November 2025

Healthcare Consolidation

Table of Contents

The Changing Landscape of Hospitals, Physicians, and Market Dynamics

In this issue, we delve into the ongoing transformation of the American healthcare system driven by consolidation among hospitals and physician practices. We will provide a comprehensive overview of current market trends, focusing on the surge in hospital mergers and acquisitions (M&A), the shrinking number of independent physician practices, and the evolving landscape of critical-access hospitals, particularly in rural areas. The issue examines how these shifts are altering the delivery of medical care and discusses the factors contributing to the decline of private practices, such as decreasing Medicare physician payments and changes in specialty representation.

There has been a significant drop in private practice physicians over the past decade and an increasing dominance of hospitals and corporate entities in the employment of doctors. While some specialties like orthopedic surgery, ophthalmology, and other surgical subspecialties remain holdouts with a majority presence in private practice, most others see consolidation. The changing composition of the healthcare sector is also heavily influenced by the growing size and impact of hospital deals.

As consolidation continues to reshape the healthcare landscape, ProAssurance remains committed to providing innovative solutions for healthcare providers of all sizes and types. This issue aims to inform and equip our readers with insights into the challenges and opportunities that come with an evolving marketplace, ensuring you stay ahead in a field marked by constant change—part of our ongoing efforts to remain your Carrier of Choice.

Market Trends – Hospital M&A Activity

In a world where change is constant, the healthcare system is not immune. Healthcare consolidation continues to impact hospitals and physician practices across the country, ultimately changing the dynamic of how medicine is delivered.

Hospital M&A activity has only become larger, independent physician practices continue to shrink, and services offered by some rural critical-access hospitals, especially in areas related to OB and emergency medicine, are starting to become more obsolete.

The American Medical Association highlights a steady drop in the number of doctors working in private practices since 2012, encompassing fewer than half of physicians in most specialties. For example, only 30.7 percent of cardiologists and 46.9 percent of radiologists are referenced as continuing to work within a private practice setting.

However, some specialties still have a majority in private practice, including orthopedic surgery (54 percent), ophthalmology (70.4 percent), and other surgical subspecialties (51.2 percent). Medicare physician payments were referenced as attributing to destabilizing private practices and access to care, as payments have fallen 33 percent over the past quarter century.

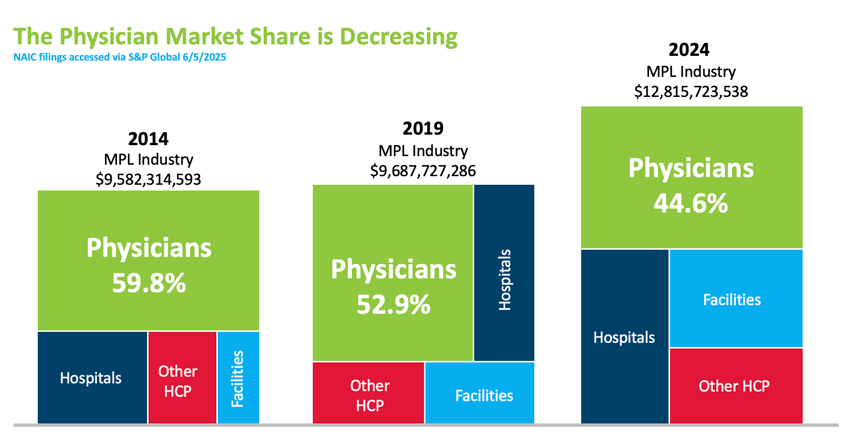

The illustration below shows how the composition of our industry has continued to evolve over the most recent 10 years.

In another study released by the Physicians Advocacy Institute, hospital consolidation is shown as continuing at pre-pandemic levels with the average size of hospital deals increasing by 64 percent over the last nine years. It was also noted that “other” facilities have doubled their market share over the past seven years. The following visual provides an illustration of how the market buyer has shifted, with 77.6 percent of physicians considered employed by hospitals or corporate entities as of 2024.

Despite physician consolidation, ProAssurance stands out as a top-five MPL carrier by market share nationwide. We continue to focus on our healthcare portfolio in the physician space, as well as other specialty divisions within the company such as Miscellaneous Medical, Senior Care, Hospitals, and Alternative Risks. As the market landscape shifts in the future, we will continue offering innovative solutions, stability, and product depth to our policyholders.

Private Equity in Healthcare Today

A couple of years ago we looked at private equity (PE) in the American healthcare space. The practice involves investors making leveraged buyouts, or using pooled funds to acquire a stake in a medical practice, physician group, hospital system, or other healthcare entity. The aim is to boost the acquired organization’s value by restructuring or strengthening its operations or management, then selling it for a substantial profit in a relatively short period of time, about three to seven years. Investors have the benefit of seeing their market share grow through expanding consolidation or “add-on” acquisitions. The potential for business growth and scalability with tax incentives and substantially large payouts can make private equity an attractive option for physicians and new or struggling practices. Improved process efficiencies, newer technologies, and reduced administrative costs are also benefits, as is the promise of greater physician autonomy and the reasonable assurance of economic stability in an uncertain market. There is an increasing demand for healthcare services in the U.S., and the potential for profit grows with that. As such, private equity has made its way into most areas of healthcare, from specialties like gastroenterology and dermatology, to outpatient clinic and home health settings, as well as technological and administrative services like equipment, IT, and medical billing.

By the Numbers

Our October 2023 issue reported that in 2021 the amount invested in the U.S. by private equity investors for healthcare-related acquisitions totaled well over $216 billion according to PitchBook capital market data. The number of PE transactions in that record year was estimated at over 1,400, with total acquisitions for the previous decade close to 8,000 (over $1 trillion in total deal values). Of note, private equity transactions rose across all industries after the pandemic, but the highest growth concentration (one in every three buyouts) was in technology, including financial tech, healthcare, and business services, according to management consulting firm Bain & Company. Significant buyouts in healthcare included health tech company Athenahealth for $17 billion and medical supply company Medline for $30 billion.

We found more stats that provide some context for PE’s evolution in the healthcare sphere in recent years.

- According to the American Hospital Association (AHA), the trend has been physicians moving away from private practices and into private equity, hospital-employed, or other, arrangements. From 2019 to 2023, 65 percent of physician practice acquisitions were by private equity groups or firms (14 percent were by physician groups, 11 percent by health insurers, 6 percent by hospitals and health systems, and 4 percent by other services).

- The American Medical Association (AMA) reported that the number of physicians in private practice had declined from 60.1 percent in 2012 to 42.2 percent in 2024. The number of physicians working in hospital-owned practices increased from 23.4 percent in 2012 to 34.5 percent in 2024. About 4.5 percent of physicians characterized their practice as private equity owned in 2020 and 2022, and this increased to 6.5 percent in 2024.

The United States led globally in private equity buyouts between 2018 and 2022, with $263 billion in deals compared with Europe at $103 billion and Asian-Pacific countries at $79 billion. And while private equity remained a strong presence globally for the first half of 2022, disclosed buyout values did drop in the second half, particularly in Europe. Stressors in that year included inflation, high labor costs and shortages, and geopolitical tensions due to Russia’s invasion of Ukraine. Still, 2022 was the second highest on record for disclosed deal value, with optimistic growth in the areas of life sciences, public-to-private deals and carve-outs, as well as five buyouts in the Asia-Pacific healthcare space at over $1 billion. According to S&P Global Market Intelligence data, 2023 had the lowest annual deal value ($7.26 billion) in three years for private equity and venture capital investments in healthcare services specifically, a 59 percent drop from the previous year’s $17.75 billion. Of note, the healthcare services category represents a sizable portion of healthcare platform deals (about 40 percent). The number of deals in this area fell by about 33 percent to the lowest levels since 2019. Impacting these deals were high interest rates, rising service costs, and labor availability.

More recently in 2024, we saw a surge in global private equity due to large deals, with five transactions in the biopharma space surpassing $5 billion. The U.S., however, was still the largest market, making up 65 percent of PE deal values for the year. Areas of growth included healthcare IT with providers and PE firms seeking systems to improve efficiency and workflows, and investors focusing on mid-market funds, carve-outs, and exit value maximization to raise values. Also in 2024, S&P Global noted a nearly 50 percent rise in private equity and venture capital deals for healthcare technology, from $10.37 billion to $15.62 billion. The first quarter of 2025 saw these healthcare tech deals at $2.91 billion, 22 percent higher than in the same quarter last year.

In January through mid-August of 2025, over $145 billion was invested in private equity-backed “megadeals.” That value is expected, potentially, to hit 2021’s estimated record of $230 billion by the end of the year. The boom is due in part to high levels of uncommitted cash reserves, or “dry powder,” held by top 25 PE firms, and high valuation for what are considered prime target assets. There is also a confidence regarding companies whose cashflows might remain strong through tariffs and a potentially unstable economy.

The Benefits and Criticisms

Opinions on private equity and its place in healthcare continue to be mixed. We mentioned the accumulation of capital, the stability of consolidation in an unpredictable and competitive market, and the reduced operational costs. The tax incentives also allow investors to deduct interest earned on their loans as a deductible business expense, and profits from sales may be taxed as capital gains at 20 percent. There’s the potential for greater efficiencies with improved work processes and management strategies. Advanced data analytics and newer, more innovative technologies that monitor patient outcomes and compliance can help advance care while easing the workload burdens on clinical staff. Additionally, physicians have an opportunity to forego the administrative, managerial, and other nonclinical duties inherent in a practice and narrow their focus to just medicine. They may have the option to expand care services and even garner a higher salary.

A common ongoing criticism of the private equity arrangement is the patient-care-as-commodity claim. Some argue that the “financialization” of healthcare and a drive for short-term profits on behalf of PE investors often compromises the quality and access of patient care, as well as the long-term stability of the healthcare organization and its care solutions. Critics worry that cost-cutting measures and organizational restructuring will result in fewer and less effective services or equipment, or that those costs will ultimately get passed on to patients. There may be staff cuts, challenging clinical workload quotas, and policy and procedural changes made by those with little knowledge or background in clinical practice management. Additionally, a lack of federal regulation and oversight over this new management can engender a lack of transparency or accountability on behalf of those now running the show and responsible for the majority of operational, financial, and even clinical decision-making. Further, the ability of a healthcare institution to repay the acquisition loan and avoid the threat of bankruptcy depends on its ability to earn consistent and reliable revenues.

Of note, the recent failures of large private equity deals like Steward Health Care in Massachusetts and Hahnemann University Hospital in Philadelphia are likely contributors to a sweeping negative perception surrounding private equity in healthcare. Jared Rhoads, a senior lecturer of health policy at The Dartmouth Institute for Health Policy and Clinical Practice points out that these outcomes can serve as cautionary tales, but that they aren’t the whole picture. “We do not have a full, transparent account of all internal deliberations and financial strategies in either case,” he says. Additionally, Rhoads states that commentaries and opinion pieces denouncing PE significantly outnumber original, evidence-based studies on the subject. He cautions that these pieces cite mainly the same few studies, leading to misconceptions about the amount of actual “evidence” available.

How Do You Measure Quality?

An analysis of studies on the impact of private equity on healthcare service quality found mixed results. One study in JAMA Internal Medicine published in late 2023 revealed that 60.8 percent of physicians surveyed considered the involvement of private equity in healthcare a negative, with 28.8 percent calling it “neutral.” About 10 percent of respondents viewed PE deals in a positive light. Another study in psychiatric medicine, where private equity ownership has increased in recent years, scoring showed lower staff ratios but a higher performance on quality measures including restraint use, follow-ups, and admissions. That study reported no evidence of lower quality among PE-owned psychiatric facilities, although it also indicated that existing measures were limited.

At nursing homes, unfavorable results were found using multiple scoring indicators. These included reduced nursing staff hours, high clinician turnover, and increased mortality rates. Additional studies at nursing homes revealed more favorable results like decreased acute myocardial infarction rates and better appointment availability.

It’s perhaps wise to resist the labeling of PE in healthcare as simply “good” or “bad,” cautions one JAMA article, stating that it’s important to consider the nuances in perception when it comes to defining “quality” and evaluating quality scores. There is some complexity in viewing quality in terms of general measures or indicators, like staffing, turnover, and readmissions (to name just a few) and considering quality in terms of health outcomes. Do poor scores in an indicator mean poor health outcomes? The authors reference a review of studies that analyze PE in healthcare (Alexander Borsa et al.) and state that of 27 studies in the review, only one found that “harmful” quality (here meaning a poor score on an indicator or benchmark) translated to a “harmful outcome” (e.g., mortality). In addition, they state that patients may have a difficult time accurately observing, let alone assessing, the value of their care. Other potential issues include tight observation windows, the potential for biases in quality assessment tools, and limited sample sizes. Borsa’s review found that the available research into the quality of care related to PE-acquired entities was largely limited to studies of nursing homes, hospitals, and dermatology practices. The article notes the potential for misconstrued findings in such a small sampling.

Regulation

There has been legislation proposed by federal and state governments in the last few years in an attempt to regulate PE-related deals in healthcare. These efforts are still in the beginning stages and, it’s suggested, could be better informed once more research is available about PE’s impact on different healthcare settings. There is also a need for research on the impacts of current regulatory interventions including implementation of purchase disclosure policies and the prohibition of PE in certain markets.

The Federal Trade Commission’s threshold for reporting is at $126.4 million for 2025 (an increase from $111.4 million in 2023), meaning transactions under this value are not reportable and thus fly under the radar. PE firms do not have to disclose the details of their acquisitions and are able to keep management practices close to the chest, which can create a lack of transparency and accountability and also compromise the quality of the organization’s care services.

Recent legislation:

- Washington: January 21, 2025: Concerning the corporate practice of medicine (SB 5387) – making it unlawful for “an individual, corporation, partnership, or any other entity without a license to practice medicine, own a medical practice, employ licensed health care providers, or otherwise engage in the practice of medicine.” (This bill has not yet been signed into law and currently sits in the Washington State Senate.)

- Massachusetts: January 8, 2025: An Act Enhancing the Market Review Process (H.5159) – signed by Massachusetts Governor Maura Healey – strengthens the oversight of major market groups including providers, insurers, pharmaceutical manufacturing companies and private equity firms, among others.

- U.S. Congress: July 26, 2024: Health Over Wealth Act (S.4804) – introduced by Massachusetts Senator Ed Markey, “to increase transparency and scrutiny of PE and for-profit companies that own healthcare facilities.” (This bill has not yet passed.)

- U.S. Congress: June 11, 2024: Corporate Crimes Against Health Care Act of 2024 (S.4503) – introduced by Massachusetts Senators Elizabeth Warren and Ed Markey “to prevent exploitative private equity practices,” imposing penalties for PE principals and requiring physicians to disclose PE investments when they apply for federal funding. (This bill remains with the Committee on Finance as of 06/11/2024.)

Areas of Growth

Clinical specialties like otolaryngology, dermatology, and ophthalmology have seen increasing numbers of PE investments, as have orthopedics and gastroenterology, due to roll-up potential, an established patient base, and reimbursements that tend to exceed primary care. Behavioral health is also a target owing to opportunities of consolidation for both outpatient and inpatient providers, scale, shared platforms, and a growing demand for mental health services. Outpatient, ambulatory, and urgent care services are attractive to PE investors as patients are shifting to lower-cost options for treatments. These services offer the convenience of extended hours and outpatient procedures. Telehealth, digital health, and health technologies go beyond traditional care by reaching more patients and complementing the post-COVID trend of spending more time in the home. Home-based healthcare is at the top for healthcare services deals, according to PitchBook, with the highest number of acquisition deals in the first quarter of 2025.

Among U.S. states, California has the highest proportion of PE and venture-capital enterprises with a 6.7 percent private equity penetration rate. Massachusetts comes in second with a rate of 6.11 percent, then Utah at 4.98 percent.

For reference, see “Private Equity & Healthcare,” ProVisions, October 2023: https://agents.proassurance.com/provisions/oct23#equity

The Expanding Risk Profile of Advanced Practice Nurses

As healthcare systems consolidate and primary care delivery models evolve, Advanced Practice Registered Nurses (APRNs) are assuming unprecedented clinical responsibility.

Between 2010 and 2017, the APRN workforce more than doubled from 91,000 to 190,000 practitioners, with current growth rates projected at 6.8 percent annually through 2030.1 Today, over 355,000 nurse practitioners are licensed in the United States, with 88 percent educated and prepared in primary care settings.2

This rapid expansion—coupled with over half of states now authorizing full practice authority for APRNs—represents a significant shift in the healthcare liability landscape that insurance professionals must understand.

The Evolution from Collaboration to Independence

The APRN role originated in the 1960s to bridge healthcare gaps in underserved communities, initially requiring physician supervision. The 2010 Institute of Medicine report The Future of Nursing accelerated the profession's evolution by recommending that APRNs practice to the full extent of their licensure. As these professionals transition from collaborative to independent practice—now able to own clinics and employ physicians—their liability exposure naturally increases.

According to the Nurses Service Organization’s (NSO) claim report, indemnity payments for APRN claims are rising, with 232 closed claims exceeding $10,000 between 2017 and 2021.3

Where Claims Originate

Understanding the practice settings where APRN liability emerges is essential for risk assessment. The NSO data reveals that 31.5 percent of claims occur in physician office practices, 20.3 percent in long-term care facilities, 13.8 percent in APRN-owned clinics, 8.6 percent in behavioral health facilities, 5.2 percent in emergency departments, and 3.9 percent in community clinics.3 This distribution reflects the profession's broad reach across healthcare delivery systems.

The Diagnostic Error Problem

Diagnostic errors represent the most significant liability risk for APRNs, accounting for 37 percent of all claims.3 Research on physician malpractice reveals that most diagnostic errors occur early in the patient encounter during initial assessment, diagnosis processing, and test interpretation, with many patients experiencing multiple errors along their care journey.4

For insurers, this suggests that APRNs practicing in specialties requiring significant diagnostic acumen—such as primary care where cancer screening is routine—may present elevated risk profiles. The ambulatory setting, where 55 percent of diagnostic error claims originate, deserves particular attention given that most APRNs work in outpatient environments.4

Communication Failures: A Hidden Liability Driver

A retrospective analysis found communication failures in 49 percent of medical malpractice claims, involving both provider-to-patient and provider-to-provider breakdowns.5 Care transitions and patient handoffs create particularly high-risk scenarios.

One study examining claims associated with patient transitions from healthcare facilities identified these handoffs as fertile ground for miscommunications, errors, and near-misses that contribute to patient harm.6

An often-overlooked liability concern involves informal consultations or “curbside consults.” The case of Warren v. Dinter (2019)* established that a physician providing treatment advice to an APRN without formally examining the patient still owed a duty of care to that patient. The patient died of sepsis three days after the physician advised against hospital admission, and the court found the physician negligent despite never establishing a formal provider-patient relationship.

This precedent has implications for both APRNs seeking informal guidance and specialists providing it, creating complex liability questions in collaborative care models.7

Productivity and Risk: Dispelling Myths

For insurers evaluating APRN practices, research offers reassurance about volume-based risk. Studies examining whether increased patient visits or procedural volume correlate with higher malpractice rates found only marginal increases in claims as patient volume grew, while the claims rate per 1,000 patient encounters actually decreased.8,9

This suggests that high-volume APRN practices do not automatically translate to proportionally higher liability risk.

Implications for Insurance Professionals

As APRNs assume greater clinical independence within consolidating healthcare systems, their risk profile increasingly mirrors that of physicians. Insurers should focus on:

- Practice setting and specialty mix, particularly those involving diagnostic complexity

- Communication protocols during care transitions and consultations

- Documentation quality and EHR utilization practices

- Collaborative relationships with high-claim-frequency providers

- Error disclosure policies and patient communication strategies

The APRN profession’s rapid growth and expanding scope represent both an opportunity and a challenge for the insurance industry. Understanding these evolving liability patterns enables more accurate risk assessment and premium setting while supporting loss prevention efforts that benefit all stakeholders in the healthcare delivery system.

1. Auerbach, D., Buerhaus, P. I., & Staiger, D. (2020). Implications of the Rapid Growth of the Nurse Practitioner Workforce. Health Affairs, 39(2). https://doi.org/10.1377/hlthaff.2019.00686

2. Nurse Practitioners in Primary Care. American Association of Nurse Practitioners. https://www.aanp.org/advocacy/advocacy-resource/position-statements/nurse-practitioners-in-primary-care

3. Nurse Practitioner Professional Liability Exposure Claim Report (5th ed.). Nurses Service Organization. (2022). https://www.nso.com/Learning/Artifacts/Claim-Reports/Nurse-Practitioner-Claim-Report-5th-Edition

4. Grenon, V. et al. (2023). Factors Associated with Diagnostic Error: An Analysis of Closed Medical Malpractice Claims. Journal of Patient Safety, 19(3), 211-215. https://pubmed.ncbi.nlm.nih.gov/36631023/

5. Humphrey, K. et al. (2022). Frequency and Nature of Communication and Handoff Failures in Medical Malpractice Claims. Journal of Patient Safety, 18(2), 130-137. https://pubmed.ncbi.nlm.nih.gov/35188927/

6. Arbaje, A. et al. (2020). Learning from Lawsuits: Using Malpractice Claims Data to Develop Care Transitions Planning Tools. Journal of Patient Safety, 16(1), 52-57. https://pmc.ncbi.nlm.nih.gov/articles/PMC9550187/

7. Zacharias, R. et al. (2021). Curbside Consults in Clinical Medicine: Empirical and Liability Challenges. The Journal of Law, Medicine, & Ethics, 49(2021), 599-610. https://doi.org/10.1017/jme.2021.83

8. Bass, G. D. et al. (2021). A Retrospective Analysis of Malpractice-Related Procedure Rates for Internal Medicine Specialists at an Academic Medical Center. The Joint Commission Journal on Quality and Patient Safety, 2021(47), 704-710. https://doi.org/10.1016/j.jcjq.2021.08.001

9. Schaffer, A. et al. (2021). The Effect of Clinical Volume on Annual and Per-Patient Encounter Medical Malpractice Claims Risk. Journal of Patient Safety, 17(8), 995-1000. https://pubmed.ncbi.nlm.nih.gov/32209950/

*Warren v. Dinter, 926 N.W.2d 370 (Minn. 2019).

The Expanding Role of the Advanced Practice Clinician

The activities and duties a licensed healthcare professional is permitted to perform within a state, along with supervision requirements and authority to administer vaccines and prescribe medications, is known as their “scope of practice.” A key trend we are seeing in modern healthcare today is the rapidly expanding scope of Advanced Practice Clinicians (APCs)—including Nurse Practitioners (NPs), Physician Assistants (PAs), Certified Registered Nurse Anesthetists (CRNAs), and Certified Nurse Midwives (CNMs).

The activities and duties a licensed healthcare professional is permitted to perform within a state, along with supervision requirements and authority to administer vaccines and prescribe medications, is known as their “scope of practice.” A key trend we are seeing in modern healthcare today is the rapidly expanding scope of Advanced Practice Clinicians (APCs)—including Nurse Practitioners (NPs), Physician Assistants (PAs), Certified Registered Nurse Anesthetists (CRNAs), and Certified Nurse Midwives (CNMs).

Historically, APCs were primarily seen in the primary care setting to fill the physician labor shortage. Today, APCs work in a wide range of settings, including hospitals, community clinics, and private practices. In in-patient settings, they increasingly perform advanced clinical roles, specializing in fields such as cardiology, oncology, and dermatology.

Contributing Factors

There are several factors contributing to the expanding scope of practice for APCs.

The Association of American Medical Colleges (AAMC) predicts a significant physician shortage by 2036, and with 1 in 5 Americans projected to be 65 or older by 2030, the demand for healthcare services is increasing. In response, many states are expanding the scope of practice laws for APCs. In fact, 27 states have granted full practice authority to NPs, allowing them to practice, diagnose, and treat patients independently.

Studies suggest that care led by advanced practice nurses can be more cost-effective than physician-led care and may result in greater patient satisfaction and reduced waiting times. In addition, the growth of telehealth and remote patient monitoring, accelerated by the COVID-19 pandemic, has enabled APCs to reach more patients, monitor conditions remotely, and provide access to care, particularly in underserved and rural areas.

Challenges and Controversies

Despite their rapid growth, APCs (specifically APRNs) are the subject of ongoing debate. APRNs often encounter barriers related to provider credentialing, hospital admitting privileges, and reimbursement issues. Physician advocacy groups, such as the American Medical Association (AMA), have also opposed expanding APRN scope of practice, citing concerns over patient safety and cost.

Physicians have raised initial concerns regarding legal exposure and training, according to Becker’s Hospital Review, as well as the ambiguity around the APC’s roles and responsibilities when it comes to patient care.

Risk Mitigation

Wendy Alderman, Senior Risk Management Consultant, notes that understanding each state’s scope of APC practice is a good starting point for risk mitigation, as full practice authority can bring broader exposures. “Of course, the strategies for managing risk and patient safety mirror those used for physicians,” says Alderman. “However, I believe APCs’ exposure is an emerging risk, and time will tell whether the same risks are applicable to them.”

As the APC workforce expands, insurers should stay alert to how these providers are used and ensure that policies align with state laws and actual clinical roles. “Because plaintiffs’ attorneys often name everyone involved in a patient’s care, both APCs and supervising physicians may face equal scrutiny in a lawsuit,” notes Alderman. “Open communication between risk managers and underwriters about provider roles and responsibilities strengthens mitigation strategies and supports sound policies.”

The Future of APCs

The job outlook for APCs is exceptionally strong and will likely continue to outpace other clinical roles in medicine. By 2036, tens of thousands of new nurse practitioners and physician associates will be needed to meet rising healthcare needs. In fact, employment for PAs is expected to grow 28 percent and NPs 46 percent by 2033, far outpacing other professions. Should more states adopt full practice authority for APCs, those numbers will continue to rise. To stay up-to-date on the scope of practice for your state, visit the National Conference of State Legislatures. According to Alderman, effective risk management starts with anticipating issues before they grow, especially as APCs take on a larger share of patient care.

Some states employ a restricted practice model, which prohibits APCs from engaging in the practice of medicine without physician supervision. Other states employ a reduced practice model, which requires that APCs collaborate with physicians in order to engage in the practice of medicine, providing APCs with considerably more autonomy than the restricted practice model. Finally, some states follow the full practice model, which grants certain APCs full authority to engage in the practice of medicine.

The Impact of Healthcare Consolidation on Patient Experience

More than a decade and a half ago, patient experience researchers, the Beryl Institute, developed what is now a widely used definition of patient experience:

Patient experience is “the sum of all interactions, shaped by an organization’s culture, that influence patient perceptions across the continuum of care.”1

Around the same time, Deloitte Center for Health Solutions took a similarly holistic approach to defining the patient experience:

“The patient experience refers to the quality and value of all of the interactions—direct and indirect, clinical and non-clinical—spanning the entire duration of the patient/provider relationship.”1

With these definitions in mind, we can understand patient experience as more expansive than just the transactional diagnosis and treatment of a patient’s medical concerns. It encompasses every interaction the patient has with a healthcare provider and system and every subjective perception of those interactions.

In 2025, the Beryl Institute published their 16th patient experience study, Consumer Perspectives on Patient Experience in the U.S. It showed that patients continued to express strong sentiment for having a good patient experience. However, the studies also reveal a great disparity among this high importance patients place on a good healthcare experience generally, their assessments of their actual healthcare visits, and their perceived quality of healthcare generally. In each poll since 2022, more than 90% of patients indicated that having a good patient experience was “extremely important” or “very important” generally. However, less than 70% rated their experiences at actual healthcare visits as “good” or “very good” while less than half rated their perception of the healthcare system overall as “good” or “very good.”2

This disparity between the ideal of patient experience, its reality, and perceptions of the healthcare system itself is striking.

The Three Pillars of Patient Experience

Researchers in one study of hospitals found that patient experience was impacted by many factors that could be grouped into three interconnected themes or pillars:3

Pillar 1 - Treatment: Safe, timely, and effective treatment

- Feeling safe in the hospital

- Ease of hospital transitions

- Effective treatment that meets patient expectations

- Effective management of pain

Pillar 2 - Staff: Caring and attentive staff

- Being informed

- Being listened to and valued

- Responsiveness to patient needs

- Providing a consistent quality of care

Pillar 3 - Environment: Comfortable and healing environment

- In hospitals:

- Having a clean and functional room

- Promoting sleep and rest

- Providing nutritious food and dietary options

- Features that connected them to nature, such as large windows, natural light, and a clean and well-maintained environment

Interestingly, Beryl Institute research of the top three reasons why people feel that having a good patient experience is important2 seem to align well with these pillars:

#1 “My health and well-being are important to me” [Pillar 1 - Treatment]

#2 “I want to know my physical needs are being taken seriously” [Pillar 3 - Environment]

#3 “I want to be treated with respect” [Pillar 2 - Staff]

Through this three pillars lens, we see that consolidation brings mixed results when weighed against the oft-given goals of consolidation: “increased efficiency, lower administrative costs, and improved quality of health care”4 and the actual results.

Healthcare Consolidation’s Impact on Patient Experience

In 2024, the Federal Trade Commission, the Department of Justice’s Antitrust Division, and the Department of Health and Human Services launched an inquiry into the impacts of consolidation (aka, integration)* transactions in healthcare. These agencies published a request for information (RFI) “to seek public comment regarding the effects of these transactions involving health care providers”5 with particular interest in comments related to “the goals or objectives of these transactions, as well as their effects on participants in the health care market including patients, communities, payers, employers, providers, and other health care workers and businesses.”5

This scrutiny is justifiable. Research suggests that consolidation “has led to less competition, which in turn comes with higher prices and significant economic impacts [and] declines in affordability and access.”6 Despite the increasing costs, though, quality for patients has stagnated or even decreased.6

A systematic review of literature of articles published from 2000 to 2024 that studied the impacts of integration on price to the consumer, costs of delivery, and quality of care found similar results. The reviewed articles included both horizontal integration (e.g., a merger of two or more hospitals or medical groups) and vertical integration (e.g., hospitals acquiring physician practices).7 The results showed no significant improvements in price, cost, or quality. Instead, many of the results were negative. Reviewed articles focusing on cost showed no change or even increases, while articles focusing on price mostly reported increases. More directly related to patient experience, of the articles focusing on quality, 77% showed reductions or no change in quality.7 According to the lead author of the study, Bhagwan Satiani:

“Proponents of healthcare integration have claimed it controls costs and enhances care quality ... but we found that evidence is lacking that integration alone is an effective strategy for improving the value of health care delivery. ...Quality improvement in healthcare cannot be achieved by mergers and acquisitions alone.”8

The reality, though, is not that clear. Another study found that hospitals integrating vertically saw higher patient experience scores than those in horizontally integrated systems and independent hospitals,9 while a RAND researcher in her testimony to the U.S. House of Representatives Committee on Ways and Means, Subcommittee on Health in 2023 testified that “vertical integration of hospitals or health systems with physician practices does not lower spending and does not improve quality of care.”4

The decades-long trend of healthcare consolidation continues and—as reported by Kaelin O’Reilly in her “Private Equity in Healthcare Today” article elsewhere in this issue—may be accelerating. However, there do not seem to be many clear prescriptions for balancing the economic and financial goals of hospital systems, insurers, private equity firms, and corporations like CVS, Walmart, and Amazon against the generally declining patient experience.

* The terms consolidation and integration are used interchangeably in the literature and in the studies mentioned in this article. To maintain the integrity of the research references, the term used in the reference is used here.

- Jason A. Wolf, et al. “Defining Patient Experience.” Patient Experience Journal. 2014; 1(1):7-19.

- The Beryl Institute - Ipsos PX. Consumer Perspectives on Patient Experience in the U.S. PX Pulse. February 2025.

- Corey Adams, et al. “The Three Pillars of Patient Experience: Identifying Key Drivers of Patient Experience to Improve Quality in Healthcare.” Journal of Public Health (Berl.), 33, 2105–2113 (2025). DOI: 10.1007/s10389-023-02158-y

- Cheryl L. Damberg. “Health Care Consolidation: The Changing Landscape of the U.S. Health Care System.” Testimony submitted to the U.S. House of Representatives Committee on Ways and Means, Subcommittee on Health. May 17, 2023. DOI: 10.7249/CTA2770-1

- U.S. Department of Justice, U.S. Department of Health and Human Services, and U.S. Federal Trade Commission. “Request for Information on Consolidation in Health Care Markets.” Docket No. ATR 102. February 29, 2024.

- Erin C. Fuse Brown, et al. “The Rise Of Health Care Consolidation And What To Do About It.” HealthAffairs. September 9, 2024. DOI: 10.1377/forefront.20240906.397095

- Bhagwan Satiani, et al. “Systematic Review of Integration Strategies Across the US Healthcare System: Assessment of Price, Cost, and Quality of Care.” Journal of the American College of Surgeons. 240(5):p 758-773, May 2025. DOI: 10.1097/XCS.0000000000001229

- Richard Payerchin. “Health Care Consolidation Pushes Up Costs, But Not Quality.” Medical Economics. January 2, 2025.

- Jillian S. Torres, Mark L. Diana. “Associations Between Integration and Patient Experience in Hospital-Based Health Systems: An Exploration of Horizontal and Vertical Forms of Integration.” Journal of Healthcare Management. 69(5):p 321-334, September/October 2024. DOI: 10.1097/JHM-D-23-00266

Private Equity in Healthcare and Its Impact on Patient Safety

The increasing prevalence of private equity (PE) acquisitions in healthcare leads many to question the impact of this type of arrangement on patient care and safety. PE firms continue to acquire medical practices, hospitals, nursing homes, and other healthcare entities across multiple specialties like primary care, oncology, and behavioral health. In 2024, 80 percent of physicians were employed by a hospital system or corporation, up from 60% in 2019, and private equity owned at least 386 hospitals—or roughly 30% of all for-profit hospitals in the United States. Today, nearly a quarter of U.S. hospitals are run by for-profit entities that offer business expertise and infuse capital for healthcare organizations.1,2 And while patients may be unaware of specific changes in the care they receive at their PE-acquired healthcare facility, PE investors do have specific financial goals that could affect care decisions.3 There is the suggestion of a “core contradiction” that exists as physicians believe patients come first while corporate investors may believe that equity to shareholders is the priority, focusing on rapid growth and high returns when they sell within three to seven years.

Growing research suggests healthcare quality declines when for-profit initiatives take control. Reports from the failed Steward Health Care System, for example, revealed compromised patient safety resulting from understaffed emergency rooms and ill-equipped maternity units to cancelled surgeries. A 2023 study reported that Medicare patients receiving care at PE-owned hospitals suffered a 25% increase in hospital-acquired complications compared to patients at nonprofit hospitals. These included a 38% increase in bloodstream infections from central line placement procedures despite 16% fewer central lines placed. Lastly, the rate of surgical site infections doubled at PE hospitals while those at control hospitals decreased. Patient falls at non-PE-owned hospitals have been trending downward for decades due to longstanding hospital patient safety initiatives. However, falls at PE-owned hospitals have experienced a 27% relative increase, as reported by the 2023 study.

According to Zirui Song, PhD, an associate professor at Harvard Medical School and Massachusetts General Hospital, the unique financial pressures private equity-owned hospitals face may contribute to cost-cutting in care delivery. While other industries allow for the replacement of workers with automation, healthcare remains human labor intensive, especially in the acute care setting. In some instances, for example, PE ownership was associated with reduced nurse staffing levels. A reduction of staff and other related measures in the name of “efficiency” can have deleterious consequences for patient outcomes and overall quality of care, which includes safety.1

Recent studies of nursing home patient data focused on mortality, greater use of anti-psychotic medications, and increases in emergency department visits and hospitalizations in PE-owned facilities and physician practices, coupled with increased costs and Medicare claims. While patient safety data on PE-owned physician practices is limited, some information can be found in academic studies and whistle blower lawsuits.Additionally, research of both private equity–owned dermatology and cardiology practices identified “almost exclusively negative impacts on patient satisfaction, daily functioning, and general quality scores.”4,5

Another important aspect to consider is the impact of the PE arrangement on the physicians who are providing the care. Information from False Claims Act lawsuits found concerns over the exertion of control by PE firms over physician decisions, including hiring and firing. A PE firm may require providers to see a greater number of patients per day and order more (potentially unnecessary) tests and procedures. Physicians may experience a decrease in autonomy, with reduced hours and benefits, and replacement with less-expensive, mid-level providers. Along with this, naturally, comes a decreased satisfaction with work and a greater risk of physician burnout.5,6

Academic and research institutions have made clear there is a need for attention and robust action from policymakers to address these accelerating acquisitions. A lot remains uncertain, and additional efforts such as stronger congressional oversight may be required to better comprehend the many implications of PE on patient care and safety. Within the last year, several congressional committees have launched investigations and held hearings on the role of PE in healthcare. State legislation to regulate private equity in healthcare is pending in several states including Massachusetts and New York, while other states such as California, Oregon, and Minnesota already have programs in place. Other bills, like the Corporate Crimes Against Health Care Act7 and the Health Over Wealth Act8, are aimed at penalizing PE firms in the event of patient death or injury, and providing greater transparency for both PE and for-profit companies that own healthcare entities.1

1. Harvard T.H. Chan School of Public Health https://hsph.harvard.edu/news/private-equitys-appetite-for-hospitals-may-put-patients-at-risk/

2. National Institutes of Health (The Journal of the Missouri State Medical Association) https://pmc.ncbi.nlm.nih.gov/articles/PMC11482842/

3. The University of Chicago Medicine https://www.uchicagomedicine.org/forefront/research-and-discoveries-articles/private-equity-investments-in-healthcare-may-not-lower-costs

4. National Institutes of Health (The BMJ) https://pmc.ncbi.nlm.nih.gov/articles/PMC10354830/

5. National Institutes of Health (Clinical Orthopaedics and Related Research) https://pmc.ncbi.nlm.nih.gov/articles/PMC11124759/

6. Brown University School of Public Health https://sph.brown.edu/news/2025-04-10/private-equity-acquisitions-health-care-industry

7. Congress Bill S.4503 https://www.congress.gov/bill/118th-congress/senate-bill/4503

8. Congress Bill S.4804 https://www.congress.gov/bill/118th-congress/senate-bill/4804 |

|

The Bind Order

This selection of accounts ProAssurance bound recently is intended to give our partners tangible examples of risk classes we’ve been successful quoting and that we’d like to see more of. These examples are anonymized with final premium rounded, but otherwise present actual accounts.

DERMATOLOGY

Delaware

Limits: $1M/$3M

Admitted

Premium: $21,000

INTERNAL MEDICINE

Florida

Limits: $250k/$750k

Admitted

Premium: $49,000

HOSPITALISTS

Texas

Limits: $300k/$900k

Admitted

Premium: $21,000

PEDIATRICS

Florida

Limits: $250k/$750k

Admitted

Premium: $14,000

RADIOLOGY SERVICES

Texas

Limits: $1M/$3M

Admitted

Premium: $63,000

PATHOLOGY & GASTROENTEROLOGY

Virginia

Limits: $2.75M/$8.25M

Admitted

Premium: $57,000

THERAPY SERVICES

Florida

Limits: $1M/$3M

Admitted

Premium: $160,000

AMBULATORY SURGERY CENTER

Illinois

Limits: $1M/$3M

Admitted

Premium: $14,000

FTCA CLINIC

New Jersey

Limits: $1M/$3M

Admitted

Premium: $10,000

MID-LEVEL PROVIDER

Tennessee

Limits: $1M/$3M

Admitted

Premium: $3,100

IMAGING CENTER

California

Limits: $1M/$3M

Admitted

Premium: $41,000

GYNECOLOGY

Indiana

Limits: $500k/$1.5M

Admitted

Premium: $9,400

ORTHOPEDIC SURGERY

California

Limits: $1M/$3M

Admitted

Premium: $12,000

FAMILY MEDICINE

New York

Limits: $1M/$3M

Admitted

Premium: $31,000

ADULT LIVING FACILITY

Missouri

Limits: $1M/$3M

E&S

Premium: $22,000

Ohio

Limits: $1M/$3M

E&S

Premium: $104,000

Ohio

Limits: $1M/$3M

E&S

Premium: $29,000

New Business Submissions

Our standard business intake address for submissions is Submissions@ProAssurance.com. For specialty lines of business, please use one of the following: CustomPhysicians@ProAssurance.com, Hospitals@ProAssurance.com, MiscMedSubs@ProAssurance.com, and SeniorCare@ProAssurance.com. Visit our Producer Guide for additional information on our specialty lines of business.

The types of business and premium amounts are illustrative of where we have written new business and not intended to reflect actual pricing or specific appetites.

.png?width=300&name=MicrosoftTeams-image%20(28).png)

Fewer doctors are employed by independent physician practices as offices are acquired by health systems, insurers, private equity firms, and other companies, according to a review of studies published by the Government Accountability Office. (Healthcare Dive)

The Leapfrog Group today released its fall 2025 Hospital Safety Grades. The biannual Safety Grade is an "A," "B," "C," "D," or "F" assigned to all general hospitals in the United States based on their ability to protect patients from medical errors, accidents, injuries, and infections. These largely preventable problems harm one in four hospital inpatients and cause as many as 250,000 deaths each year. (PR Newswire)

Outpatient care volumes are expected to rise by 18% over the next decade, while inpatient care will see a more modest growth rate of 5%, according to a June forecasting report from Sg2. Inpatient acuity, however, is expected to rise, and many health systems are already seeing this shift play out. (Becker’s Clinical Leadership)

Locum tenens are increasingly integrated into strategic planning, addressing physician shortages and protecting revenue, with actual use 25% above plan in 2024. Organizations are using locums to prevent revenue loss, meet rising patient demand, and supplement staff during peak periods, shifting from backfill to strategic use. (Medical Economics)

Primary care physicians (PCPs) clocked more than 60 hours a week caring for their patient panel, a cross-sectional study suggested. The finding translated to a median of 1.7 hours per patient per year, they wrote in the Annals of Internal Medicine. Patient panel characteristics and patient message volume also were associated with physician time expenditure. (MedPage Today)

Radiologists are 10% more likely to practice as subspecialists than as generalists after experiencing a practice closure, a recent study found. The Harvey L. Neiman Health Policy Institute study, published Oct. 27 in the Journal of the American College of Radiology, used data from nearly 240,000 radiologist-years between 2014 and 2021. (Becker’s Hospital Review)

Gratitude in the Season of Reinvention

For years, medical sales representatives sold directly to doctors and other product end-users. If a doctor requested a product, you received the purchase order, and that was that. Then things began to change. Hospitals realized that giving physicians free rein to use whatever products they wanted was costly, so they established product approval committees to make decisions.

When I entered medical sales, it was because I could speak the clinical language of healthcare professionals. Suddenly, I found myself interacting more with stakeholders who had no interest in discussing clinical issues. They wanted to talk about their business. My initial reaction? "I didn't sign up to have spreadsheet discussions with CFOs and other number-crunchers I didn't know." But I had no choice.

Sound familiar? That's where many MPL agents are today. You've spent years cultivating relationships with physicians and practice managers who called the shots. Now those same stakeholders are employees of a hospital system—or worse, a private equity firm in another state, run by people who've never even met the personnel you know.

The most glaring change for medical reps is that access is more difficult. Why would a doctor spend time with salespeople when the products they use aren't their choice anymore? Sure, they might influence committee decisions, but with limited time, they now choose their battles carefully. Instead of one-on-one conversations, reps face product submission processes where feedback is anything but immediate—and often nonexistent.

If you're feeling frustrated, I get it. But here's the uncomfortable truth: this is the same kind of disruption that separates average salespeople from those who become indispensable.

The Touchpoints Are Changing—Not Disappearing

In medtech, reps learned that instead of just calling on a surgeon, they now have to engage with every member of a value analysis committee. Each stakeholder has different concerns and speaks a different language. Personalizing communication for each individual is no longer optional; it has become the only way to stay relevant.

That same shift is happening now for MPL agents. The titles are different, but the challenge is identical: learning to speak the language of administrators, CFOs, and private equity partners while still connecting with the clinicians you've always known.

Relearning Is Painful—Until It Starts Working

The biggest barrier isn't knowledge—it's ego.

I spent decades mastering clinical sales conversations and building relationships with my accounts. However, the market didn't care who I knew or what I liked to discuss; it only rewarded me once I adapted to its needs.

The same principle applies here. Agents who cling to "how it's always been" will fade into obscurity. Those who invest the time to understand new buyers and adapt accordingly will become irreplaceable. The job now is as much about providing insight as it is about offering coverage.

Be Grateful for the Access Your Competitors Don't Have

It's hard to feel grateful in times of forced change, but in a world where access is limited, those who find ways to connect have a true advantage. Be thankful when you get the meeting or when you reach the one person who'll take your call—because if you connect when your competitors can't, you're already winning.

Consolidation doesn't erase opportunity; it just changes where it lives. It rewards those who can:

- Translate old expertise into new conversations.

- Understand the motivations of new decision-makers.

- Bring perspectives others can't.

If you've survived the changes in this industry thus far, that's something to be thankful for. And if you're willing to keep learning and evolving, you can add one more thing to your gratitude list when it's your turn to speak at the Thanksgiving table.

|

Written by Mace Horoff of Medical Sales Performance. Mace Horoff is a representative of Sales Pilot. He helps sales teams and individual representatives who sell medical devices, pharmaceuticals, biotechnology, healthcare services, and other healthcare-related products to sell more and earn more by employing a specialized healthcare system. Have a topic you’d like to see covered? Email your suggestions to AskMarketing@ProAssurance.com. |

Risk Management Updates

Rapid Risk Review Podcast

Latest Episode: A Conversation with Dr. Gita Pensa—Litigation Stress & Physician Burnout

In this episode, guest Dr. Gita Pensa discusses the significant impact of medical malpractice litigation stress on healthcare providers. She explores the psychological and physical effects of litigation stress, the cultural stigma surrounding it, and the changing public perception of physicians, especially post-pandemic. The conversation highlights the increasing burnout among healthcare providers and emphasizes the need for advocacy and collective action to address these challenges. Dr. Pensa shares her personal experiences and insights on how physicians can navigate the complexities of litigation while maintaining their well-being and advocating for systemic change in healthcare.

Allegation

Negligent preparation of surgical site and oxygen administration during surgery alleged in patient injury.

Read the issue

Event reporting is a systematic and timely internal process of reporting occurrences that deviate from expected outcomes. Adverse events include medical errors, near misses, and patient harm obtained as the result of the care delivering process. The benefit of event reporting is to foster a culture of patient safety and provide the opportunity for process improvement.

Watch here

Spoliation is the intentional or unintentional destruction or loss of evidence that may be used in connection with litigation. Learn how spoliation can happen and what you can do to avoid finding yourself the subject of a spoliation jury instruction during a medical malpractice claim.

Keep Up-to-Date on All Our Risk Management Resources

Our weekly risk management newsletter features the latest releases from ProAssurance’s Risk Management department—as well as highlights from our expansive online library of tools and publications. Join our email list.

Our Hottest Leadership Elite Yet

Thank you to everyone who joined us in Los Cabos in September. The event offered opportunity for the best of ProAssurance's agents and brokers to enjoy some time out of the office, networking and discussing our industry with each other, the ProAssurance team, and invited guests.

The agenda at Leadership Elite 2025 prioritized, as always, our efforts to become your Carrier of Choice. The past few years have been heavily focused on laying the groundwork for the company we have become—and we are pleased your feedback indicates we are a more consistent, reliable partner as a result. We appreciate all that you do on behalf of ProAssurance and will continue to work to earn your partnership.

While we could not possibly capture the full camaraderie, scenery, delicious food, fun, and relaxation, we have gathered a selection of photos submitted by our guests to commemorate the weekend. Enjoy!

If you'd like to see more photos, visit the gallery: https://pralinks.proassurance.com/2025LE

Click on "I want to request access." Once you set up your account, you can view our entire photo library from the event.

Women of Influence Reconvenes in Cabo

ProAssurance was delighted to host our second annual Women of Influence event at Leadership Elite in Los Cabos, Mexico. It was a morning filled with networking opportunities and inspiration, thanks to an inspiring session led by Natalie Buccini of Peabody & Buccini LLP, a Registered Nurse and a respected member of ProAssurance’s Defense Panel in California. We look forward to continuing to foster leadership development opportunities throughout the year.

Happy Holidays!

Wishing you and yours a joyful and prosperous holiday season this year. As a reminder, ProAssurance’s offices will be closed the following days in recognition of the holidays.

- November 27-28

- December 24-26

- January 1-2

ProVisions Team

- Communications

- Design

- Digital Marketing