformation has increased compared to five years ago, with 50 percent reporting a significant increase even after the COVID pandemic began. Discouragingly, over half the physicians surveyed felt that rampant medical misinformation affected their ability to provide quality care.6

This issue is so widespread that the Duke Clinical and Translational Science Institute has developed a short program, Duke Program on Medical Misinformation, to help physicians best approach medically misinformed patients. During their medical school and subsequent training, most physicians are not educated on how to combat patients who find and rely upon inaccurate healthcare information. The Duke program includes an approach focused on patient dignity and strengthening patient-provider communication and relationships.7 “Encountering patient-held misinformation offers an opportunity for clinicians to learn about patient values, preferences, comprehension, and information diets,” writes Brian Southwell and Jamie L. Wood, program co-directors.7

Healthcare workers can and should play a significant role in debunking medical misinformation that influences their patients. This task may be easier said than done and, while it should not be rushed, it cuts into the precious little time physicians have to spend with their patients. Physicians need to understand the root of medical misinformation, the way it affects their patients, and how to maintain trust while still exposing viewpoints that might be unhealthy or dangerous.

Physicians and their staff will benefit from expecting the consequences of medical misinformation and being prepared for questions or pushback to treatment recommendations. It will be important to show patience during these conversations while leaving defensive posturing behind. The informed consent process may be more involved and take multiple discussions, which should be well documented. Neither patient compliance nor perspective can be forced, but physicians must continue to play a critical role in discrediting the untruths of medical misinformation to help keep patients safe and healthy.

- JAMA Pediatrics [https://doi.org/10.1001/jamapediatrics.2025.0290]

- Surgeon General [https://www.hhs.gov/sites/default/files/surgeon-general-misinformation-advisory.pdf]

- World Economic Forum [https://www.weforum.org/publications/global-risks-report-2024/]

- KFF [https://www.kff.org/public-opinion/kff-health-misinformation-tracking-poll-artificial-intelligence-and-health-information/]

- Communications Medicine [https://doi.org/10.1038/s43856-025-01021-3]

- The Physicians Foundation [https://physiciansfoundation.org/research/the-effect-of-misinformation-and-disinformation-on-physicians-ability-to-provide-quality-care/]

- Duke Program on Medical Misinformation [https://ctsi.duke.edu/medical-misinformation]

Dr. Jekyll Unmasked in the OR

A terrifying tale of mental health meeting malpractice ...

The surgeon … to everyone’s unbelieving horror—began operating as though in a world gone mad. He was in Cantrell’s obese body within about a minute, had the gallbladder out in two or three minutes more, and was beginning to dissect the stomach, not bothering to tie off any but the largest vessels, leaving the smaller ones to spurt bright red arterial blood onto the drapes and over the masks of the assistants. Before I realized how far he’d gone, he tossed a perfectly normal section of the stomach into a specimen pan and—right before our astonished eyes—cut a transverse slash though the front wall of the aorta. The decibel level in the room rose as high as the column of blood blasting its lethal way toward the ceiling …

That was a scene from Dr. Sherwin B. Nuland’s collection of medical tales, The Soul of Medicine: Tales from the Bedside. The story, told by the anesthesiologist present, goes on to explain that this once competent and dependable general surgeon was also—unknown to most at the hospital—under medication for a chronic mood disorder. He had just returned from a three-week vacation, which included a vacation from taking his meds.

The patient not only survived but thrived. He had struggled with obesity and, while this incident preceded modern bariatrics, the stomach repair functioned similarly to surgical stapling resulting in a trim new body that he retained for the remainder of his life. The repair to his aorta was sound, never causing a complication. The billing for the gallbladder removal (the reason he was in for surgery) was waived and, after the numerous lawsuits settled, the 55-year-old accountant never had to work again!

A Decade On, Our Retention Program Is Frighteningly Strong

Earlier this year I read The Soul of Medicine, a potential candidate for the “response offer” for our annual customer retention campaign. For more than a decade, our practice has been to mail physician insureds a thank-you note for choosing ProAssurance. These direct mail pieces are sent to physicians written in the standard market in small- or medium-sized groups approximately 90 days in advance of their renewal. The direct mail pieces include a response offer. If the insured returns the enclosed postcard, we mail them the selected item at no additional cost.

Because the offer is usually a book, we review a lot of titles to decide whether they might be good for the campaign.

The books we are seeking typically fall into one of three categories:

1. Doctors writing about being doctors: In past campaigns we offered Attending by Ronald Epstein, MD (in 2018), and last year was The Laws of Medicine by Siddhartha Mukherjee.

2. Risk management or patient safety: Dr. Danielle Ofri is a terrific resource in this category, and we’ve used two of her books: When We Do Harm in 2023 and What Patients Say, What Doctors Hear in 2020.

3. A current event or trend affecting medicine: In 2023 we got ahead of the AI wave before ChatGPT went mainstream by offering Eric Topol’s Deep Medicine. In 2021, a year after the pandemic financially stressed medical practices, along with most other businesses, our response offer was Dr. James M. Dahle’s The White Coat Investor. Jim spoke that year at our agents’ Leadership Elite annual meeting in Park City, UT.

This year’s campaign offer is When Good Doctors Get Sued by Angela M. Dodge, PhD. This aligns with our marketing push to both highlight the rising claims severity crisis and differentiate ProAssurance as having the most capable Claims department in the medical malpractice industry. This title is also recommended by Dr. Gita Pensa, a leading physician litigation stress advisor. Our Risk Management department partnered with her this year on a variety of projects, including her Physician Online Seminar, “Healing the Healers: Litigation Stress Support for Physicians,” and a guest appearance in an upcoming episode of our Rapid Risk Review podcast.

We target a 20 percent response rate for these campaigns and see anything above 25 percent as an excellent year. After the campaign, we compare the renewal rates of responders to non-responders. While correlation is no causation, the higher rate of renewals among the responders leads us to believe the benefit exceeds the time and costs to run the campaign. So far in 2025, we are running a little behind, but the year is not over yet, and we’ve been experimenting with changes to try to increase responses along the way. The slow 2025 may simply be a less popular book choice (mine). Despite nuclear verdicts in the headlines, I fear insureds just don’t think it will happen to them—until it does.

The response offers have not always been books. Back when thumb drives were useful but not yet considered vectors for malware, we offered a Risk Management Resource Kit. Another year we used the campaign to promote our cyber-insurance buy-up product, ProSecure, by sending out webcam covers with the mailers, before embedded covers became standard on most laptops.

Our plan for 2026 is not only “not a book,” but it’s also an internal Risk Management team creation. We’re always seeking new ways to bring risk management issues to the attention of our insured physicians and practice managers. This year’s new podcast, Rapid Risk Review, is an example, as is our long-running YouTube series, “2 Minutes: What’s the Risk?” We’ve heard about practice managers kicking off staff meetings by showing one of our short videos. As another tool in that spirit, our Risk consultants created a set of conversation starter cards called “What’s the Risk?” Conversation Cards. Each card in the set has one question on it designed to engage practice staff in a discussion about one specific operational risk management topic. The set of cards is laminated on heavy card stock with a hole in the corner and bound together on a ring. We field-tested these at the ASHRM conference in Charlotte last month. The feedback was positive enough to convince us it should be next year’s response offer.

If you’d like a sample of the 2025 book, campaign materials, or next year’s Conversation Cards, just let us know by contacting Marketing at AskMarketing@ProAssurance.com. Include your name, the items and quantities you’d like, and the mailing address.

If you’d like a sample of the 2025 book, campaign materials, or next year’s Conversation Cards, just let us know by contacting Marketing at AskMarketing@ProAssurance.com. Include your name, the items and quantities you’d like, and the mailing address.

Get to Know the Risk Management Team—They’re a Real Scream!

This month we feature our team members in Risk Management! This dynamic group is dedicated to delivering guidance and education to our insureds, supporting them in their mission to provide safe, quality care for their patients, and helping them reduce their risk for liability claims. Risk Management is comprised of individuals with diverse professional backgrounds, from attorneys to healthcare administrators, quality assurance professionals, and nurses.

Risk Consultants apply specialized knowledge of healthcare risk management, which is evidenced in their training resources, publications, and their Annual Baseline Self-Assessment (ABSA), which identifies areas of risk in practices. These and other tools are designed to help healthcare professionals at all levels, equipping them with guidelines and strategies for risk mitigation and giving them the ability to improve their defensibility so they can keep doing what they do best!

We asked representatives from the team what they do in the office, what they love about their work and their mission, and how they strive to make life a little less—risky!—for our insureds.

- Risk Management Team

We Asked, They Answered: Risk Edition

I’ve been with ProAssurance for 10.5 years (started March 2015), and I lead the Risk Management department at ProAssurance for Medical Professional Liability. - Mallory Earley

I have been with ProAssurance for almost 19 years, starting as a NORCAL team member. I am a manager in the Risk Management Department for the West Region. - Katie Theodorakis

This month is my 10-year anniversary. I am the project manager of Claims Rx. I also answer policyholder questions on the Helpline. I do live and remote presentations on risk management issues, and I do hospital risk maps, which are on-site risk assessments at hospitals. I also visit brokers with the Business Development team. - Mary-Lynn Ryan

I have been with ProAssurance for 18 months working as a Senior Risk Management Consultant for the MPL’s Northeast division. - Gerryann Whalen

I have been here for two years in August. Each day is very different based on meetings, projects, and needs of the Northeast and the Risk Management team. Daily items include email (the non-stop influx and outflow of information), working on our region’s Annual Baseline Self-Assessment send-outs and report generation, and answering calls from insureds or agents to our Helpline. These daily items may lead to investigating new information, lending a calm voice to a crazy situation, or just validating the insured is on the right track in managing an issue. - Michele Crum

Like my colleagues, daily, I might wear multiple hats—answering practice management questions, developing or reviewing training materials, preparing or presenting webinars, and supporting insureds with practical, real-world advice. Risk management isn’t just about handling bad events; it’s about preventing them where possible and being prepared to respond smoothly when issues arise. I’m there as a proactive partner: accessible by phone for guidance on practice management, risk management, and incident response. - Anne Marie Lyddy

I have enjoyed my work with ProAssurance and our insureds for over 20 years. Success in this career comes from creating and maintaining relationships. With those relationships comes trust and credibility in delivering services such as educational sessions and on-site assessments, and being available to answer questions via email and phone. As a team member who answers the Helpline, my role extends to performing research, providing resources, and answering risk questions across the country. At times, my role may require simply listening to a physician and reassuring him or her that we are here for them every step of the way while taking the next step, which may entail a transfer to the Claims department. - Laurette Côté

I have been with ProAssurance for almost 2.5 years. Every day is different enough to keep things interesting! On a regular basis, I keep an eye on regulatory and legislative changes that might impact our insureds and their practices. Staying on top of the latest trends means that I research and track current developments to create articles and other helpful resources for our insured practices. I also have the privilege of collaborating with Claims and Underwriting to best serve our physicians and meet their needs. - Jennifer Freeden

I have been with ProAssurance for seven years. I am the Midwest Regional Manager. We are all working managers, so I contribute to our publications, presentations, and answer the Helpline in addition to supporting the consultants on the Midwest team. Most recently, I have been working on a team to produce the Q4 Webinar, which will educate our insureds on documentation, and I am leading a podcast miniseries for residents. - Barbara Hunyady

I’ve been with ProAssurance for five years and nine months. In my role, I work closely with healthcare practices to evaluate risks, provide education, and support them in implementing strategies that reduce liability exposure. On a daily basis, that means everything from reviewing emerging trends and developing risk management resources, to consulting directly with physicians and practice leaders about compliance and safety issues. - Bradley Byrne

I’ve been with ProAssurance for five years, and as part of my position I answer phone calls from physicians, practice managers, and advanced practice clinicians who have concerns regarding adverse events. - Wendy Alderman

I’ve been with ProAssurance for over nine years, serving as a Senior Risk Management Consultant and Team Lead for the Content Management Team. A top priority in my role is being available to insureds by phone or email to provide guidance when questions or concerns arise. My daily work focuses on developing educational resources, toolkits, and strategies that help healthcare providers reduce risk, improve documentation, and strengthen patient safety. I also collaborate with Underwriting, Marketing, and leadership teams to ensure our content is practical, relevant, and aligned with industry standards. - Joanne Simmons

I have been with ProAssurance for two years as a Risk Management Data Analyst. I collect and clean departmental data, produce operational reports, and provide Risk Consultants with data as requested. - Kiersten Pines

I have been with ProAssurance since January of this year. Some of my regular, everyday duties include entering and verifying data, handling phone inquiries from policyholders experiencing issues with the seminars or the online portal, entering seminar details, and generating various reports. I also perform a range of other administrative duties as needed. - Gina Davis

I started with ProAssurance in August 2025. I came over from another MPL carrier. At ProAssurance I create educational content, proactively address insured risk issues on a daily basis, and administer ABSAs. - Tara Eichman

I love answering questions from our agents and insureds. I find this the most rewarding part of my job because I get to hear what is going on in the practices and assist them with resources and advice. - Mallory Earley

My favorite part of my work is the one-on-one interactions with the insureds. I value being there for our insureds when they call our Helpline in search of answers. I particularly find it meaningful when an insured contacts us after a bad outcome and really needs someone to listen to them and help them with next steps. – Katie Theodorakis

That’s a toss-up. My three favorites are (1) working the Helpline because it is something new every day; (2) visiting brokers with the Business Development team, which makes me feel like I’m helping spread the word about the value of our risk management services; and (3) doing risk maps at hospitals because it gives me an opportunity to have in-depth risk management and patient safety conversations with the leadership of our insured hospitals. - Mary-Lynn Ryan

My favorite part of the work I do is assisting and providing guidance to providers and medical staff after a patient safety event, as well as developing new resources for them to decrease operational, regulatory, and clinical risks associated with providing healthcare in today’s stressful environment. - Gerryann Whalen

My favorite part of the work we do is working with agents and insureds to support and present information to reduce liability in a claim. When people want to learn or are surprised by something they learn, it’s so rewarding. - Michele Crum

Those moments on the Helpline when I connect with a caller who may be feeling really concerned or even overwhelmed. In those minutes, I try to listen and offer some practical guidance, realistic options, and resources that can help. I try to leave each caller with something, a plan they can carry forward, and a sense that they’re not alone in this. If I’ve done that, even in a small way, it is gratifying, and it matters to me because it builds trust when someone feels heard and understood—especially during a stressful moment. It reinforces that our team can be a compassionate resource, not just a policy or process. - Anne Marie Lyddy

Many things come to mind including the interaction with physicians and other healthcare professionals, both face-to-face and virtually. Sometimes insureds are on point but just need to bounce it off a consultant. When that is the case, a general list of other considerations is offered and generally very well received, and that is satisfying. Whether the issue is triaged to another discipline within ProAssurance or it is a risk management item, listening to the caller is crucial, and asking additional questions generally leads to the real risk, and I enjoy educating on those risks. - Laurette Côté

I am presented with daily opportunities. I assist our insureds with real-time, stressful situations, providing risk management guidance that saves them time and worry. It’s such a rewarding feeling to know we help our frontline healthcare workers avoid panic or concern—and increase patient safety—as we talk through the next best steps for a tough scenario. - Jennifer Freeden

My favorite part is helping insureds find solutions to complex issues. - Barbara Hunyady

What I enjoy most is the opportunity to make a tangible difference for our insureds. Helping physicians and staff feel more confident about managing risk is extremely rewarding, and it gives me the same sense of satisfaction I had when supporting clients during my litigation career. I also value the collaborative nature of the work; every conversation with my outstanding colleagues is a chance to learn something new about how medicine is practiced on the ground. - Bradley Byrne

I enjoy answering calls, as the questions are engaging and give me an opportunity to research answers for our insureds. It is stimulating because many questions allow me an opportunity to learn information about specific clinical scenarios I wouldn’t otherwise be exposed to. - Wendy Alderman

I love transforming complex risk issues into tools and strategies that physicians and healthcare teams can actually use. My favorite part is hearing from providers that a resource we created helped them improve communication with patients and colleagues. Making a measurable impact on safety and defensibility is deeply rewarding. - Joanne Simmons

I love working with consultants to create data-driven educational materials for our insureds. Combining their knowledge with my analytics makes the resulting content even more impactful. - Kiersten Pines

My favorite part of working as Admin in Risk Management is being part of the organizational backbone of the team. I like being in the role where I support the details, manage documentation, and track compliance. I am still learning every day and enjoy the variety of tasks and the opportunity to expand my knowledge while supporting the team. - Gina Davis

I love being able to meet my insured on what may be their worst day, and to be able to offer guidance and resources to put them at ease. Partnering with the insured to guide them through tough situations is my favorite part of the work. - Tara Eichman

I think a misconception would be that you have to be a clinician to work in our department. We are instead a balance of legal, practice management, and clinical backgrounds who work collaboratively to approach questions and topics for education. - Mallory Earley

When I go out to an insured’s practice to conduct a risk assessment, our insureds sometimes think that I am more like an auditor and coming to find fault with them. I always assure them right away that we are on their side and are there to support them. I want to work together with them to better protect their practices. It is always nice to see the relief come across their faces. - Katie Theodorakis

Insureds often believe we provide legal advice. - Mary-Lynn Ryan

I think with the challenges and pressures of working in healthcare, a misconception about Risk Management that people often make is that changing practice or policy is “not really worth it,” or they think “it won’t make that big a difference” implementing recommendations, to prevent events or decrease associated costs. The answer is it is immeasurable even if one physician’s practice is safer or one fewer patient experiences harm from an error, especially if that patient is someone you care about. - Gerryann Whalen

One misconception that others may have of our team is that we offer legal advice. Despite having attorneys on our team, we give recommendations, but ultimately it is up to each practice to make the decision of what they are going to do. - Michele Crum

There are a few myths I hear often:

- “We only deal with bad things.” - Our work is about preventing losses and improving day-to-day operations that ultimately positively impact patient safety.

- “We’re only about claims.” - Actually we serve as a resource for practice management and risk management. We are available for guidance on routine issues as well as crises.

- “If nothing happens, there’s nothing to do.” - In reality, proactive risk management reduces near-misses, enhances patient safety, and lowers overall risk by keeping insureds prepared and informed. - Anne Marie Lyddy

One misconception is that we are a regulatory body. Our job is to provide information in order for the insured to make the best decision in terms of patient safety and liability exposure. - Laurette Côté

I don’t know that I would call it a misconception as much as an underestimation of the collective talent and expertise within our department. I feel privileged to work with this team that holds decades of invaluable and frontline clinical, legal, administrative, quality assurance, and legislative advocacy experience, all of which is directly relevant to skills needed to help our insureds. I am fortunate to be surrounded by such talented colleagues who I get to collaborate with daily. - Jennifer Freeden

Some people think that our Helpline is only for physicians or practice managers. However, we welcome calls from anyone within an insured practice, agents, and brokers. - Barbara Hunyady

A common misconception is that Risk Management only gets involved after something goes wrong. In reality, the bulk of our work is proactive—helping practices strengthen policies, improve communication, and prepare for challenges before they escalate into claims. - Bradley Byrne

Many callers to our Helpline believe that their policy includes legal advice on matters that are not related to malpractice. Frequently callers will ask for an attorney to answer their concerns regarding business practices. - Wendy Alderman

A common misconception is that Risk Management is just about pointing out problems or acting as “compliance police.” In reality, our role is collaborative—we’re here to be partners and problem-solvers. We help practices view risks as opportunities for improvement and focus on supporting providers, not penalizing them. - Joanne Simmons

The Risk Management department is not here to police insureds. We are here to educate and help them navigate the ever-changing risks impacting healthcare. - Kiersten Pines

A common misconception of the Risk Management department is that we only focus on problems. However, we are actually about finding solutions and, most importantly, protecting the insureds. - Gina Davis

One misconception is that we are only here when things go wrong. We can actually assist proactively to prevent adverse outcomes. - Tara Eichman

Preparation is key and no amount of knowledge can replace drills and practice. - Mallory Earley

Being prepared is so important to handling these types of scenarios. Developing policies and procedures, conducting mock drills, providing staff education—all of these are crucial to be prepared. Remember to utilize all risk management resources available to you as a ProAssurance insured. - Katie Theodorakis

Staff might not know what to do if they aren’t trained on the policies and procedures in place for such an event. Also the ProAssurance Risk Management Consultants are always available to provide resources for preparing for these situations. - Mary-Lynn Ryan

That the ProAssurance Risk Management website has many resources readily available for them to help with planning and preparing for things like disaster mitigation and workplace violence. Also when there is a national disaster affecting our insureds, we send out informative e-blast mailings with up-to-date information specific to affected locations. And lastly, we have a live Helpline, where they can call during business hours to speak to a Risk Management Consultant for real-time advice and guidance. - Gerryann Whalen

I have done risk management for almost 20 years. When anyone thinks, “That won’t happen here,” they will always be surprised when it happens. Floods, snowstorms, shootings, a death in the office, or even loss of computers can all happen in the blink of an eye, in any community. Preparation is the key to minimizing chaos and keeping other patients and staff safe, and by having a plan that has been practiced, everyone knows their role and can act accordingly. - Michele Crum

If I could tell policyholders one thing about preparing for catastrophic or high-risk events, it would be this: Proactive risk management is your best defense. By building strong policies, investing in regular training, and running practical simulations now, you minimize disruption, protect patients, and are more nimble in your response when things do go wrong. The goal is to make readiness part of the everyday routine, not a last-minute add-on. - Anne Marie Lyddy

Pick up the phone and contact us. We are here for them every step of the way. - Laurette Côté

Every practice should intentionally prioritize taking active steps to prepare for worst-case situations because, without meaningful proactive effort, the ability to respond to a live emergency is compromised. A solid, well-understood plan creates confidence in the delegated roles and responsibilities, and helps ensure that the safest steps are followed. - Jennifer Freeden

Don’t hesitate to ask the hard questions or talk to us about any skeletons in the closet. Oftentimes we can help find a solution, and many times it’s not as bad as you think. - Barbara Hunyady

The key is preparation and communication. Too often, practices don’t think about high-risk scenarios until they’re in the middle of one. Having a plan, rehearsing it, and ensuring everyone on the team knows their role can make a significant difference. It’s not about eliminating all risks but about minimizing the impact and demonstrating that the practice took thoughtful, responsible steps. - Bradley Byrne

Physicians and providers often believe that clinical care in the ambulatory setting is low risk; however, ambulatory medical malpractice claims account for 58 percent of claims. Frequency of errors in the ambulatory setting is underestimated due to the high volume of care, patients’ self-autonomy, and lack of reporting. Most errors are attributable to communication failures. Clinicians and practices that fail to implement communication tools within clinical workflows place their practice in a high-risk category. Reducing communication failures can include utilizing structured hand-off tools, following up on critical lab and test results, and maintaining rapport with patients. - Wendy Alderman

The best preparation happens long before a crisis. Small, consistent habits—like thorough documentation, clear communication, and regular team training—build a strong foundation. Resilience comes from preparation, not reaction. - Joanne Simmons

I want them to know that our team is here to help, no matter the situation. Our consultants are amazing at finding answers to their questions, and we have countless resources to help prepare for worst-case scenarios. - Kiersten Pines

When preparing for worst-case or high-risk scenarios, focus on being organized and proactive by keeping proper documentation and updated training, and having clear procedures. - Gina Davis

We are only one phone call or email away. Reach out to us before the worst-care scenario happens, and let us help you prepare! - Tara Eichman

I love taking my three boys to the pumpkin patch to pick out a pumpkin to carve for Halloween. - Mallory Earley

There is an area close to where I live, on the way to Lake Tahoe, called Apple Hill. There are many apple farms that you can visit, with activities, wine tasting and, of course, lots of apples and baked goods to buy. It makes for a great fall day. - Katie Theodorakis

In Minneapolis where I live, fall is my final opportunity to enjoy warm weather before winter sets in, which can be long and severe. So I take as many walks as possible. - Mary-Lynn Ryan

Cool morning walks with my pup down leafy paths, with a cup of hot coffee, a warm flannel, and no timetable.😊- Gerryann Whalen

Autumn is all about the cool, crisp air, colors changing, and the excitement of the upcoming holiday season. I love being outdoors walking, craft fairs, and celebrating the end of baseball and start of football season. - Michele Crum

I love autumn: apple picking, pumpkin choosing, and fleece-wearing fun. I love to get outdoors, hiking with camera in hand. I am from New England and am always awed by its fall beauty. There was a stand of trees, visible as I would drive toward my old home, that looked just like a bowl of Fruit Loops. I miss that! - Anne Marie Lyddy

Long bike rides. - Laurette Côté

I spend at least 20 hours at the baseball and softball fields each weekend to watch my kids play select ball, and I wouldn’t trade it for the world. Next in line is watching Penn State football games (We Are!) with my favorite pair of jeans and a sweatshirt (though the Texas heat usually prevents my go-to football outfit from happening). - Jennifer Freeden

This year I’m starting a new fall activity. I’ll be drag racing my supercharged Mustang on the weekends, which will be a change of pace from being a crew member on our oval track team during the summers. - Barbara Hunyady

For me, fall is all about being outdoors. Most weekends, I will be in one of three places: my kids’ baseball/softball tournaments, a college football game, or on my deck watching sports. - Bradley Byrne

Walking on the beach and playing pickleball. - Wendy Alderman

I love spending time outdoors in the crisp fall weather—hosting family gatherings with comfort food and bonfires, cheering on college football (Roll Tide!), and enjoying long walks in the changing leaves with the grandkids! - Joanne Simmons

I love going on hikes to see the fall colors, making apple cider, and all things Halloween! - Kiersten Pines

My favorite fall activity is all the festivals, musicals, and hikes that are amazing with this weather and time of the year. - Gina Davis

I enjoy hiking in the woods or reading on my deck. I also enjoy reading, camping with my family, and spending time with my horses - Tara Eichman

Find more information on the Risk Management department and get access to helpful resources including publications, videos, webinars, and speaker seminars: RiskManagement.ProAssurance.com

The Bind Order

This selection of accounts ProAssurance bound recently is intended to give our partners tangible examples of risk classes we’ve been successful quoting and that we’d like to see more of. These examples are anonymized with final premium rounded, but otherwise present actual accounts.

ORTHOPEDIC SURGERY

Indiana

Limits: $500k/$1.5M

Admitted

Premium: $365,000

HOSPITALIST

California

Limits: $1M/$3M

Admitted

Premium: $237,000

UROLOGY

Florida

Limits: $1M/$3M

Admitted

Premium: $178,000

EMERGENCY MEDICINE

Arizona

Limits: $2M/$4M

Admitted

Premium: $61,000

DERMATOLOGY

Indiana

Limits: $500k/$1.5M

Admitted

Premium: $30,000

FAMILY MEDICINE

Delaware

Limits: $1M/$3M

Admitted

Premium: $10,000

PLASTIC SURGERY

Texas

Limits: $1M/$3M

Admitted

Premium: $24,000

CARDIOVASCULAR DISEASE

Florida

Limits: $250k/$750k

Admitted

Premium: $16,000

ENDOCRINOLOGY

California

Limits: $1M/$3M

Admitted

Premium: $11,000

PHYSICAL MEDICINE & REHABILITATION

Connecticut

Limits: $1M/$4M

Admitted

Premium: $5,700

PODIATRIST

Indiana

Limits: $500k/$1.5M

Admitted

Premium: $4,100

PATHOLOGY

Pennsylvania

Limits: $500k/$1.5M

Admitted

Premium: $2,500

HOSPITAL

Illinois

Limits: $10M/$10M

E&S

Premium: $2,034,000

ADULT LIVING FACILITY

California

Limits: $1M/$3M

E&S

Premium: $85,000

MID-LEVEL PROVIDERS

California

Limits: $1M/$3M

Admitted

Premium: $3,900

MID-LEVEL PROVIDERS

Georgia

Limits: $1M/$3M

Admitted

Premium: $2,600

New Business Submissions

Our standard business intake address for submissions is Submissions@ProAssurance.com. For specialty lines of business, please use one of the following: CustomPhysicians@ProAssurance.com, Hospitals@ProAssurance.com, MiscMedSubs@ProAssurance.com, and SeniorCare@ProAssurance.com. Visit our Producer Guide for additional information on our specialty lines of business.

The types of business and premium amounts are illustrative of where we have written new business and not intended to reflect actual pricing or specific appetites.

.png?width=300&name=MicrosoftTeams-image%20(28).png)

Halloween, for many, is a time of spooky fun, wild costumes, and candy overload. But for resident physicians on call, the night is far from a playful scare. As we close in on Halloween weekend, brace yourselves for some ghoulish tales from the hospital. (Rosh Review)

In this collection of dental horror stories, Blue Ocean Dentistry explores accounts from mysterious disappearing teeth to haunted dental chairs. Many of the stories are likely just for fun but just the thing to get your spine tingling this spooky season. (Blue Ocean Dentistry)

A federal investigation found a Kentucky nonprofit pushed hospital workers toward surgery despite signs of revival in patients. (New York Times – login required)

In what experts are calling an unprecedented legal outcome, in August 2025, a Utah judge awarded $951 million to the family of a child who now has lifelong disabilities due to negligent care during delivery. The verdict marks the largest medical malpractice award in Utah’s history. (MDLinx)

New research has found “significant variation” between the price markups different hospitals charge for four elective inpatient surgeries and that those with the highest increases also demonstrated worse outcomes than their peers. (Fierce Healthcare)

When the Rush Becomes the Risk

Some people get their fright fix from haunted houses at Halloween. Others prefer a more realistic experience, such as one that comes from speed.

When I was 15, my friend Billy invited me for a ride to show off the Pontiac Grand Am he and his dad had rebuilt. He warned, “Buckle up tight!”

The engine practically begged to run. Moments after turning onto Jericho Turnpike, with the nearest car at least a mile down the road, Billy punched the accelerator, pinning me to my seat. The speedometer climbed—90, 110, 140. I remember screaming, “Slow down!” as telephone poles blurred by. It’s a fun memory and one I’m glad to have survived.

A decade later, I learned about speed in another place where it can either save lives or cause harm—the operating room.

I’ve stood beside trauma teams when every second mattered. I’ve also witnessed medical professionals who rush out of habit instead of medical necessity.

Let’s Go

I worked with a surgeon who craved speed just as Billy did. Dr. Speedy, as he was known, burst through the OR doors for every case with his trademark greeting: “Let’s go!” His cases were a surgical sprint, and he quickly sidelined anyone who couldn’t keep up.

Speedy often performed unicompartmental knee replacements, which required ordering the exact side and compartment in advance. Because his staff scheduled cases with hurried phone calls, I required them to fax the implant details for every uni knee to protect myself, and I kept each fax in a binder for proof.

One day, while I was covering another hospital, Speedy’s OR called in a panic: “You sent the wrong implants. Can you get us the right ones, stat?” I couldn’t; my company had shipped exactly what they ordered. His only option was to do a total knee replacement, and he immediately tried to blame me. Thankfully, my binder of faxed orders spoke louder than his accusations, showing the mistake came from his office.

I had repeatedly witnessed the true villain in his practice—the doctor fueling a rushed environment where details fell through the cracks.

Too Many Real-World Horror Stories

Dr. Speedy’s patient did fine—switching to a total knee was still within the standard of care. But not every story ends well. Across healthcare, mistakes linked to a “speed mentality” happen more often than anyone would like to admit.

Case studies where rushing led to ignoring safeguards are not uncommon: Teams that hurried through—or skipped—the mandatory time-out to confirm patient and procedure; surgeons who bypassed critical imaging or visualization before inserting a trocar or making an incision; and production pressure, packed schedules, or last-minute emergencies that pushed entire operating rooms past the margin of safety.

What MPL Agents Can Take Away

For MPL agents, these stories are more than cautionary tales. They’re conversation starters with physicians who value efficiency but must also consider potential trade-offs. Use them to highlight:

- The hidden accelerants: packed schedules, staffing gaps, and throughput pressures that tempt teams to skip verification.

- The shield of documentation: policies and procedures—and the malpractice coverage that backs them—are only as strong as the records behind them.

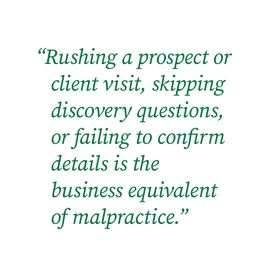

And from a sales or business perspective? The lesson is the same. Rushing a prospect or client visit, skipping discovery questions, or failing to confirm details is the business equivalent of malpractice. Consider a “time-out” before proposing coverage options. Pause to confirm the risks, the decision-makers, and their genuine concerns. And yes—keep impeccable notes.

The rush of speed can be exhilarating, but unlike a haunted house, there’s no exit sign when urgency steamrolls protocol. Let’s help HCPs limit the scary moments in healthcare.

|

Written by Mace Horoff of Medical Sales Performance. Mace Horoff is a representative of Sales Pilot. He helps sales teams and individual representatives who sell medical devices, pharmaceuticals, biotechnology, healthcare services, and other healthcare-related products to sell more and earn more by employing a specialized healthcare system. Have a topic you’d like to see covered? Email your suggestions to AskMarketing@ProAssurance.com. |

Risk Management Updates

Rapid Risk Review Podcast

New Episode: "Evidence vs. Influence: Combating Misinformation in Healthcare"

In this episode, healthcare risk management professionals Bradley Byrne and Jennifer Freeden discuss the pervasive issue of misinformation in healthcare. They explore the unique risks posed to healthcare professionals and patients, the erosion of trust in patient-provider relationships, and practical strategies for addressing misinformation. The discussion highlights the importance of clear communication, understanding patient perspectives, and fostering trust to mitigate the impact of misinformation in healthcare settings.

- Misinformation includes both unintentional and intentional false information.

- The COVID-19 pandemic has exacerbated the spread of misinformation.

- Social media is a primary source of health information for many patients.

- Misinformation can erode the patient-provider relationship.

- Practices need to prepare staff for conversations about misinformation.

- Physicians should approach misinformation academically and without defensiveness.

- Building trust with patients is crucial in addressing misinformation.

- Proactive measures can help mitigate the impact of misinformation.

- Evidence-based resources should be made available to patients.

- Misinformation is likely to remain a significant issue in healthcare.

Event reporting is a systematic and timely internal process of reporting occurrences that deviate from expected outcomes. Adverse events include medical errors, near misses, and patient harm obtained as the result of the care delivering process. The benefit of event reporting is to foster a culture of patient safety and provide the opportunity for process improvement.

Watch here

Allegation

The parents of a 3 YOF alleged that pediatricians failed to properly and timely diagnose and treat the patient’s bronchopneumonia via telemedicine and in person, resulting in her death.

Read the issue

Spoliation is the intentional or unintentional destruction or loss of evidence that may be used in connection with litigation. Learn how spoliation can happen and what you can do to avoid finding yourself the subject of a spoliation jury instruction during a medical malpractice claim.

Keep Up-to-Date on All Our Risk Management Resources

Our weekly risk management newsletter features the latest releases from ProAssurance’s Risk Management department—as well as highlights from our expansive online library of tools and publications. Join our email list.

ProVisions Team

- Communications

- Design

- Digital Marketing