December 2023

Checking It Twice:

A Year in Review

Table of Contents

Looking Ahead: A Message from Rob Francis

2023 has been a year of completion at ProAssurance. We completed the conversion to a new policy administration and claims system. We completed the full integration of NORCAL where no separation exists between legacy companies as we manage our malpractice business. We completed the initial two-year cycle of our regional leadership teams ending with empowered cross-functional teams. And we set the standards to which we will hold ourselves accountable in working with you, our agency partners.

These accomplishments have helped us almost double our new business writings in partnership with you.

Even as we celebrate this progress, we understand the need for further improvement and adaptation. Our responsiveness will continue to improve beyond those standards as we provide our teams with better tools and information.

These tools, new policy forms, and standardized underwriting rules will greatly increase our consistency in service delivery and underwriting across regions. Our agency partners and insureds will gain more ways to transact business as we put new tools in your hands through enhancements to our agency portals. Data will improve efficiency and decision-making, meaning faster response times and faster decisions.

We understand the need for adaptation in how we do business and how we react to the external environment. Healthcare consolidation, erosion of tort laws, and uncontrolled jury verdicts threaten the practice of medicine and require us to respond.

Healthcare consolidation has reached the point where some estimate that no more than 25% of physicians practice in historically independent situations. Private equity is using its financial muscle to buy practices even as hospital systems have largely completed their employment efforts. Larger organizations change the way insurance is purchased. Service can become a second thought to price. Risk management does not have a payoff within the 3-to-5-year lifespan under which such groups are managed. Premium dollars are removed from the market. According to MPL state filings, between 2012 and 2022, physician premiums as a component of all medical professional liability premiums fell by 31%—even with increasing rates of late. And what will the effect of “retail medicine” be with Amazon, Walmart, and others like them now entering the fray?

Tort law changes that are adverse to our insureds abound. Illinois has adopted a pre-judgment interest law that will result in higher claims costs, meaning higher premiums. Pennsylvania has liberalized their venue rules taking the state backward 20 years. California has altered its historic MICRA statutes by increasing cap levels, increasing the number of caps that can apply, and increasing attorney contingency fees. Higher claims costs there are a certainty. Nevada has followed California’s lead.

With these factors removing premium from the market and creating a need for higher rates, social inflation in the form of dramatic jury awards that far exceed economic need have resumed and accelerated following a brief COVID-induced hiatus. In fact we have seen numerous record-breaking verdicts across the country over the past year—with one of the most memorable in Pennsylvania, where a Philadelphia jury awarded $182.7 million in a birth injury suit against Penn Medicine.

These verdicts, the erosion of tort reforms, and medical inflation are driving up settlement costs. The average settlement reported to the National Practitioner Databank in 2022 was approximately $450,000. That same statistic was $250,000 20 years ago, yet the average policy limit remains $1,000,000.

We will adapt and fight to affect change in this environment. Our commitment to allow our insureds to deliver care without fear of the loss of their livelihoods is stronger than ever.

Our collective accomplishments over the past year have given us a new energy to further establish strong relationships with you, our agency partners.

As we carry our momentum into 2024, ProAssurance stands ready to become your Carrier of Choice. Your sales efforts are an essential part of our work, and we look forward to partnering with you in 2024.

Happy Holidays!

Inaugural Advisory Council Meetings

Meeting the needs of our best trading partners is a critical component to becoming Carrier of Choice. To help ProAssurance understand how to best meet those needs, we have formed our Advisory Councils. There are seven councils including five Regional Councils, one National Brokers Council, and the President's Council, made up of the presidents of the six councils. The charter for these councils is to provide an external perspective on matters of importance related to marketing, underwriting, claims, risk management, and service quality. In addition, these councils provide feedback on new products and product enhancements. The initial meetings of the five Regional Advisory Councils occurred over the summer and fall of 2023. The first meeting of the National Brokers Council will take place this coming April, and the first President's Council meeting will take place at our Leadership Elite meeting in October.

Meeting the needs of our best trading partners is a critical component to becoming Carrier of Choice. To help ProAssurance understand how to best meet those needs, we have formed our Advisory Councils. There are seven councils including five Regional Councils, one National Brokers Council, and the President's Council, made up of the presidents of the six councils. The charter for these councils is to provide an external perspective on matters of importance related to marketing, underwriting, claims, risk management, and service quality. In addition, these councils provide feedback on new products and product enhancements. The initial meetings of the five Regional Advisory Councils occurred over the summer and fall of 2023. The first meeting of the National Brokers Council will take place this coming April, and the first President's Council meeting will take place at our Leadership Elite meeting in October.

The inaugural Regional Council meetings were a universal success. Your council members represented you well, providing open and frank input on what ProAssurance is doing well and what we need to do better. The evolving healthcare and professional liability markets were discussed, helping us better understand the challenges that you are facing every day as healthcare continues to consolidate and the claims environment continues to deteriorate. While each region has its unique challenges, there were certainly a few universal issues discussed, including:

- The need to improve proactive appetite, product, and process change communication

- The need for better visibility into submissions, accounts, and work-in-progress

- The challenges related to agency onboarding and training of new staff

- The importance of strong relationships at all levels

- The need for presentable information related to market conditions and the claims environment

The valuable input provided was included in ProAssurance’s 2024 planning processes and incorporated into our tactical goals. Stay tuned for specifics on how the issues raised are being addressed and what you can expect. On behalf of your team at ProAssurance, thank you to all our Council members for your commitment to helping us continually improve and progress toward becoming your Carrier of Choice.

2024 Retention Campaign

Prioritizing our marketing efforts to acquire and retain customers includes looking for ways to further develop relationships. To that end, we like to thank our insureds by offering them a complimentary resource related to their field, usually a book, as part of our annual retention campaign.

The initiative involves a series of direct mailings, and we’ve seen great success in the past with reply rates up to 25%. At the conclusion of each campaign, we measure the retention rate for those who request the book as compared to non-responders and have seen between a 4% and 10% bump for those who reply.

We are excited about our upcoming offering. It will feature The Laws of Medicine: Field Notes from an Uncertain Science by Dr. Siddhartha Mukherjee.

We are excited about our upcoming offering. It will feature The Laws of Medicine: Field Notes from an Uncertain Science by Dr. Siddhartha Mukherjee.

A Pulitzer Prize-winning author and premiere cancer researcher, Mukherjee investigates several perplexing and illuminating medical cases from his career and posits three key principles that he believes govern medicine:

1. A strong intuition is much more powerful than a weak test.

2. “Normals” teach us rules; “outliers” teach us laws.

3. For every perfect medical experiment, there is a perfect human bias.

For all of the intensive medical training and education that healthcare professionals receive, medicine can be an uncertain world, where data is often imperfect or incomplete. The Laws of Medicine attempts to reconcile “perfect” knowledge and “imperfect” clinical wisdom.

How the Campaign Works

Our Marketing team sends out a series of mailings to our MPL insureds (excluding Certitude insureds) 60-90 days in advance of their renewal date. The mailings include:

Mailing 1: A personal note, a custom pocket note with quotes from the book, and a reply card

Mailing 2: Following 4-5 weeks after Mailing 1, a letter from our Risk Management team referring them to their Risk Management contacts and a reply card

Mailing 3: Following 4-5 weeks after Mailing 2, an email communication to all remaining insureds who had yet to reply, with a link to request the book

The mailings go out approximately one month apart, and once someone responds, they are removed from the follow-up mailings. We actively monitor results of each stage of the mailings and adjust the campaign to optimize success. A final reminder email to nonrespondents concludes the campaign.

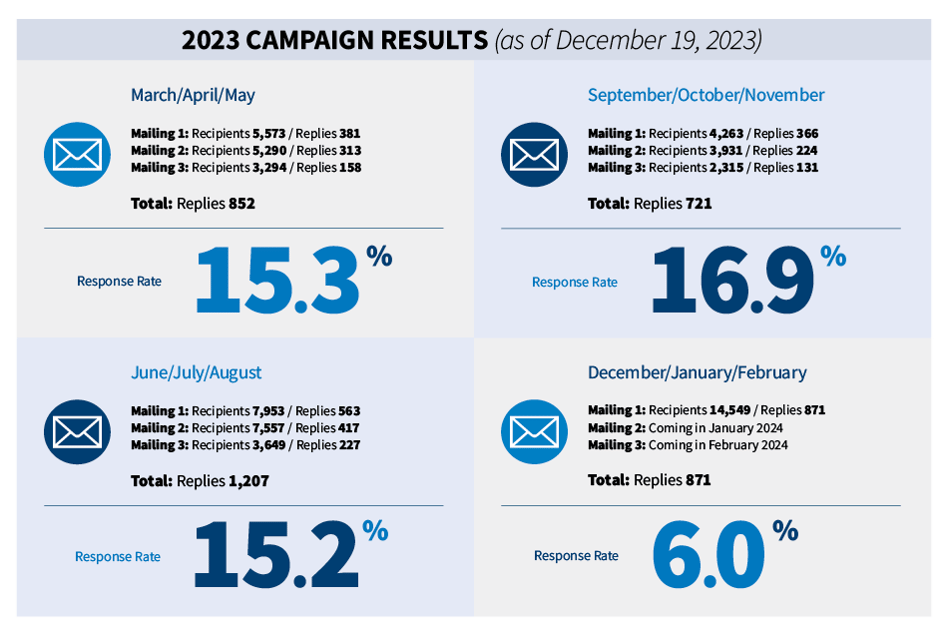

2023 Campaign Results

Over the last year, we offered Deep Medicine: How Artificial Intelligence Can Make Healthcare Human Again, by Dr. Eric Topol, cardiologist and Executive Vice President of Scripps Research.

The book explored the role artificial intelligence (AI) will play in the future of medicine and how deep learning algorithms can further a physician’s ability to create custom treatment plans.

With a few weeks left in the campaign, we can see that it was largely successful, with an overall response range of 15%-16%.

The Marketing department will provide ongoing campaign updates in future issues of ProVisions.

If you’d like to read either of the books yourself, email AskMarketing@ ProAssurance.com letting us know your mailing address.

We appreciate everything you do to place and retain business with ProAssurance.

Risk Management 2023

Each December I find myself reflecting on the past year and all that transpired. As I think about our initial vision for Risk Management in 2023 and how far we’ve come, the word preparation keeps coming to mind. Throughout the year our team has been planning and implementing the processes, services, and resources necessary to succeed in 2024.

In 2023 we experienced a year of growth and change for the Risk Management team. We hired two new Regional Managers, a Data Analyst, and two new Senior Risk Management Consultants. More importantly, though, our leader Lisa Van Duyn closed her chapter with ProAssurance after 22 years of service and sets out on a new adventure—enjoying retirement.

Our team approached 2023 as a year to prepare for the implementation of changes to our Risk Management discount offerings. We improved our internal systems and programs to better suit our needs in 2024 and did much of the preparation necessary for the changes to succeed. These preparations included educating our internal and external customers, promoting new services, and meeting and beating our customer service standards.

Our traditional ProAssurance Loss Prevention Seminar will no longer be the main vehicle for premium discounts for insureds. We turn our eye instead to realizing our long-standing goal of implementing a self-assessment tool to collect real-time practice data from our policyholders. This new process will enable us to be proactive with our educational resources and publications by identifying the current risks our insureds face and addressing those head on with practical solutions.

I see 2024 as a year of innovation, opportunity, and continued improvement for our Risk Management team. I encourage our agent partners to continue promoting the first-class service we can provide to insureds.

All the best,

Risk Management Publications & Content

Your first-stop resource for your Risk Management questions. These guidelines make it easier for healthcare professionals to meet day-to-day challenges and facilitate implementation of long-range loss prevention strategies. Visit the new Risk Management Guidelines page here.

Visit the "2 Minutes: What’s the Risk?" video series page here.

- January: Unexpected Outcomes

- February: Closing a Practice

- March: Behavioral Health in Emergency Departments

- May: Natural Disaster Mitigation and Preparation

- June: Direct Liability

- July: The Power of Medical Errors: A Physician’s Perspective

- August: Responding to Subpoenas

- October: Cybersecurity

- November: Off-Label Prescribing

- December: Tracking and Follow-Up

- January 2023: Family Medicine

- February 2023: Advanced Practice Professionals

- March 2023: General Surgery

- April 2023: Internal Medicine

- May 2023: Anesthesiology

- June 2023: Telemedicine

- July 2023: Senior Care (LTC)

- August 2023: Emergency Medicine

- September 2023: Urology

- October 2023: Ob-Gyn

- November 2023: Pediatrics

- December 2023: Psychiatry

National Webinars

- Crossing the Line: Examining Professional, Personal, and Ethical Boundaries

- Medication Management: Minimizing Errors and Improving Safety

- When the Stakes Are High: Understanding Nuclear Verdicts

- Evolving Trends in National Healthcare Regulation

- AI in Healthcare: Examining the Matrix of Risk and Opportunity

2023 Practice Administrator Seminar—Practice Check-Up: Assess Your Risks (Released June 2023)

Annual Baseline Self-Assessment

The baseline self-assessment is a medical liability wellness check that helps practices identify gaps in practice protocols and improve staff competency.

Medical Society Engagements

Regional Agent Meetings

- Southwest Region

- Northeast Region

- Midwest Region

- Southeast Region

- West Region

What it’s about: “Focusing on the Future” highlighted what was to come in 2023 at ProAssurance. A goal for the year was to become the Carrier of Choice for our agents. To achieve our goals, we set up four areas to work on for the year: responsiveness, underwriting flexibility, customer experience, and product offerings.

Read More

What it’s about: Our February 2023 ProVisions focused on balancing the benefits of opioids in the medical professional liability insurance field. It was also the first issue launched digitally by the HCPL Marketing team.

Read More

What it’s about: The ProAssurance Risk Management team was the highlight of the March ProVisions edition. The issue dove into the 2023 Loss Prevention Seminar as well as Risk Management’s overall content. It showcased the efforts of the HCPL Risk team in helping ProAssurance insureds reduce risk.

Read More

What it’s about: Our ProVisions April edition highlighted the HCPL line of business 2023 strategic plan theme: “Beat the Standard.” It was used to show transparency for our agents by communicating our service standards and what our agents can expect when partnering with ProAssurance and its brands.

Read More

What it’s about: A look into the question, “Are we witnessing the next ‘claims crisis?’” While there is no simple answer, our May edition of ProVisions examined the changes in tort reforms that impacted damage caps. It addressed who can bring forth a claim, and where a claim can be filed. We also looked at some overarching trends across the country that impact “nuclear verdicts.”

Read More

What it’s about: The legal and medical landscape surrounding medical and/or recreational cannabis is hazy, to say the least. In our June 2023 issue we explored the intersection of cannabis and healthcare liability as physicians, lawmakers, and average citizens monitor the future of cannabis legislation.

Read More

What it’s about: In “Learning Curves” we look at the ebb and flow of the medical professional liability market and where the current market may be heading. The edition looked at the state of the industry and drivers of certain trends, including the uncertainties that COVID-19 may have caused and the increased costs of litigation and reinsurance.

Read More

What it’s about: Our annual “Difference” edition of ProVisions summarized common terminology for new professionals navigating the healthcare liability insurance field.

Read More

What it’s about: A review of legislative changes at the state level, ProVisions examined pieces of legislation enacted as of September 2023 that impact MPL as well as what could be on the horizon.

Read More

What it’s about: Private equity activity in the healthcare space has increased over the last decade, and our October ProVisions examined where the healthcare private equity market is today. The edition examined the scale of deals, potential areas of concern in medical liability, and litigation funding impacts on private equity in healthcare.

Read More

What it’s about: Our November edition of ProVisions highlights our Leadership Elite event in October. To all those who attended, thank you. For those who could not, this edition highlights the main sessions covered during the event. The top priority for us was providing our agency partners the right information to help them successfully sell insurance.

Read More

Regional Leaders Spotlight

SOUTHEAST

- Claims: Frank Bishop

- Underwriting: Christine Vaz

- Risk Management: Mallory Earley

- Business Development: Seth Swanson

Claims: Frank Bishop

What is the best part of your position?

What is the best part of your position?

The best part of my job as Regional Claims Executive is the satisfaction from working with my team and other operational departments to resolve issues that arise. I have an incredible team in the Southeast region that keeps me balanced, and other departments and their teams are professional and take their jobs seriously. So I know that I am not alone, and although not all issues may be resolved to everyone’s preference, it is not from a lack of effort by all.

What is your favorite holiday tradition?

For over 25 years on Christmas morning, after the presents are opened, I make eggs Benedict and Bloody Mary’s/mimosas for the family and, in years past, the extended family. This has been more challenging as my daughters have graduated college and moved to different states, but so far, we have been able to continue this tradition.

Underwriting: Christine Vaz

Underwriting: Christine Vaz

What is the best part of your position?

The one thing that I enjoy most about my position at ProAssurance is the conversations with my fellow colleagues, brokers, and insureds. I am most happy when learning, and through these interactions I have the opportunity to gain knowledge and expand my understanding of the healthcare industry.

What is your favorite holiday tradition?

My favorite holiday tradition dates back to when I was 2 years old and my 5-year-old brother asked Santa for a jelly donut. He received his Christmas wish, and I received a chocolate donut. We have continually for the past 35+ years eaten a chocolate donut and jelly donut each year on Christmas together. While it may not be at 6:00 a.m. anymore since we live separately, “Santa” has ensured that this tradition continues, and it is one of our family's most cherished during the season.

Risk Management: Mallory Earley

Risk Management: Mallory Earley

What is the best part of your position?

I truly enjoy working with my staff in Risk Management. Each person brings a unique perspective and knowledge to the table due to our diverse backgrounds as lawyers, nurses, case managers, risk professionals, and practice managers. We are a close department that collaborates regularly with each other as well as our other departments. I enjoy being on the preventive side of educating and assessing our insureds by making a difference before a bad outcome occurs.

What is your favorite holiday tradition?

My favorite tradition growing up as well as passing along to my three kids is getting ready for Santa on Christmas Eve. Once it is time for bed, we prepare a special plate of homemade cookies and milk for Santa and carrots for the reindeer. We turn on the Christmas tree lights knowing that Santa will turn them off and let us know he has visited our house. We read ’Twas the Night Before Christmas as a family and try our best to go to sleep anticipating the joy of Christmas morning.

Business Development: Seth Swanson

Business Development: Seth Swanson

What is the best part of your position?

I enjoy building relationships and helping our partners protect the healthcare community.

What is your favorite holiday tradition?

I love the football traditions that happen around the holiday season.

NORTHEAST

- Claims: Mark Lightfoot

- Underwriting: Tim Pingel

- Risk Management: Michele Crum

- Business Development: Lori Sunday

Claims: Mark Lightfoot

Claims: Mark Lightfoot

What is the best part of your position?

The most rewarding aspect of my job is defending physicians, particularly when the result is a defense verdict.

What is your favorite holiday tradition?

I love watching Holiday Baking with my kids.

Underwriting: Tim Pingel

Underwriting: Tim Pingel

What is the best part of your position?

I enjoy working with other departments in trying to produce a solution to a problem. I also work with the best group of people who really make coming to work everyday fun.

What is your favorite holiday tradition?

I enjoy Christmas morning, especially breakfast. We make an apple cake and a Nutella Christmas Tree. Then we watch the children open presents and see the excitement on their faces. With the help of technology, we have video calls with our family throughout the country. Aunts, uncles, and grandparents get to watch the kids open the presents from them and that is a lot of fun too.

Risk Management: Michele Crum

Risk Management: Michele Crum

What is the best part of your position?

The best part of my position is collaborating with an amazing team both in Risk Management and with the Northeast Region. People have been so kind to me in my time with ProAssurance.

What is your favorite holiday tradition?

My favorite holiday tradition is something my adult kids have wanted over anything else we have ever done. Their stockings have now become totes. They want every single item in their tote to be individually wrapped. They like to guess what is inside based on something I put in the tote every year, like a toothbrush or a chocolate orange: they sniff, shake, and guess each item. The effort to do this is minimal compared to the joy it brings them! One person at a time, one gift at a time, and rotate until all the gifts are open. Makes for a great day!

Business Development: Lori Sunday

Business Development: Lori Sunday

What is the best part of your position?

I enjoy building relationships, and value those I have established with our agency partners over the years. That coupled with a collaborative team here at ProAssurance makes for a fulfilling work environment.

What is your favorite holiday tradition?

My favorite holiday tradition is spending Christmas Eve with my family and experiencing it through the eyes of my niece and twin nephews. They are the reason for newer traditions of pajamas after dinner and my mother’s annual reading of ‘Twas the Night Before Christmas.

MIDWEST

- Claims: Mike Severyn

- Underwriting: Debbie Farr

- Risk Management: Tina Santos

- Business Development: Doug Darnell

Claims: Mike Severyn

Claims: Mike Severyn

What is the best part of your position?

The best part of my position is the opportunity to work with talented, motivated, and enthusiastic people across ProAssurance. I love working on medical professional and general liability claims knowing my work and those with whom I work with have a direct impact on the company as a whole. Helping others navigate the legal system when they have been sued and helping facilitate the sale of MPL insurance to protect healthcare providers from the risks they face each working day really inspires and motivates me. My position also encourages and expects me to promote and inspire “Treated Fairly” every day, and this aligns with my values too.

What is your favorite holiday tradition?

I really like Christmas and Thanksgiving. I like preparing the holiday meal, including shopping for the food. I like waking up early and cooking the holiday meal. It reminds me of my childhood and waking up to the smell of good food cooking and being around family. The smell of a turkey cooking in the oven with herbs and spices is just awesome to me. I like cleaning up after cooking too. I love catering to my family and friends on the holidays as well as on nonholidays. I also like decorating the house, outside and inside, for Christmas and Thanksgiving.

Underwriting: Debbie Farr

Underwriting: Debbie Farr

What is the best part of your position?

The best part of my job is working with the Midwest staff. It is inspiring to see their growth and desire to have a career path in Underwriting.

What is your favorite holiday tradition?

I have a huge family and I host a “Christmas" the Sunday before Christmas Day every year. I started doing my parents' shopping for them a few years back, so rather than moving presents from one place to another, my parents and I give out our presents at my Christmas. Last year all the kids, grandkids, and great-grandkids were there—a total of 46. This year we will be at 49, with four new great-grandkids and the unexpected loss of my nephew. It is the one time each year our entire family is together at the same time, which brings so much joy to my parents.

Risk Management: Tina Santos

Risk Management: Tina Santos

What is the best part of your position?

The best part of my position is by far the many relationships I have developed over the years. This not only includes my ProAssurance team members but also the agents, brokers, and insureds I have had the pleasure and honor to work with. Recently several of us on the Midwest team, with our spouses, visited our agents in Kentucky. So relationships through work have now become personal friends.

What is your favorite holiday tradition?

My favorite holiday tradition is meeting with family and friends on Christmas Eve. The past few years we have started to play the dice game, Left Right Center. Understandably this may seem odd to many for a holiday tradition, but we have so much fun with it. We all look forward to being together and enjoying this pastime!

Business Development: Doug Darnell

Business Development: Doug Darnell

What is the best part of your position?

The best part is helping our agent/broker partners find the solutions that ProAssurance can bring their clients. Making us the Carrier of Choice is our mission, and we are working relentlessly to ensure that status with all of our partners.

What is your favorite holiday tradition?

On the first Sunday of every year, we still do Christmas with my extended family in Newton, Iowa on “the farm.” This was the home of my great aunt and now belongs to my mom’s cousin. We started doing Christmas here when I was a child, as my grandmother passed away when I was quite young. It is a day filled with great people and great food that continues to take us to a place that actually fits the Iowa stereotype. The second is “mom’s Christmas.” My mom passed away several years ago, but we celebrated with my mom on the day of Christmas Eve for years. The day starts with a big brunch, followed by church, and then a spaghetti dinner—easy and fast to do well even after church. It has been "a thing" since 1993 and a tradition my niece and nephew both refer to as “one of the best days of the year.”

- Claims: Laura Ekery

- Underwriting: John Alexander

- Risk Management: Jennifer Freeden

Claims: Laura Ekery

Claims: Laura Ekery

What is the best part of your position?

I am proud to lead a team of intelligent, capable, and insightful claims professionals who shepherd our insureds through some of the most difficult times in their respective careers.

What is your favorite holiday tradition?

Since they were little, my nieces and nephew have come to my house for “Holiday Madness,” a night spent eating foods of their choice, doing crafts, and watching Christmas movies.

Underwriting: John Alexander

Underwriting: John Alexander

What is the best part of your position?

The best part of my position with ProAssurance is the collaborative, team oriented style of providing solutions to our clients and partners. I joined ProAssurance two years ago and am inspired by its culture and values. In my role as a leader in Standard Underwriting, I enjoy the challenges and successes that come from protecting others. My experiences here have been collegial and innovative. Whether it involves examining a new business opportunity with an Underwriting team member that requires input and action from another department or working diligently to secure a bind order on an existing account in the face of competitive pressure; the experience of achieving success through teamwork and being accountable for using my best judgment is both exciting and rewarding.

What is your favorite holiday tradition?

The traditions inherent with the holiday season are countless. One that is particularly meaningful to me involves lights. From the earliest moments of the season’s arrival, the bright and colorful display of lights in the city and around my home never fails to capture my attention and deliver warm vibes. I enjoy stringing as many rows of lights on the Christmas tree branches as possible. Arranging the lights in a balanced way takes patience. I will admit that the process often involves starting over at least a couple of times. The numerous strands consist of a collection my family has accumulated over many years. Success is accomplished when every light is used and, when illuminated, there is a festive glow that extends to every room in our home.

Risk Management: Jennifer Freeden

Risk Management: Jennifer Freeden

What is the best part of your position?

The best part of my position is my relationships with my team members, who are a welcoming, gracious, and extremely knowledgeable group. They, along with the opportunity to assist our insureds, make my job fun and rewarding.

What is your favorite holiday tradition?

Right now, my favorite holiday tradition is our yearly staycation with our kids, who are 9 and 12. A few weeks before Christmas, we take them to a hotel, dress up a bit, go out for a “fancy” dinner, and walk around a fun part of town listening to holiday music, with their drinks of choice: hot chocolate and a decaf latte.

- Claims: Gina Harris

- Underwriting: Lucy Sam

- Risk Management: Katie Theodorakis

- Business Development: Andrea Linder

Claims: Gina Harris

Claims: Gina Harris

What is the best part of your position?

I love being able to hire, teach, and train people and watch them get better and more confident in their roles. Then, it is wonderful having the ability to promote them so they can eventually do the same with others. It is quite rewarding when that happens.

What is your favorite holiday tradition?

Doing absolutely nothing during Christmas. It is one of the few instances during the year when most people take time off and there are typically no court proceedings, depositions, emails, or phone calls. I get to relax, clear my head, sleep late, and eat a bunch of things made with pumpkin. It is the gift I give myself.

Underwriting: Lucy Sam

Underwriting: Lucy Sam

What is the best part of your position?

I am fortunate to be part of an Underwriting team that has been together for many years. My favorite thing is being part of a team that is committed to customer service, specifically assisting our clients and supporting team members. I really enjoy mentoring staff and seeing individuals achieve their professional goals.

What is your favorite holiday tradition?

I enjoy baking and cooking especially around the holidays. My friends and I spend the day together, bake favorite cookies, share recipes, and drink wine!

Risk Management: Katie Theodorakis

Risk Management: Katie Theodorakis

What is the best part of your position?

The best part of my position is getting to work with my fellow regional leaders. I am fortunate to work with a team of women who are so supportive of one another. We all want to do our best for the West Region and work together to accomplish our goals. We also manage to have a lot of fun along the way. Cheers to a truly great team!

What is your favorite holiday tradition?

My favorite Christmas tradition is piling into the car with my family and driving around to see the Christmas lights. We always bring hot cocoa and snacks to enjoy along the way.

Business Development: Andrea Linder

Business Development: Andrea Linder

What is the best part of your position?

Ours is a relationship business and the best part of my position is the ability to interact with all aspects of our company, making friends along the way. Having strong connections both internally and externally, with our trading partners, is critical to the success of my position.

What is your favorite holiday tradition?

My favorite holiday is Thanksgiving and I love preparing the turkey meal. It takes me several days from shopping to serving and I find it very relaxing (I know most people would not). And then the next day I make my turkey soup—yum!

2023 Web Updates

ProAssurance Group Website

We’re very excited about our new ProAssurance Group site, launched in August. With a primary focus on healthcare professional liability insurance, we reiterate the Mission, Vision, and Values that unite us in The ProAssurance Way and highlight our coverage options.

Our Careers page showcases our community-oriented company culture and includes video features by our own team members. We discuss how we incorporate our mission and give future candidates the information they need about what makes our Company great, covering work-life balance and benefits, career growth potential, and community involvement, as well as our commitment to diversity, equity, and inclusion (DEI).

Our Careers page showcases our community-oriented company culture and includes video features by our own team members. We discuss how we incorporate our mission and give future candidates the information they need about what makes our Company great, covering work-life balance and benefits, career growth potential, and community involvement, as well as our commitment to diversity, equity, and inclusion (DEI).

Our Group site also introduces our ProAssurance Leadership Team with bios and photos and lays out our Company History in a visual timeline, showing mergers and acquisitions, in addition to significant developmental events spanning the last 45+ years.

Also available are links to our multiple lines of business, including Medmarc, Eastern, PICA, and some helpful Risk Management resources, as well as ProAssurance Corporate.

Risk Management Updates

Risk Management has completed the first phase of their new website, RiskManagement.ProAssurance.com.

Risk-related items once housed on the ProAssurance and NORCAL domains are now available in one central location. Risk Management has also increased functionality on their pages, saving users both time and clicks by grouping their Practice Resource Library plus Claims Rx and Vital Signs publications together under one dropdown menu. Comprehensive Risk Management Guidelines and “2 Minutes: What’s the Risk?” videos are also accessible from the Education menu.

Risk-related items once housed on the ProAssurance and NORCAL domains are now available in one central location. Risk Management has also increased functionality on their pages, saving users both time and clicks by grouping their Practice Resource Library plus Claims Rx and Vital Signs publications together under one dropdown menu. Comprehensive Risk Management Guidelines and “2 Minutes: What’s the Risk?” videos are also accessible from the Education menu.

As the Risk Management team produces regular and ongoing content, development of their website will be accomplished in phases. As new sections become available, links on the original sites will redirect to the new website, making content easier to find. The Risk Management section of NORCAL’s website now redirects to ProAssurance as part of the decommission plan. These changes will also refine our analytics, providing more in-depth tracking of user engagement, which will help inform decisions about future content.

The next development phase includes addition of the seminar library, with on-demand seminars, live webinar promotions, and annual Loss Prevention Seminars (LPS). The revised and specialty-customized Annual Baseline Self-Assessment will also be available, which can be completed for a CME premium credit. Lastly, the content bundle library will feature a rich collection of resources for topic-based learning.

ProVisions

We took ProVisions digital in February of this year. Our dedicated newsletter for ProAssurance agents was previously available in PDF format and print, and we chose to continue our popular print option—for those who love the smell of paper. With this 12th issue, we have consistently provided our agents with relevant, industry-informative content in a visually attractive package.

The ProVisions page is continually updated with our most recent issues and includes an archive of past releases. The site also provides links to our agency partners, including our Regional Advisory Councils and their corresponding representatives.

We also plan to implement a digital version of our HCPL Producer Guide for our agents, plus a dedicated page for state profiles.

2023 Financial Snapshot

Specialty P&C saw significant gains in the third quarter, including $23.6 million in new business written compared to $12.1 million last year. This contributed to an increase in gross written premiums, up by $11.2 million, or 4.6%, and a strong renewal price increase of 7%, one point lower than in the third quarter of 2022.

Specialty P&C saw significant gains in the third quarter, including $23.6 million in new business written compared to $12.1 million last year. This contributed to an increase in gross written premiums, up by $11.2 million, or 4.6%, and a strong renewal price increase of 7%, one point lower than in the third quarter of 2022.

Premium retention remained unchanged from the previous year at 87%, and standard physician retention was also steady at 89%. Specialty retention was up six points quarter over quarter to 80%, and the underwriting expense ratio was reduced to 25.2% from 26.8% last year.

The current accident year’s net loss ratio did increase by 1.2 points this quarter, and earned net premiums declined 1.4%. Factors impacting these numbers included competitive market conditions and social inflation, higher than anticipated loss trends, and reorganization of business segments. ProAssurance now reports underwriting results from participation in our Lloyd’s Syndicate in the Specialty P&C segment and reports investment results of assets allocated to their operations in the Corporate segment.

All encouraging figures are attributed to ProAssurance’s commitment to a disciplined pricing and underwriting strategy. “Market conditions and judicial trends in our lines of business continue to be a significant headwind to our efforts to return to our desired level of underwriting profitability,” says Ned Rand, Chief Executive Officer of ProAssurance. “We are meeting those challenges head on in the marketplace by taking appropriate rate actions, maintaining our underwriting criteria, effectively managing claims, and providing the best-in-class service that has allowed us to attract well-priced new business."

.png?width=300&name=MicrosoftTeams-image%20(28).png)

The 2023-2024 Judicial Hellholes® report shines its brightest spotlight on nine jurisdictions that have earned reputations as Judicial Hellholes. Some are known for allowing innovative lawsuits to proceed or for welcoming litigation tourism, and in all of them state leadership seems eager to expand civil liability at every given opportunity.

For the first time in the history of the report, the Foundation has ranked two jurisdictions at the top of the list. Both Georgia and Pennsylvania’s courts, specifically the Pennsylvania Supreme Court and the Philadelphia Court of Common Pleas, share the unfortunate distinction of jointly being named the year’s No. 1 Judicial Hellholes. (American Tort Reform Foundation)

Substantial rate improvements, higher attachment points and rising investment income are combining with increased demand for reinsurance cover to create a stable outlook for the global reinsurance sector, according to AM Best in a report.

Of course, headwinds still exist for reinsurers such as the “persistent, growing uncertainty about underlying risks, including frequency and severity of weather-related activities and evolving risk profiles,” said the report, titled, “Market Segment Outlook: Global Reinsurance.” (Insurance Journal)

Risk is always a part of practicing medicine, and the coming year will have no shortage of challenges practices must face in order to succeed. With this in mind, Medical Economics spoke with Peter Reilly, North American Healthcare Practice Leader, HUB International, an insurance and risk management expert. (Medical Economics)

The traditionally conservative health care landscape has undergone massive and rapid technological disruption in the past decade. The explosion of generative AI and Large Language Models (LLMs) outpaced any wave of innovation that we’ve seen.

While these innovations are being hailed as potential solutions to many of the challenges plaguing health care, the digital health industry faces a harsh reality check. The once-soaring sector is grappling with market corrections, leading to the shutdown of unicorn startups and raising questions about its future. (Medical Economics)

Medline, the Northfield, Ill.-based major medical supplier, made several headlines this year for key developments ranging from newly inked deals to challenges due to fire damage at a manufacturing plant.

Here are the supplier's top 5 headlines covered by Becker's from 2023. (Becker’s Hospital Review)

Making a List and Checking It Twice: A Year of Self-Care, Starting with the Holidays

The holiday season during my medical sales days added two things to my life I could have done without—more stress and overeating. The pressure resulted from trying to close year-end deals when hospitals and clinics leaned toward postponing business discussions until after the New Year. Meanwhile, my waistline expanded faster than my credit card bill thanks to those obligatory customer-hosted holiday parties, where I could rack up as many as five in a single weekend. By the time January 1st rolled around, I'd be exhausted, yearning for a vacation (and a return to normal eating!), and regretting I hadn't eased up on work and enjoyed the holidays more.

The holidays focus on giving to others—your family, friends, colleagues, and clients. But they're also an ideal time to reflect on yourself, specifically your work-life balance. The toll of inadequate sleep, poor dietary choices, and neglecting the people you care about the most can go unnoticed for years. I once considered self-care a selfish luxury, but it's far from that; it's essential for preserving your mental and physical well-being and enabling peak performance at work.

Rather than postponing self-care to the realm of fleeting New Year's resolutions (often forgotten by January 3rd), give yourself the gift of integrating it into your daily routine. It's as easy as making a list and checking it twice.

Making Your List: Write It Down

I bet you have a to-do list for your work tasks. Why not create what I call a Me-List? This is an inventory of the activities that nourish you physically, mentally, and spiritually. I learned a long time ago that if an action isn't on my list, it won't happen, whether making a sales call, going to the gym, or scheduling a night out with my wife. Whatever supports your physical and mental health—exercising, meditation, reading, or anything else—put it on your list and prioritize these activities just as you would your tasks at work.

Checking It Twice: The Power of Consistency

Checking your list twice isn't just for Santa! Keep your list someplace where you'll review it every day. Many people start the year with good intentions but never develop consistency. Add a recurring task to your work list to check your Me-List. This will create a habit that ensures your self-care isn't left to chance.

The Greatest Gift: The People You Love and Care About

The work ethic and on-call mentality of HCPs tend to infect their staff and service providers. Work will always be a high priority, but the people in your life are your greatest gift. Therefore, prioritize time with family and loved ones on your Me-List. And when a person you've been meaning to call or spend time with comes to mind, add them to the list.

A Gift to Others and Your Profession

Self-care isn't just a gift to yourself but also to the people in your life. When you're happy, healthy, and well-rested, you'll perform better at work, and people will notice. That's good for you personally and professionally.

And speaking of self-care, one of the things that nourishes me is sharing my thoughts in ProVisions each month about selling in the complex and fulfilling healthcare world. Thank you for allowing me to be a part of your journey throughout the year.

Wishing you a Happy Holiday season and a happy and healthy New Year!

|

Written by Mace Horoff of Medical Sales Performance. Mace Horoff is a representative of Sales Pilot. He helps sales teams and individual representatives who sell medical devices, pharmaceuticals, biotechnology, healthcare services, and other healthcare-related products to sell more and earn more by employing a specialized healthcare system. Have a topic you’d like to see covered? Email your suggestions to AskMarketing@ProAssurance.com. |

New Jersey Rate Change

Rate Change Effective 1/1/2024

We are committed to responsible pricing that reflects the current risk environment. In keeping with our commitment to apprise you of developments within your market, we would like to share with you our recently updated rate strategy for New Jersey. Upon recent review of our rate plan and rating factors, it was determined that an overall rate impact of 9.1% may impact ProAssurance insureds. The change, which has been filed and approved, goes into effect January 1, 2024, and is applicable to new and renewal accounts. We will notify affected policyholders of the change.